DHS has published 2018 Annual report with key highlights on the EB-5 program.

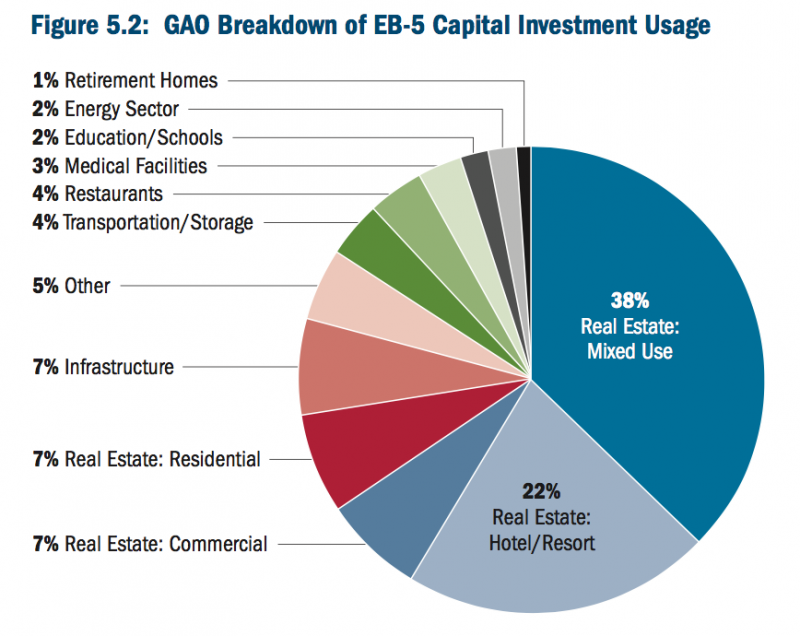

According to the report on EB-5, 22% EB-5 invested in hotels and resorts, while 38% invested in real estate for mixed use, resulting in total 60% of investments in the real estate sector.

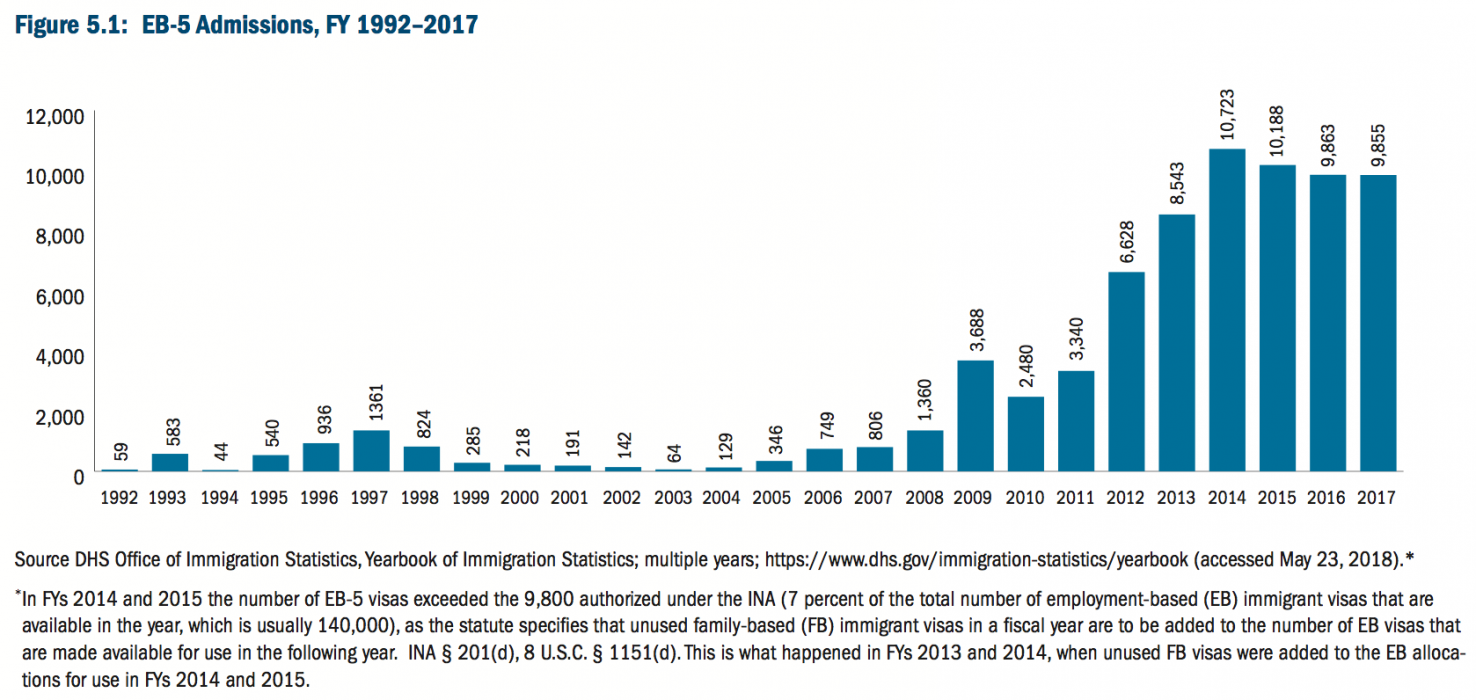

In 1992, when the program started, only 59 visas issued and after 23 years, EB-5 admissions exceeded 10,000 limit in 2014 and 2015.

Congress established the EB-5 Immigrant Investor program in 1990 to encourage foreign entrepreneurs

to make capital investments in the United States and produce jobs for American workers. Under the EB-5 program, foreign nationals who invest $1 million in a new or existing U.S. for-profit entity and create ten full-time positions for U.S. workers are eligible to apply for an immigrant visa. The required investment decreases to $500,000 when the business operates within a TEA, which is a rural area or an area with high unemployment rates.400 Congress allocates approximately 10,000 immigrant visas annually to immigrant investors and their immediate family members.

At the outset of the EB-5 program, foreign investors used a small fraction of the 10,000 annual visa allotment. In 1992, Congress attempted to spur more participation by creating the EB-5 Regional Center Pilot Program (Regional Center Program).402 The Regional Center Program allowed investors to pool investments into larger projects that would have greater impact on the U.S. economy.

Investors now could meet program requirements through direct and indirect job creation―a new job based on an employer-employee relationship between the new commercial enterprise and the people it employs or a new job held outside of the new commercial enterprise created as a result of the enterprise.404 This pilot program was intended to sunset after five years, but Congress has repeatedly extended it, with the most recent grant scheduled to end on October 23, 2018.

Congress’s expansion of investor visa options through the Regional Center Program did not lead to increased use of the EB-5 program throughout its first 15 years of existence.

Financial crisis

Since 2008, regional center filings have increased dramatically, a trend that began during the financial crisis; currently, almost all EB-5 filings are now through regional centers. Prior to 2008, the EB–5 program received on average fewer than 600 immigrant petitions per year. However, since 2008, the program has averaged over 5,500 petitions per year, primarily due to the increase in regional center filings. In the fourth quarter of FY 2015, a random sampling taken by GAO of pending immigrant investor petitions showed approximately 91 percent of EB-5 investments were made through regional centers, and 99 percent of all EB-5 projects were located in a TEA.

The financial crisis resulted in the closure of many U.S. lending institutions, reawakening interest in the EB-5 program from investors, as well as project developers. As the United States fell deeper into recession, it became more difficult for large-scale commercial real estate developers to access conventional financing for their projects. In response, developers and other intermediaries turned to the EB-5 program to raise capital. The program attracted commercial real estate and other developers as a way to access below-prime lending rates using foreign investor funds. By September 2016, nearly 74 percent of petitioners investing in a TEA used various types of real estate projects including mixed use, hotels and resorts, commercial, and residential developments.

EB5-Fraud and Abuses

The EB-5 program has faced a number of challenges since inception. Among the issues are fraud committed by principal investors; fraud and malfeasance committed by attorneys; gerrymandering of TEAs for the bene t of investors; and sourcing of funds in ways that have the potential to threaten national security. Congress, federal agencies, and the public have all expressed concern that Americans have not seen the bene t of the program

as designed (jobs, investment, etc.) while fraud and questionable practices result in foreign nationals losing their money and immigration benefits they sought.

Fraud, Embezzlement and Other Abuses: Fraud and abuse, in the form of embezzlement, Ponzi schemes, and securities violations, continue to be ongoing challenges for the EB-5 program, particularly the Regional Center Program. Fraud impacts direct investors as well as the intended beneficiaries of the investment, both direct and indirect. The U.S. government has prosecuted dozens of EB-5 fraud cases where attorneys, or regional center principals and of officials, and other financial personnel funnelled investors’ funds for personal or other impermissible use.422 The U.S. Securities and Exchange Committee (SEC) has charged several lawyers with offering EB-5 investments without registering as brokers, as is required under the Securities Exchange Act, and without disclosing the commissions received from investment offers. Some faced prosecution; others have settled the charges without admitting or denying SEC’s findings.Those prosecuted are often sentenced to prison and ordered to pay restitution to the victim investors.

When USCIS discovers fraud, it not only terminates the regional center’s designation, but also revokes project investors’ immigration benefits, regardless of their involvement in the scheme. The immigrant EB-5 petitioner, whose goal was to obtain permanent resident status, loses this opportunity, along with the investment.

Targeted Employment Area Issues. Another area of concern is the designation and use of the TEAs. In an address to Congress, Senator Grassley noted that existing EB-5 regulations do not prohibit TEA gerrymandering― stitching together contiguous census tracts to allow projects physically located in affluent areas to bene t from the lower $500,000 investment threshold. Under the current rules, Senator Grassley stated that there is “little incentive to invest EB-5 funds in distressed or rural areas.

Lawful Source of Funds

Another challenge for the EB-5 program has been the development of money laundering schemes and proving the lawful source of funds. The EB-5 regulations require immigrant investors to identify the source of EB-5 funds to establish they were obtained lawfully.426 This investor burden is met through business records, such as foreign business registration records; business and personal tax return filings in any country within the past ve years; and/or evidence identifying other sources of capital such as business entity reports, audited financial statements, income earning statements, gift instruments, and property ownership.

However, even with the presentation of these documents, USCIS nds that in many countries, investors are permitted to self-identify and self-report the sources of their assets and income, making it dif cult for USCIS

to verify the lawfulness of the source of funds that are then invested in the EB-5 program.428 Critics of the program have raised concerns regarding the origin of investors’ funds. They have raised the potential for abuse of the program by corrupt foreign officials and criminals attempting to evade laws and protect illicitly gained funds. Others argue that the agency is hyper-technical in its requirements, making it nearly impossible to meet the burden identifying fund sources.430 Both sides would agree that the standard requires review by the agency.

Source: DHS Annual Report 2018