by World Citizenship Council

We are announcing our exciting proposals for a brand new ‘Digital nomad citizenship’ program for cash strapped nations looking to raise revenues from remote workers and entrepreneurs. This unique program was designed by World Citizenship Council, a non-profit startup in association with Best Citizenships online platform.

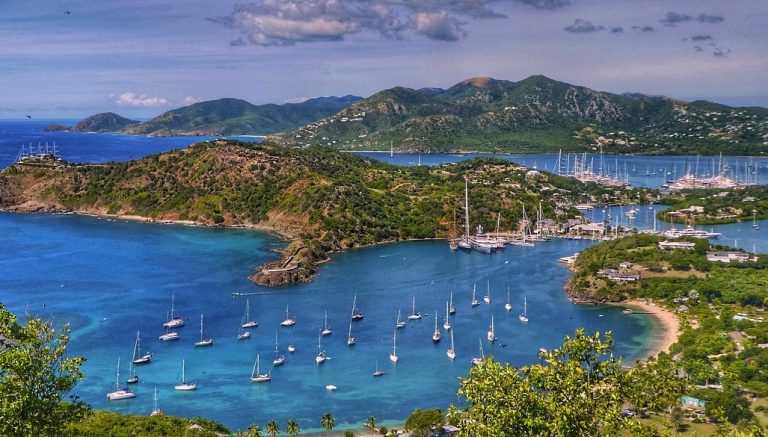

The Digital Nomad visa (DNV) market is expected to reach $30 billion by 2025 with millions of wealthy digital nomad expected to apply, working remotely from anywhere in beaches, open offices, cafes etc. Estonia, Antigua, Georgia, British Virgin Islands are already issuing nomad visas. The Digital nomad visa market is expected to surpass Citizenship by investment (CBI) market in few years. It will be the new future!

Covid has accelerated digital innovations in visas and immigration. The microstates and tourist economies hit hard by the crisis turn to short-term nomad visas instead. A great example is Barbados welcome stamp visa for nomads. This program raised excess of $1 million in just two months of launching the program. This 12-month welcome visa, aimed at a new breed of digital nomads, saw almost 2,000 applications between July and November 2020 and similar schemes has been emulated by several states in Europe, Caribbean and elsewhere.

We propose attaching citizenship option to digital nomad visas which is granted after one or two years. This makes nomad visas more attractive to woo wealthy nomads.Citizenship legislations can also be enacted or amended providing a path to nomad visa holders to naturalize.

Cash strapped governments can greatly benefit from Nomad citizenship program. They can use the nomad citizenship program to raise revenues. For example filing a single application costs $2000 one time fee and $500 for additional dependants and family members.

All parameters can be fine tuned to flexibility

- Apply for Digital Nomad Visa online. Pay a $2000 fee

- Visa approved for 1 year (or 2 years)

- Citizenship possibility after 1 year (or 2 years)

We propose the following conditions for granting citizenship

- Must own a Nomad visa

- Must spend atleast 1 day in the country

- Pass background checks done by the government

- Must support financially themselves and prove net worth and fully support other family members.

- Must own a property or rent a place of residence for one year.

- Governments must do one final dual citizenship check from databases.

Citizenship must be granted only to nationals where dual citizenship is permitted after checking dual citizenship database. (If dual citizenship is not permitted.,visa is converted to permanent residency falling short of citizenship. In this case it become a Digital nomad residency visa program)

The Digital nomad visa grants fully residency rights to applications. Additional benefits include healthcare, education, all other equal rights with locals, except for voting or engage in political affairs.

The Slow path of citizenship to nomads does not make it a citizenship for sale program. It is a low risk citizenship model (away from attracting criticism and negative publicity from media outlets, european commission and anti-corruption organizations). It is neither a golden visa or citizenship by investment program, can be deployed anywhere in the world. It also gives enough time for proper vetting applicants. Governments can add additional security feature such as residence conditions before granting citizenship (for example 9 months nomad visa and 3 months residence permit).

There have been failed citizenship by investment schemes (eg. Bulgaria) did not bring much needed revenues. In these cases, CBI schemes can be scaled down or converted implementing Digital nomad citizenship program.

Thus our simple model solves many problems associated with dual citizenship restrictions (eg. China, India), money laundering, vetting issues, negative publicity and importantly will not pose a risk to visa waiver agreements until citizenship is granted, at the discretion of the governments. This program can be easily marketed and promoted anywhere.

We believe our Digital Nomad Citizenship model will be deployed and used by over 50 nations in the next 5 years generating millions in revenues for economic developments.

The Digital Nomad Citizenship Program (DNCP) will be cheaper, easier and faster to implement. It does not require any investment but will boost demand for property market indirectly. It is affordable for any nomad who seek citizenship or residency. It is a win-win for all bringing prosperity to governments.

Assuming governments receive $2000 for each application (at the minimum), this would collect atleast $2 million for 1000 applications received.

Governments can establish a cap on this program such as 10,000 limited visas.

Our model can be implemented by any state or governments free of charge. It is an open model which can be fully customized to any requirement.

The World Citizenship Council welcomes governments providing free advisory and assistance for launch of DNC program.

The World Citizenship Council is a non-profit startup for research, development and promotion of citizenship and residence schemes. The Council offers free membership to governments, research organizations, immigration firms and lawyers. More information can be found on worldcitizenshipcouncil.org