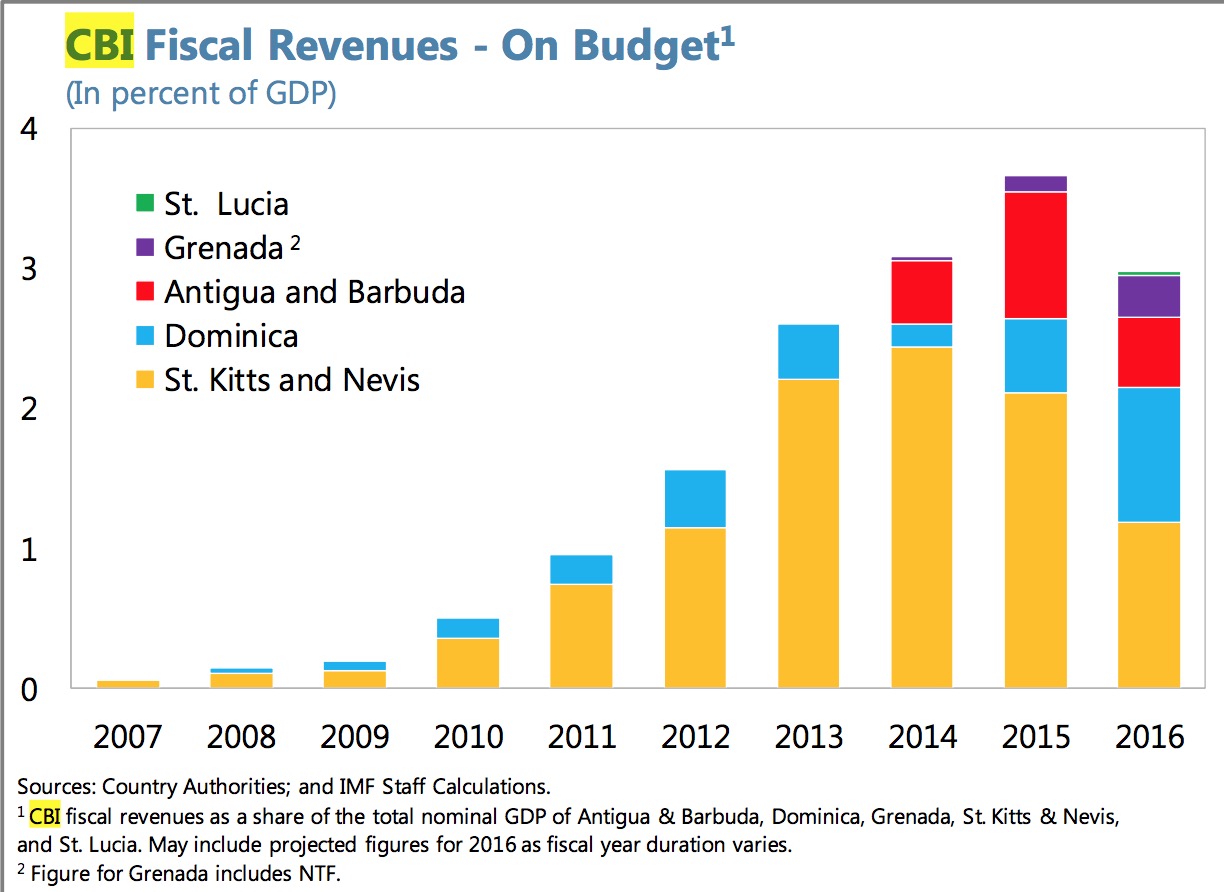

A number of CBI programs has surged in recent years on the back of soaring demand for secondary citizenships and the advantages of these programs for small island states. This has yielded substantial inflows of CBI revenues in some countries, increasing their reliance on this volatile and unpredictable source.

While the number of applications has been stable, increased competition among countries is reducing requirements, which lower revenue per citizenship, and an increasing share of receipts are not recorded on budget.

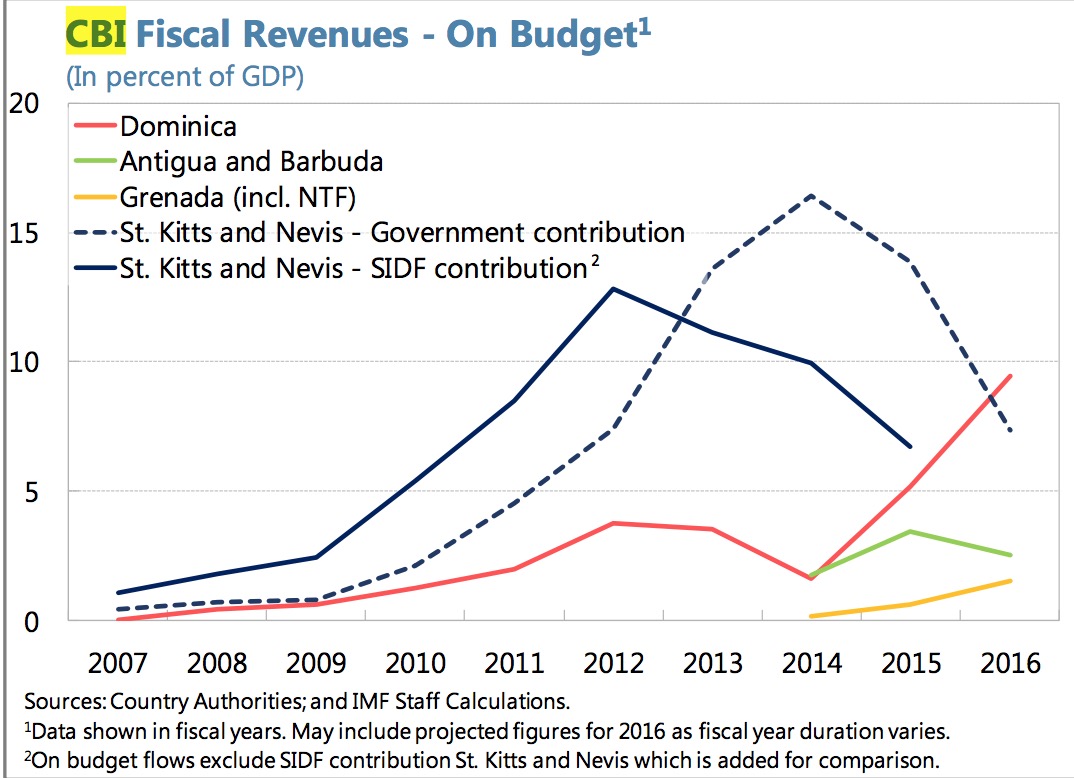

Revenue in St. Kitts and Nevis dropped sharply after its 2014 peak (Annex II).

Increased competition and intensified due diligence of prospective applicants impacted income in Antigua and Barbuda. Conversely, Dominica’s lower cost and more aggressive marketing approach has contributed to increase its regional market share. St. Lucia, after a disappointing launch in 2016, made its program more competitive.

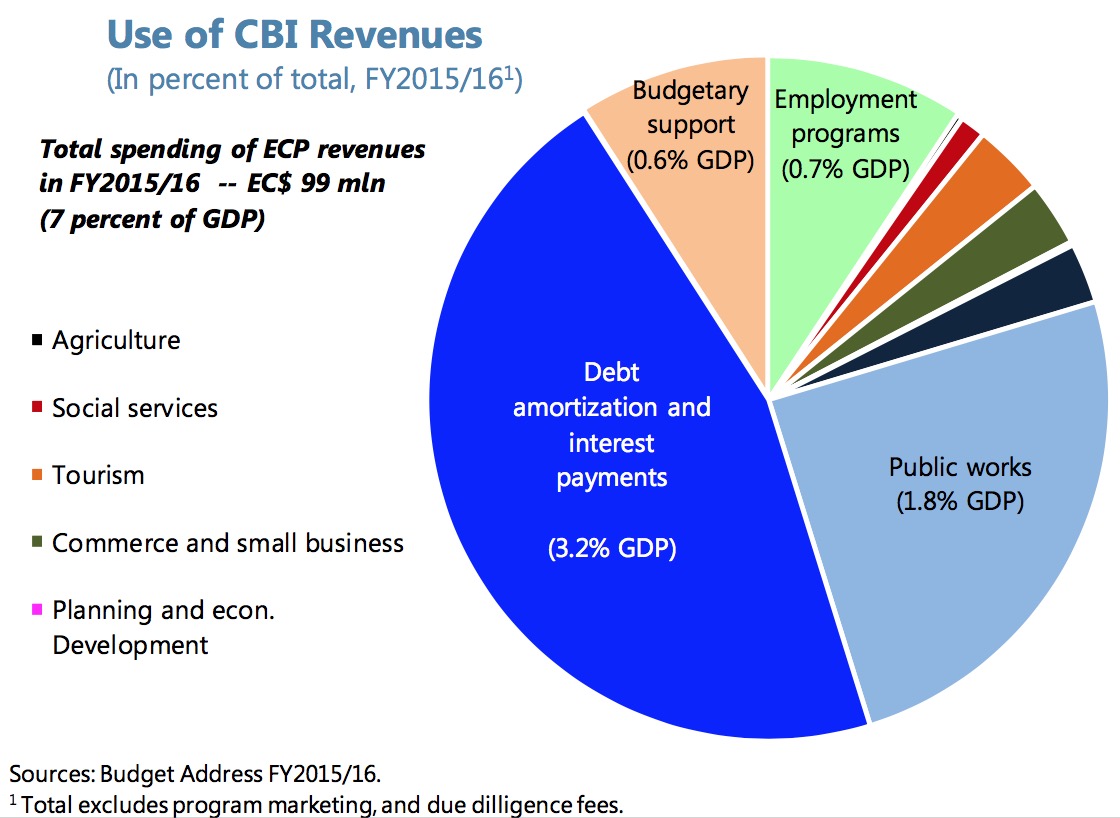

ECCU member countries need a significant fiscal effort to achieve their debt target by means of large deposits from CBI inflows should be used to reduce debt. Revenues from Citizenship-by-Investment (CBI) programs, which should be used to reduce public debt where necessary, can also be directed to saving funds and to finance appropriate investment plans.

Dominica: Interest in Dominica’s CBI program has gained momentum, reflecting aggressive outreach and competitive conditions. CBI-generated revenues (gross of CBI-related expenses) reached an estimated 19 percent of GDP in FY2015/16. The use of CBI funds has largely targeted debt reduction, post-Erika reconstruction and infrastructure rehabilitation.

On August 27, 2015, Dominica was hit by Tropical Storm Erika, resulting in loss of life and substantial damage to crops and physical infrastructure. The damage was estimated at US$483 million or 96 percent of GDP, of which 65 percent are attributed to the public-sector reconstruction costs.

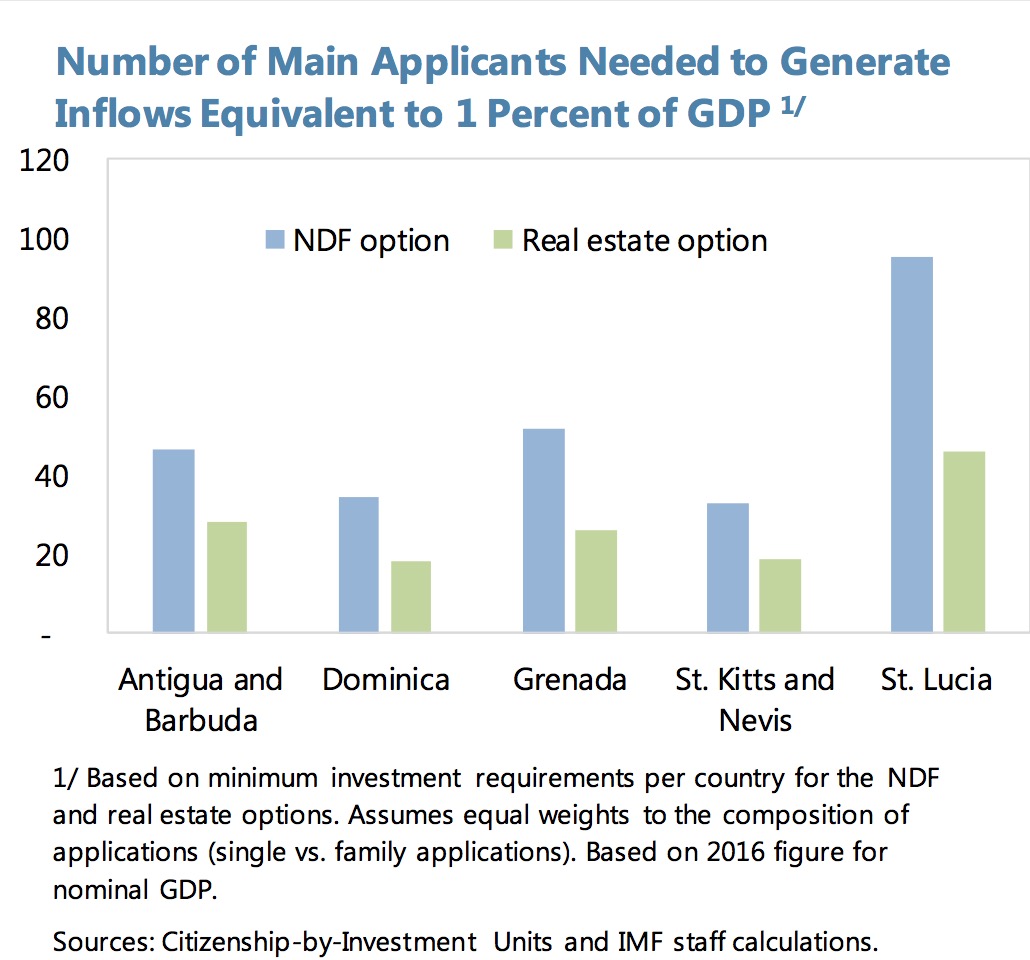

To expand hotel construction, Dominica amended its CBI program requirements by lowering the

government fee of the real estate investment option. To enhance the program’s competitiveness and revenue, St.

Lucia has substantially eased accessibility to the citizenship program (see table).3 The authorities expect that these changes will improve the appeal of St. Lucia’s program and boost applications and revenues. While this decision aligns St. Lucia’s citizenship program with Dominica’s, and may therefore generate additional demand, it is unlikely that CBI revenues in the former will become as important a source of revenue as in the latter owing to the much larger size of the St. Lucian economy.

To establish a stronger regulatory framework and promote collaboration on due diligence, the Citizenship-by-Investment Programs Association was formed in 2015. Moreover, the authorities of ECCU countries have recently granted to the Organization of Eastern Caribbean States (OECS) the mandate to coordinate regional cooperation on CBI programs. Joint management of CBI applications would yield economies of scale and reduce costs.

Investment Requirements of Citizenship-by-Investment Programs in the Caribbean

(In US dollars)

|

Contributions and Investments |

Option I |

Option II |

|||||||

|

Government Fee & Contribution to National Development Fund (NDF) |

Government Fee & Redeemable Investment 6/ |

||||||||

|

Type of Application |

Single Appplicant |

Family |

Single Appplicant 200,000 |

Family |

Single Appplicant |

Family |

Single Appplicant Real estate: 400,000 Business: 1,500,000 |

Family |

|

|

Antigua and Barbuda 2/ |

50,000 |

150,000 |

200,000 |

50,000 |

150,000 |

Real estate: 400,000 Business: 1,500,000 |

|||

|

Dominica 3/ |

100,000 |

200,000 |

… |

… |

25,000 |

75,000 |

Real estate: 200,000 |

Real estate: 200,000 |

|

|

Grenada |

… |

… |

200,000 |

200,000 |

50,000 |

50,000 |

Real estate: 350,000 |

Real estate: 350,000 |

|

|

St. Kitts and Nevis 4/ |

… |

… |

250,000 |

300,000 |

50,000 |

125,000 |

Real estate: 400,000 |

Real estate: 400,000 |

|

|

St. Lucia 5/ |

… |

… |

100,000 |

190,000 |

… 50,000 |

… 50,000 |

Real estate: 300,000 Business: 3,500,000 Gov. Bonds: 500,000 |

Real estate: 300,000 Business: 6,000,000 Gov. Bonds: 550,000 |

|

|

Sources: Country Authorities; Citizenship by Investment Units Guidelines; Henley and Partners and Arton Capital. 1/ Depicts minimum Investment requirements for single vs. family applications (a couple with up to two dependents under the age of 18). Additional due diligence and processing fees apply. 2/ A limited time offer that remained valid from the launch of the program in 2013 through end-April 2016 allowed for a flat government processing fee of USD100,000 for a family of four, waiving the processing fees for the two dependents. 3/ Dominica ammended program requirements effective December 2016. Changes include higher age limit of young dependents, and lower government fees for real estate investment option. 4/ Although an explicit government application fee is not required in the NDF option of St. Kitts and Nevis, about 25 percent of the contribution is retained by the government as budgetary fees. 5/ Business investment must fall under one of the following categories: Specialty Restaurants, Cruise ports and marinas, Agro-processing plants, Pharmaceutical products, Ports, bridges, roads and highways, Research institutions and facilities, or Offshore universities. In early 2017, St. Lucia made an announcement to change its program requirements. The required contribution to the Economic Fund was reduced fro USD200,000 to USD100,000 for single applicants, and from USD250,000 to USD190,000 for a family (applicant with a spouse and up to two dependents). The cap of 500 citizenships per year was removed. An administrative fee of USD50,000 was introduced for the bond option. The remaining two options were left unchanged. 6/ For most programs, a minimum holding period of 5 years is required for redeemable investment options. Assets maybe eligible for resale to future applicants under the CIP. |

|||||||||