Malta’s Individual Investor Program grants citizenship to foreign investors who contribute to investment fund and investors have an opportunity to buy or rent a property, to satisfy residence requirement for citizenship.

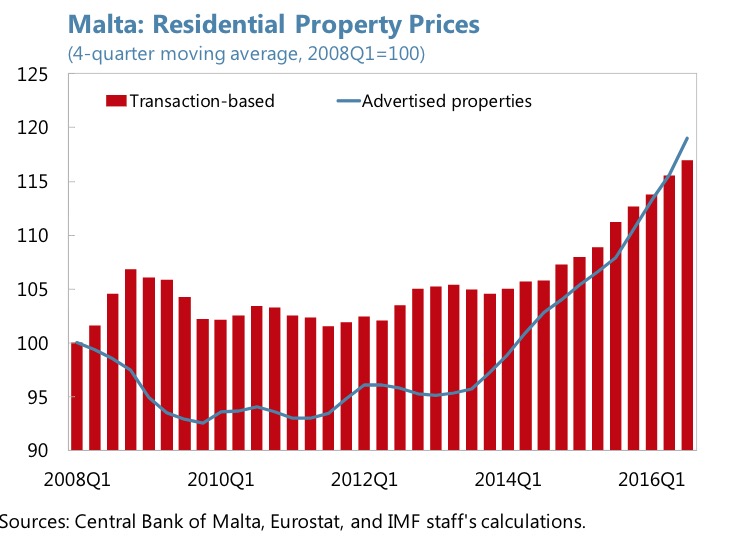

According to 2016 IMF report on Malta, Residential property prices in Malta have showed a positive momentum, surpassing their pre-crisis peaks despite limited supply.

The following factors contributed to rise in property prices in Malta.

- Government’s measures such as the Individual Investor Program (IIP), reduced tax rate on rental income, and the first time buyers’ stamp duty relief may have also stimulated demand.

- The transaction-based price index increased by a cumulative 20 percent since 2011, while the advertised property price index increased in 2016 Q3 by about 30 percent in this period.

- Residential property prices are being boosted by buoyant mortgage lending, low interest rates, rising disposable incomes, and influx of foreign workers.

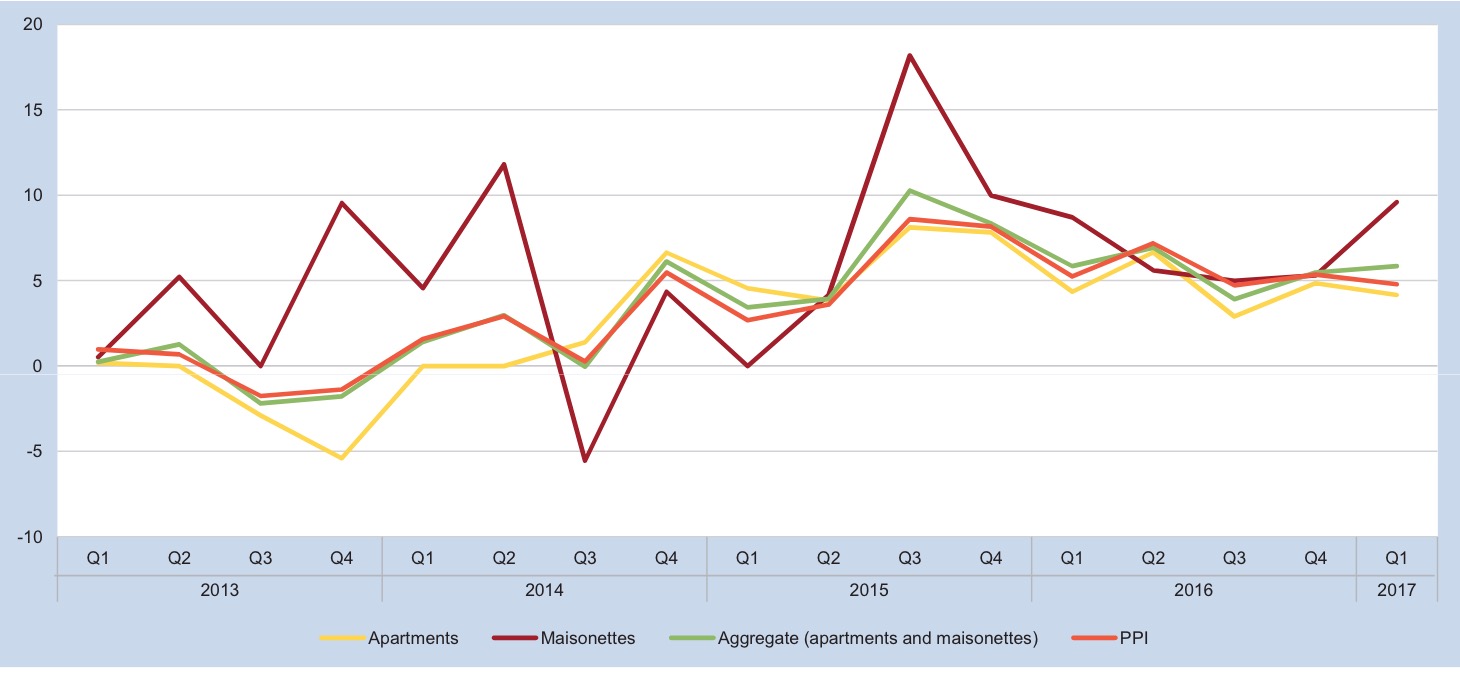

According to Malta Property Price Index (PPI) published by Government, during the fi rst quarter of 2017, the Property Price Index (PPI) increased by 4.8 per cent when compared to the corresponding quarter of the previous year.

Pembroke, St Julian’s, Tas-Sliema, Swieqi, Ħal Għargħur recorded 11.4% of property transactions in Malta

The Property Price Index (PPI) shows the price changes of residential properties purchased by households, whereas the Property Volume Index (PVI) measures changes in the volume of transactions from time to time.