The Malaysia My Second Home Programme (MM2H) offers foreign nationals a long term 10 year multiple entry renewable visa to foreign nationals who want to become a resident and live in Malaysia. The MM2H program is otherwise known as “Malaysian Golden visa”. In addition to Malaysia, Thailand and Singapore also offer Golden visa schemes in Asia.

MM2H scheme is open to citizens of all countries recognised by Malaysia regardless of race, religion, gender or age. Applicants are allowed to bring their spouses and unmarried children below the age of 21 as dependants. The scheme is quite cheap because it requires about USD 125,000 as bankable assets to be shown and requires about USD 75,000 deposit maintained in a bank account for those below fifty years. You also have to show about $2500 income per month. No real investment is required, but the scheme has provisions for property investment.

Malaysia My Second Home (MM2H) Programme is promoted by the Government of Malaysia to allow foreigners who fulfill certain criteria, to stay in Malaysia for as long as possible on a multiple-entry social visit pass.

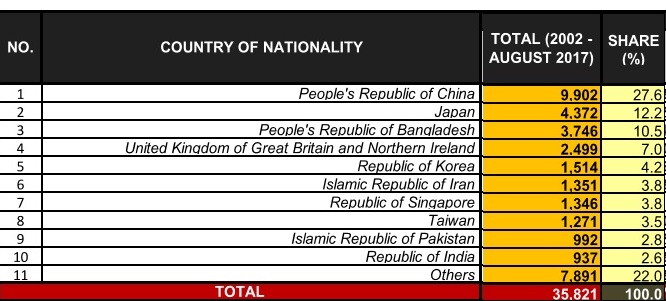

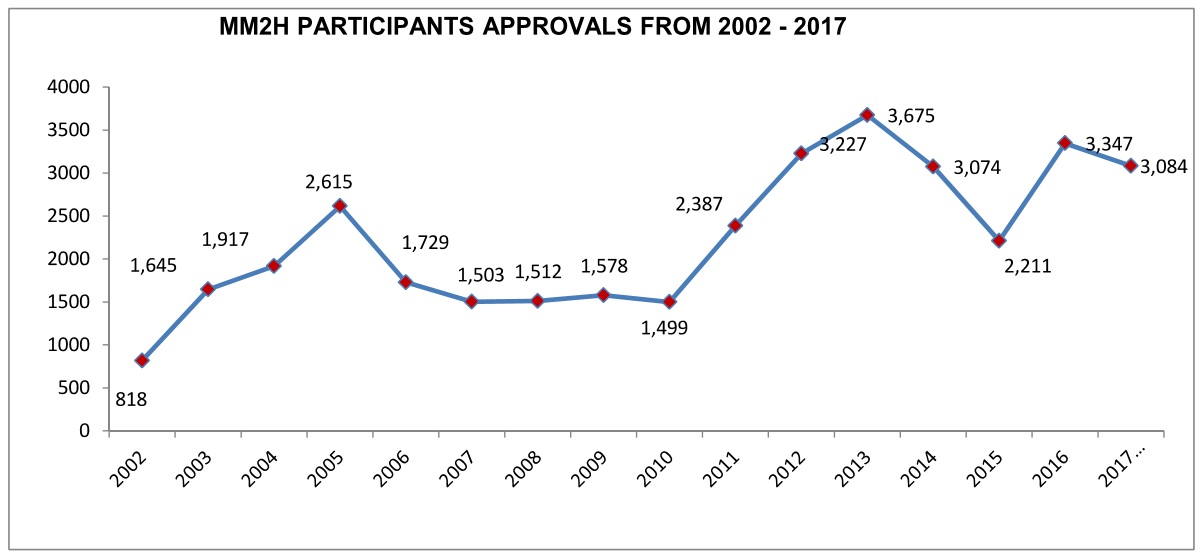

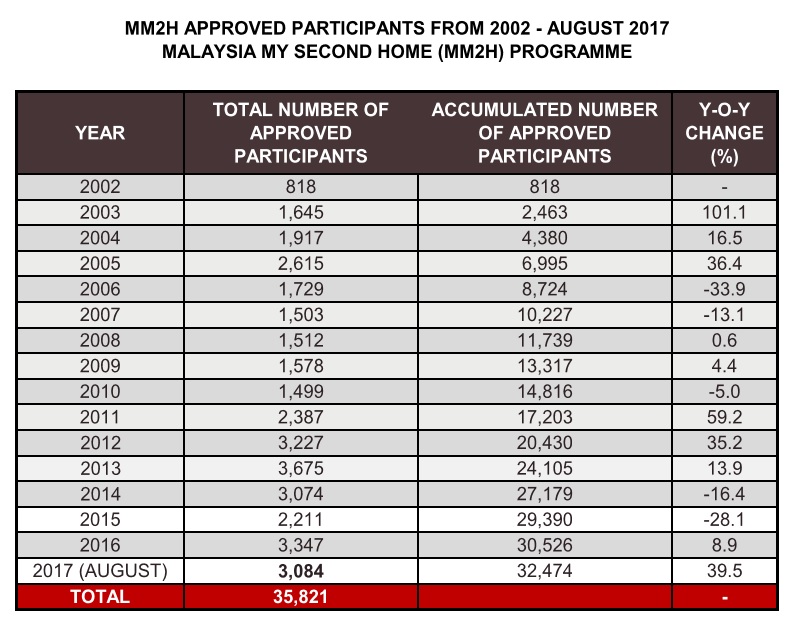

According to MM2H program statistics

- Over 3000 applications approved in 2017 in MM2H

- A total of 35,821 approved participants in MM2H

- Top applicants are from China, Japan, Bangladesh and UK

INVESTMENT CONDITIONS

Applicants are expected to be financially capable of supporting themselves on this programme in Malaysia.

Upon application:

-

- Applicants aged below 50 years are required to show proof of liquid assets worth a minimum of RM500,000 ($128,000) and offshore income of RM10,000 per month. For certified copy(s) of Current Account submitted as financial proof, applicants must provide the latest 3 months’ statement with each month’s credit balance of RM 500,000.

- Applicants aged 50 and above may comply with the financial proof of RM350,000 in liquid assets and off shore income of RM10,000 per month. For certified copy(s) of Current Account submitted as financial proof, applicants must provide the latest 3 months’ statement with each month’s credit balance of RM 350,000. For those who have retired, they are required to show proof of receiving pension from government RM 10,000 per month.

- Approved participant who has purchased and own property which was bought at RM1 million and above in Malaysia may state his/her intention in letter of application during submission to lower down basic fixed deposit requirement.

UPON APPROVAL

(A) Aged Below 50 years old

-

- Open a fixed deposit account of RM300,000.00 ($76,000)

- After a period of one year, the participant can withdraw up to RM150,000.00 for approved expenses relating to house purchase, education for children in Malaysia and medical purposes.

- Must maintain a minimum balance of RM150,000.00 ($38,000) from second year onwards and throughout stay in Malaysia under this programme.

Property investment

Approved participant who has purchased and own property which was bought at RM1 million and above ($256,000) in Malaysia may state his/her intention in letter of application during submission to lower down basic fixed deposit requirement of RM300,000 to RM150,000 on condition that the property has been fully paid and ownership documents such as grant and land title have already been issued. This amount may not be withdrawn until the participant decides to terminate his participation in MM2H programme.

(B) Aged 50 years and above

-

- Can either choose to:

- After a period of one year, participant who fulfills the fixed deposit criterion can withdraw up to RM50,000.00 for approved expenses relating to house purchase, education for children in Malaysia and medical purposes.

- Participant must maintain a minimum balance of RM100,000.00 ($38,000) from the second year onwards and throughout his/her stay in Malaysia under this programme.

Property investment

Approved participant who has purchased and own property which was bought at RM1 million and above in Malaysia may state his/her intention in letter of application during submission to lower down basic fixed deposit requirement of RM150,000 to RM 100,000 on condition that the property has been fully paid and ownership documents such as grant and land title have already been issued. This amount may not be withdrawn until the participant decides to terminate his participation in MM2H programme.

Buying a Property

Any foreigner may purchase any number of residential property in Malaysia, subject to the minimum price established for foreigners by the different states. They start from RM500,000 per unit for most states, from 1st Mac 2014. Land is a state matter and it is important to check state laws before making any commitment, as the minimum purchase price is not standardized between states.

We advise buying homes which are already issued with certificates of fitness but if you intend to purchase from developers, esnure that it is from a reputable company.

Profits made on the sale of property is subjected to current Real Property Gains Tax rate set by the Government of Malaysia.

1st year – 5 th year : 30%

6th year and above : 5%

Read more http://www.mm2h.gov.my/pdf/mm2h3.pdf

Acquisition of Residential Units Under Malaysia My Second Home Programme

- Purchase of residential unit under Malaysia My Second Home Programme is exempted from FIC’s approval. (Effective 1st March 2014).

- All categories of residential units are allowed except for low-cost and medium low-cost units as determined by the state authorities, all properties built on Malay reserve land, units that are reserved for Bumiputera quota and agricultural land developed on the basis of the homestead concept

- State authority has the discretion to consider the acquisition based on location, no. of unit in any single project development and type of the properties

Source: http://www.mm2h.gov.my/index.php/en/home/programme/statistics