On December 13, 2017, the Executive Board of the International Monetary Fund (IMF) concluded the Article IV consultation with Cyprus.

According to the IMF report..

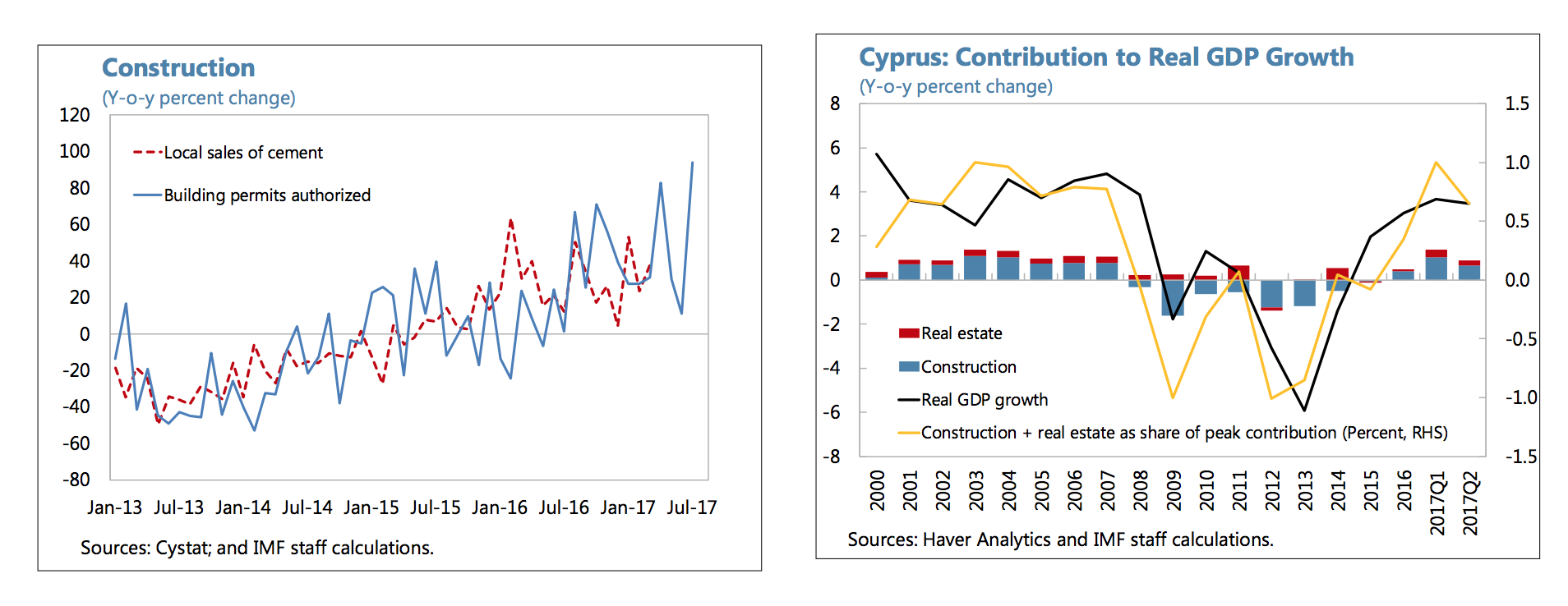

The Cypriot economy has achieved an impressive turnaround since the 2012–13 banking crisis. GDP growth has been accelerating for three consecutive years on strong foreign demand, reaching 3.8 percent (year-on-year) during the first nine months of 2017.

Prudent macroeconomic policies and progress on structural reforms since the crisis, including in the context of the IMF-ESM-supported program, together with strong foreign demand, contributed to this impressive turn around. Growth has been robust and employment has risen rapidly, helping to boost incomes and alleviate social hardship.

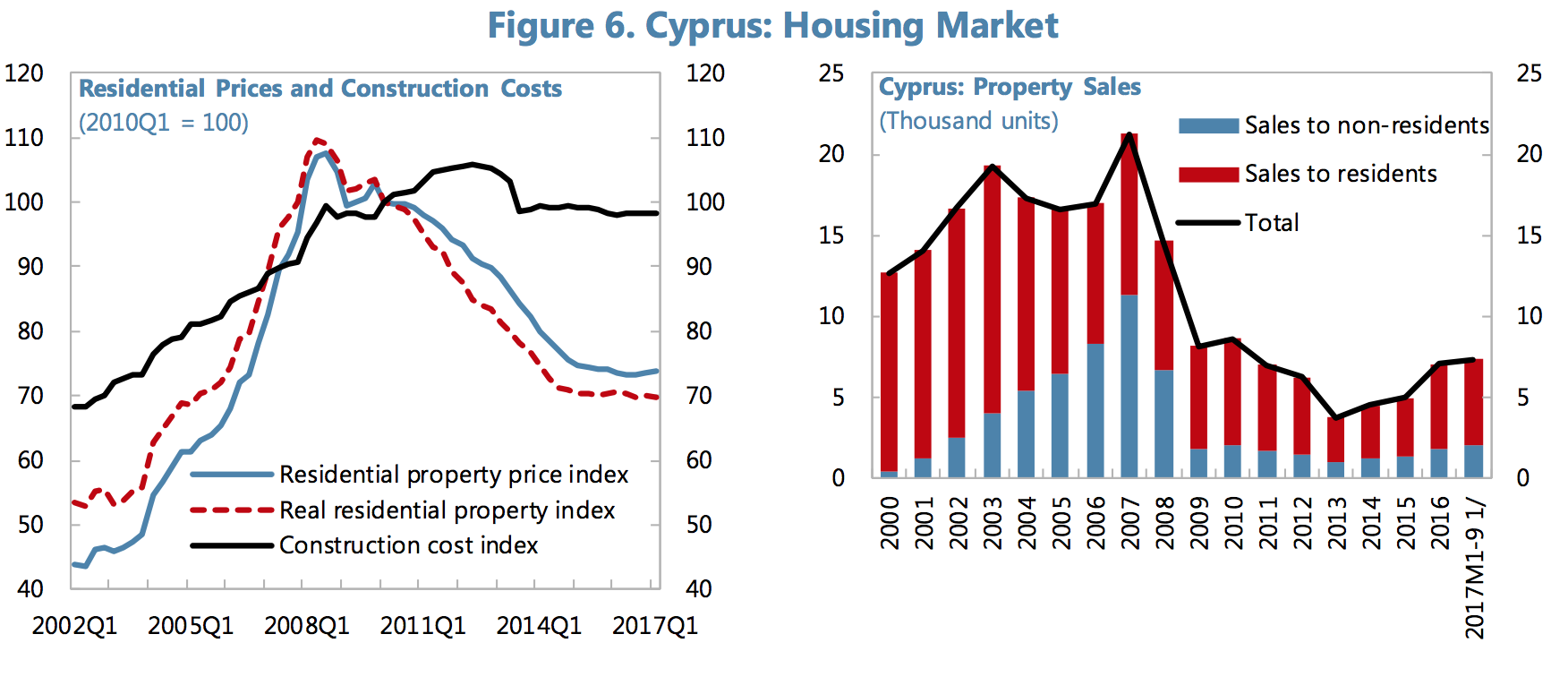

Property prices after falling sharply, property prices are now rising marginally while transactions are recovering, especially in the luxury segment.

Citizenship by Investment

The CBI program already brought Cyprus over €3 billion euros through property investment since its inception. Regarding the Citizenship by investment program in Cyprus, IMF report made the following observations.

- Private net financial inflows have been strong, at more than 30 percent of GDP per year in 2014–16, likely attracted by relatively high interest rates and the citizenship-by-investment (CbI) program. The current CBI scheme requires a minimum own-equity investment of €2 million, held for at least three years, and purchase of a residence with a minimum price of €500,000, to be held indefinitely. While there are no sectoral requirements on eligible investment, much of the investment is focused in real estate.

- Property prices is more active in the luxury market owing in part to the CbI scheme.

- Several investment incentives, including the CBI scheme, provided welcome support to construction and the economy more broadly in the aftermath of the crisis. However, this support has now achieved its goal, and could turn procyclical. Further decoupling the scheme’s eligibility requirements from real estate would help avoid excessive concentration of economic activity, and reduce the risk of over-supply of luxury properties.

- Full compliance with AML/CFT standards by all sectors involved in the CbI scheme and supervision of those sectors for compliance with requirements should be ensured to maintain the integrity of the CbI scheme and mitigate correspondent banking pressures. AML/CFT requirements should include checking the source of wealth and source of funds of applicants, including by the authorities as part of eligibility criteria and processes.

- Tax and other incentives targeting the property sector helped to stabilize prices and bring jobs and economic growth.

- The CBI scheme is a general investment scheme, although real estate is the major beneficiary. Regulatory improvements to the CBI—with stricter controls on intermediaries (including real estate agents and lawyers)—are being considered

Source: IMF