by Natalia Zakharova

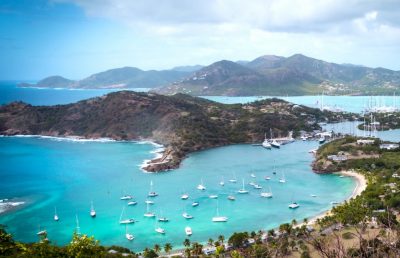

Little known Permanent Residency Program of Antigua & Barbuda was introduced in 1995 to encourage wealthy individuals to establish tax residency in the country.

Antigua and Barbuda is an offshore jurisdiction with no personal income tax, capital gains tax, inheritance tax and wealth tax. It offers wide range of opportunities for asset protection, including the Citizenship by Investment Program, launched in 2013.

Antigua’s Tax Residency program offers ZERO worldwide income, capital gains, inheritance and wealth tax.

The requirements to qualify for Permanent Residency Program of Antigua & Barbuda are as follows:

- Maintain a permanent place of abode in Antigua & Barbuda (either leased or purchased);

- Spend at least 30 days a year in Antigua & Barbuda;

- Annual income must exceed US$100,000;

- Pay a flat tax of US$20,000 per annum.

A qualified applicant will be issued a Certificate of registration as a Permanent Resident of Antigua and Tax Identification Number.

The Permanent Residency Scheme is available for all nationals, but it especially useful for the economic citizens of Antigua, who have already purchased a real estate in order to qualify for the Citizenship by Investment Program.

For more information about this program, please contact:

Natalia Zakharova

Director of International Operations at Citizens International

Antigua and Barbuda

Linkedin: https://www.linkedin.com/in/natalia-zakharova/

Email: [email protected]