Citizenship coin (CTZ) is a first of its kind crypto currency payment system for the CBI/RBI industry built on the top of blockchain.

CBI/RBI industry have grown to $10 billion dollar industry annually, expanding globally in many countries, and is projected to grow 20% every year. Bitcoin and other crypto-currencies are still not accepted by the CBI/RBI/EB-5 industry. Lack of knowledge and difficulty in understanding about cryptocurrency and blockchain has pushed the industry behind others from using new emerging technologies. The reliance of fiat currencies and banking services are far greater than ever.

Citizenship coin offers full freedom to legally buy citizenship or residency in several countries in the World, to become a ‘World citizen’. Highly qualified wealthy investors and their families can acquire second citizenship or permanent residency through CBI/RBI schemes.

Stable and Non-Volatile

Citizenship coin is backed by a strong Euro currency, rather than US dollar. The value of one citizenship coin is tied to one euro. This makes it stable, non-volatile currency unlike Bitcoin.

1 Citizenship coin (CTZ) = 1 Euro

How do i get Citizenship coins?

There are two ways to get citizenship coins.

1. Buying (1 CTZ = 1 Euro)

2. Mine (with source code, see in the mining section)

You can securely send and receive citizenship coins by downloading and installing the Citizenship coin wallet software in our homepage, which works in Windows/Mac/Linux.

Why not Bitcoin?

Bitcoin is the first ever created cryptocurrency by Satoshi Nakomoto in 2009 and is the most popular cryptocurrency in the world. The widespread adoption and explosive growth of Bitcoin and other cryptocurrencies like Ethereum, Ripple, Litecoin has pushed the Bitcoin price to $10,000 per coin. But Bitcoin has several problems. Several countries have already banned bitcoins. Banks in several countries already block payments for buying and selling bitcoins citing crime, money laundering and other illicit activities.

Bitcoin and other major crypto currencies are anonymous and no KYC/AML done on the transactions which presents a high risk and cannot be a viable crypto currency solution for the CBI/RBI industry. Bitcoin and other crypto currencies are highly volatile, cannot be safely used for payments within CBI/RBI/EB-5 industry. The industry needs a stable, safe and trusted cryptocurrency.

Bitcoin and other publicly traded crypto currencies have also become a safe haven for countries like Iran, North Korea, Iraq, Somalia, Venezuela, Yemen etc.. to evade latest US sanctions. People from these countries are known to buy Bitcoin and other major cryptocurrencies and then convert to fiat currencies to evade such sanctions. US citizens and companies (eg.EB5) cannot do business or accept funds from these countries. For these reasons, Bitcoin and other crypto-currencies cannot be used within the CBI/RBI/EB-5 industry, as this brings more problems then benefits.

Therefore we propose “Citizenship coin”, our new own industry standard cryptocurrency for the investment migration industry. Citizenship coin will be complaint to all KYC/AML rules and will conform to all regulations as industry standard cryptocurrency payment.

Where Citizenship coin is used?

Citizenship coin can be used to pay for citizenship related services throughout the world, not just limited to CBI/RBI/EB-5 industry. Property developers, Agents and even Governments promoting citizenship and residency programs may chose accept citizenship coin in the future.

How it works?

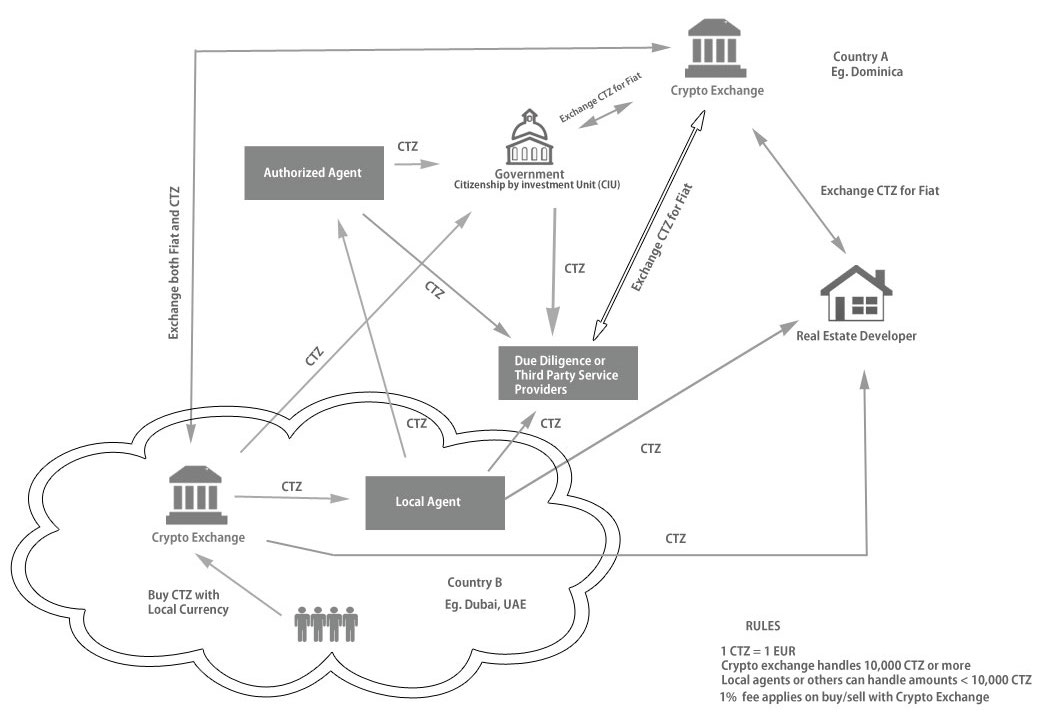

- Clients buy citizenship coins (CTZ) from the Crypto exchange within their country paying in local currency, at a price equivalent to Euro. Only crypto exchange should handle fiat currencies. Local agents should only hanle crypto coins. Invoices can be issued accordingly.

- Local crypto exchange transfers initial fee as CTZ to local agent, who then transfers the fee to Authorized agent who handles all paper work. For real estate purchase, the cryptobank transfers coins to local agent who then transfers CTZ to real estate developer outside the country. The coins can be cashed by developer from the coin bank operating in the country.

- Once application is approved, client again buys coins (for donation option) and the crypto exchange transfers the equivalent directly to the Government as CTZ.

- The Government can convert CTZ coins to Fiat (EUR, ECD, CHF, USD) from the cryptoexchange. The Government can pay CTZ to third parties or due diligence providers which again can be converted to fiat by these firms. Local agents and authorized agents and others can rely on third party due diligence firms for initial background checks and pay through CTZ

- The authorized agent receives commissions from the Government, shares it with local agent by sending CTZ coins, which can then be exchanged to fiat at the exchange

Crypto Exchange: Crypto exchange is a crypto bank that exchanges citizenship coins with fiat currency, supports major currencies exchanged at EUR prices, since 1 CTZ =1 EUR. Crypto exchanges are licensed to mine (create) citizenship coins specific to market demand. All buy/sell transactions incur 1% exchange fee. The crypo exchange is operated collectively by the CBI/RBI industry.When the volume of transactions is high, the cryto exchange can apply for banking license in the operating country. Exchanges can freely exchange coins and fiat currencies with each other. Large Firms can apply to become crypto exchange (crypto bank)

Only Crypto exchanges can handle large payments over 10,000 CTZ for trust and prevent fraud with agents. Crypo Exchange must handle volume of 1 million CTZ or more.

Crypto Exchange must be setup in all countries running CBI/RBI programs: Dominica, Antigua, St Kitts, St Lucia, Malta, Cryprus, Portugal, Greece etc..

Crypto Exchanges must also be setup where there are great demand for clients: Dubai (handling Middle east clients), Hong Kong (chinese clients), Russia (russian clients), India (asia clients), South Africa, Brazil etc.. All Crypto-exchanges function in a decentralized way.

Local Agent: A local agent is authorized by Authorized agent to operate in the country. Local agents or authorized agents can send or receive maximum limit of CTZ 10,000

Authorized Agent: The authorized agent is appointed by the Government and licensed to handle CBI/RBI applications. Authorized agents pay small amounts such as application fees or passport fee to Governments using CTZ coins.

Real Estate Developers: Approved real estate properties authorized by the Government to qualify for Citizenship or Residency. The local agent serves as intermediary to authorized agent and real estate developer moving the paperwork.

Due Diligence Firms and Third Parties: Agents and Governments can take the services of due diligence firms or third parties for KYC and background screening.

Government: The Government CIU unit holds a ledger of Authorized agents, Real estate developers, Local agents and all other service providers. This eliminates the risk of unauthorized persons offering passport programs and cannot participate in the citizenship coin network. Crypto exchanges check this informatio before making CTZ payments.

As you can see above, traditional Correspondent banks are replaced by crypto exchange banks and involves transacting CTZ coins with each other. In other words, we are setting up our industry backed crypto bank. This completely eliminates correspondent banks, reliance on one single currency such as US dollar.

To transfer 1 million citizenship coins, it will only cost 0.2 CTZ and payment is confirmed within 10 minutes and the coin network can scale to 10 million transactions per day. The real fiat money is held in crypto exchanges, so if citizenship coins are lost or stolen, real money equivalent of coins is not lost and thus can be recovered. The assets of Coin exchange will be insured accordingly.

If the coins are sent to a wrong address or password is forgotten, then it is impossible to recover the coins.

How much it costs?

It only costs a fraction, to send payments and payments are confirmed within 10 minutes. For example to send 1 million coins equivalent of 1 million euros, the transfer fee is only 0.1 CTZ and much less. The coin network is scalable to handle over 10 million transactions per day. In 2014 Paypal handled 10 million transactions per day and credit card company VISA and Mastercard handles on average 3 million transactions per day. There is no limit on amount of coins sent.

Free Open Source

Citizenship coin is a free software and its source code is licensed as free open source to CBI/RBI/EB-5 industry. It is not free and closed to the general public outside of the industry.

Citizenship Coin Mining

Citizenship coins can also be mined (created) with the source code licensed as Crypto Exchange. Governments, Agents, Law firms and individuals in the CBI/RBI/EB-5 industry apply to setup a Crypto Exhange (Crypto Bank) operating in several countries handling a turnover of 1 million coins or more.

All is needed is a powerful computer, linux system, internet and advanced computer knowledge (we can help you for a fee). About 6 blocks can be generated every hour and mining each block rewards 250 citizenship coins. After generating 100 blocks the coins are available for spending. Mining blocks confirms transactions for maturity thus making it spendable.

To mine large number of coins through a pool ASIC compatible GPU are required (mining farm). Citizenship coins can be created through a process known as ‘mining’. Just like gold is mined, only few coins can be mined every hour, because of the algorithmic difficulty algorithm. Generating a block rewards 250 citizenship coins. Every four years this difficulty will double and will require enormous processing power and electricity to generate coins. We are able to provide authorization to investment migration companies and Governments within the CBI/RBI/EB-5 to mine citizenship coins.

We charge a 10% developer fee for firms who want a Crypo Exchange license with turn over of over 1 million coins. For example if you mine 1 million citizenship coins, you only have to pay 100K coins as a development fee. If you dont want to mine, you can buy citizenship coins by paying 1 euro per coin through the ICO.

Fiat Currencies

Citizenship coins can be bought and sold with fiat currencies such as EUR, USD, ECD, CHF, CAD etc for a small 1% exchange fee. Citizenship coins will not be traded in other crypto exchanges as we propose setting up our own in-house Coin Exchange for the industry, with the funds raised from investors or ICO. Citizenship coin also supports other major cryptocurrencies such as Bitcoin(BTC), Bitcoin cash (BCH), Ethereum (ETH) and Litecoin (LTC), if KYC/AMC is met.

AML/KYC Regulations

The blockchain transactions of Citizenship coin will be subjected to KYC/AML rules and is complaint to other industry regulations. We are currently plan to partner with third party due diligence firms and Self-Key, a secure digital identity system based on Blockchain for KYC validation.

Total supply

The total supply of Citizenship coins is limited to 105 million coins.

Whitepaper

Please read our whitepaper: https://citizenshipcoin.org/whitepaper.pdf

Investors

We invite investors, ICO advisors and partners to join the Citizenship coin startup. We plan to raise one million euro initial fundraising for our startup. We invite investors starting from $50,000 into our project. We do not accept investors from countries that are subjected to US/EU sanctions.

The Citizenship coin startup is still in the initial phase of development. A mobile version is still not developed, for lack of funds and coin is promoted is on much smaller scale within the Fintech and Blockchain industry.

Product Demo

We can show you the product demo and working of the coin. Please contact at [email protected]

Social Media

- Website: https://citizenshipcoin.org

- Twitter: https://twitter.com/citizenshipcoin

- Facebook: https://www.facebook.com/citizenshipcoin/

- Linkedin: https://www.linkedin.com/company/28603756/

- Telegram: https://t.me/citizenshipcoin