Many only know about donation and real estate are the two popular routes to Antigua citizenship program, little is known or talked about business investment option of the Antigua CIP program.

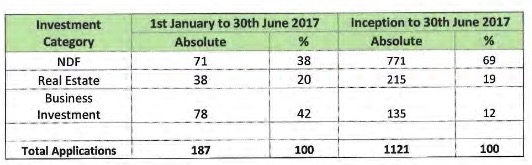

Taking a look at CIP statistics of Antigua, it appears that 12% of applications on average for Antigua CIP came for Business Investment. That is 135 applications from inception to 30 June 2017. The Business investment option is almost as popular as real estate option.

If you look at closely below for the first half of 2017, the 78 applications (42%) were received for business, only 71 received for NDF (38%) and only 38 applications (20%) for property route.

The popularity of business route soared in 2017, clearly surpassing the applications for NDF and Real estate.

The Antigua and Barbuda Citizenship by Investment Unit (CIU) shall after consultation with the Antigua and Barbuda Investment Authority (ABIA) approve businesses, whether existing or proposed, for the purposes of investment in business under the Citizenship by Investment Program.

Business Investment Option

The two business investment options are:

- Investment in an approved business of at least US$ 1,500,000 on their own behalf.

- At least two persons propose to make a joint investment in such an approved business totalling at least US$ 5,000,000, and each of those persons individually propose to contribute at least US$400,000 to the joint investment an application or application for Citizenship by Investment may be submitted on his, her or their behalf through an agent.

The process is similar to NDF or Real estate route. Any potential applicant(s) under this investment option is/are advised to make contact with the ABIA to discuss their proposal.

Investors must also pay the due diligence fees and 10% of the government processing fees.

For a single applicant, or a family of 4 or less

- Processing fees: US$50,000

For a family of 5 or more:-

- Processing Fees: US$15,000 for each additional dependent

Invest in Antigua

Setting up a business is relatively a straight forward process. The following are some of the attractive benefits to foreign investors in Antigua and Barbuda.

- The Antigua CIP offers very attractive business option for foreigners to invest in Antigua and Barbuda and contribute to the economy. Antigua depends on 60% on tourism and other key sectors are agriculture, services. Antigua is famous for its many luxury resorts.

- Residents of Antigua and Barbuda benefit from no capital gains tax or estate taxes. Income taxes are progressive to 25% and for non-residents, they are at a flat rate of 25%. Proposed amendments to Part 111 Section 5 of the Income Tax Act will change taxation on worldwide income to taxation on income sourced within Antigua and Barbuda. Antigua and Barbuda is a constitutional monarchy with a British style parliamentary system of government.

- Antigua and Barbuda has an estimated Gross Domestic Product of USD $1.18 billion, with forecast growth of 3.21 percent in 2017. Antigua and Barbuda is currently ranked 113th out of 190 countries in the World Bank’s 2017 Doing Business report.

- Established in 2006, the Antigua and Barbuda Investment Authority facilitates foreign direct investment in the aforementioned priority sectors and advises the government on the formation and implementation of policies and programs to attract investment in Antigua and Barbuda.

- Antigua and Barbuda bases its legal system on the British common law system.

- There are no limits on foreign control in Antigua and Barbuda. Foreign investors may hold up to 100 percent of an investment

- Antigua and Barbuda offers many incentives to investors. These are legally codified in the Investment Authority Act of 2006. The list of incentives includes exemption from or reduction of payment of duty on the importation or purchase of raw materials, building materials, furniture, fixtures, fittings, appliances, machinery, and equipment for use in the construction and operation of the business. Duty on the importation or purchase of vehicles for use in the operation of the business is also exempted or reduced.

- The Property Tax Act (2000) allows a reduction of up to 10 percent for land and a building used in the operation of the business and provides certain tax holidays.

- As a member of the WTO, Antigua and Barbuda is party to the Agreement to the Trade Related Investment Measures.

Approved Business Projects

The Citizenship by Investment Unit of Antigua and Barbuda has approved 12 business projects for investment. Only investing in CIU approved projects qualify for citizenship.

| Company Name | Address | Website |

| Antigua Sustainable Aquaculture Limited | Hill & Hill Chambers, Long Street, St. John’s, Antigua | Tel: +1416 549 1612Fax:+1905 698 1096

Email: [email protected] |

| Call Centre Services Inc. | C/o Cort & Cort, Attorneys –at-Law, Fitzgerald House, P.O. Box 2010, 44 Church Street, St. John’s | Tel: 268-462-5232/330Email: [email protected] |

| Caribbean Free Trade Zone Development (Antigua) Inc | International free Trade centre of Antigua, Carlisle, St. George’s, Antigua W.I. | Tel: 1 (268) 462-4717Toll free: +86-400-8520-860

Email: [email protected] |

| Diamond Caribbean Properties Limited | c/o Hill and Hill Chambers, Long Street, St. John’s, Antigua | Tel: (268) 4624717 Email: [email protected] |

| Freetown Destination Resort Limited | P.O. Box 1301, #60 Nevis Street, St. John’s. Antigua and Barbuda | Tel: 1 604 648 6681 Web: www.replayresorts.com Web: www.myhalfmoonbay.com E-mail: [email protected] |

| Freetown Hotel Development Limited | P.O. Box 1301, #60 Nevis Street, St. John’s. Antigua and Barbuda | Tel: 1 604 648 6681 Web: www.replayresorts.com Web: www.myhalfmoonbay.com E-mail: [email protected] |

| Golden Island Filmworks Ltd | C/o Cort & Cort, 44 Church Street, St. John’s, Antigua | Tel: 1 (268) 562-1530Email: [email protected] |

| G.V. Development Limited | Courtyard Marriott Hotel Antigua c/o James and Maginley Ltd., #51 Church Street and Hardcastle Avenue, St. John’s, Antigua W.I. | Tel: Office (268) 562-8775 Tel: ( 268) 720- 3800 Mr. Kirthley Maginley Tel: (268) 720 – 7284 Mr. Casroy James Tel: (268) 728 4155 Mr. Patrick MaginleyCassie Walker #424 Jolly Harbor St Mary’s Antigua W.I. Tel: (268) 785 – 9005 |

| Jiahao Investment (Antigua & China) Limited | Long Bay Hotel, C/o Hill & Hill, Long Street, P.O. Box 909, St. John’s, Antigua | Tel: 1 (268) 462-4717 Tel: 1 (268) 464-7743E-mail: [email protected] |

| Operose Capital ATG Investors Limited | Level 41 Emirates Towers, Sheikh Zayed Road, PO Box 31303, Dubai, United Arab Emirates | Office: +971 4 319 7542 Mobile: +966 56 776 7737www.operose.net [email protected] |

| The Verandah Resort & Spa | By Verandah Resorts Limited, Long Bay, St. Phillip’s, Antigua, W.I. | Tel: (613) 290-4719www.clientreferrals.com

|

| Whitegate Real Estate Limited | Hill & Hill Chambers, Long Street, St. John’s, Antigua, W.I. | Tel: (268) 462-4217[email protected] |