The Non-Habitual Residence Tax Regime (NHR) is an often overlooked and missed by Ultra and High-net worth investors, while taking up residence in Portugal through Golden visa scheme.

This taxation scheme was introduced in 2009, with the aim of attracting talent and high net worth individuals. Portugal is a top choice for Ultra and High Net Worth Individuals who wish to take up residence in the European Union, according to PWC

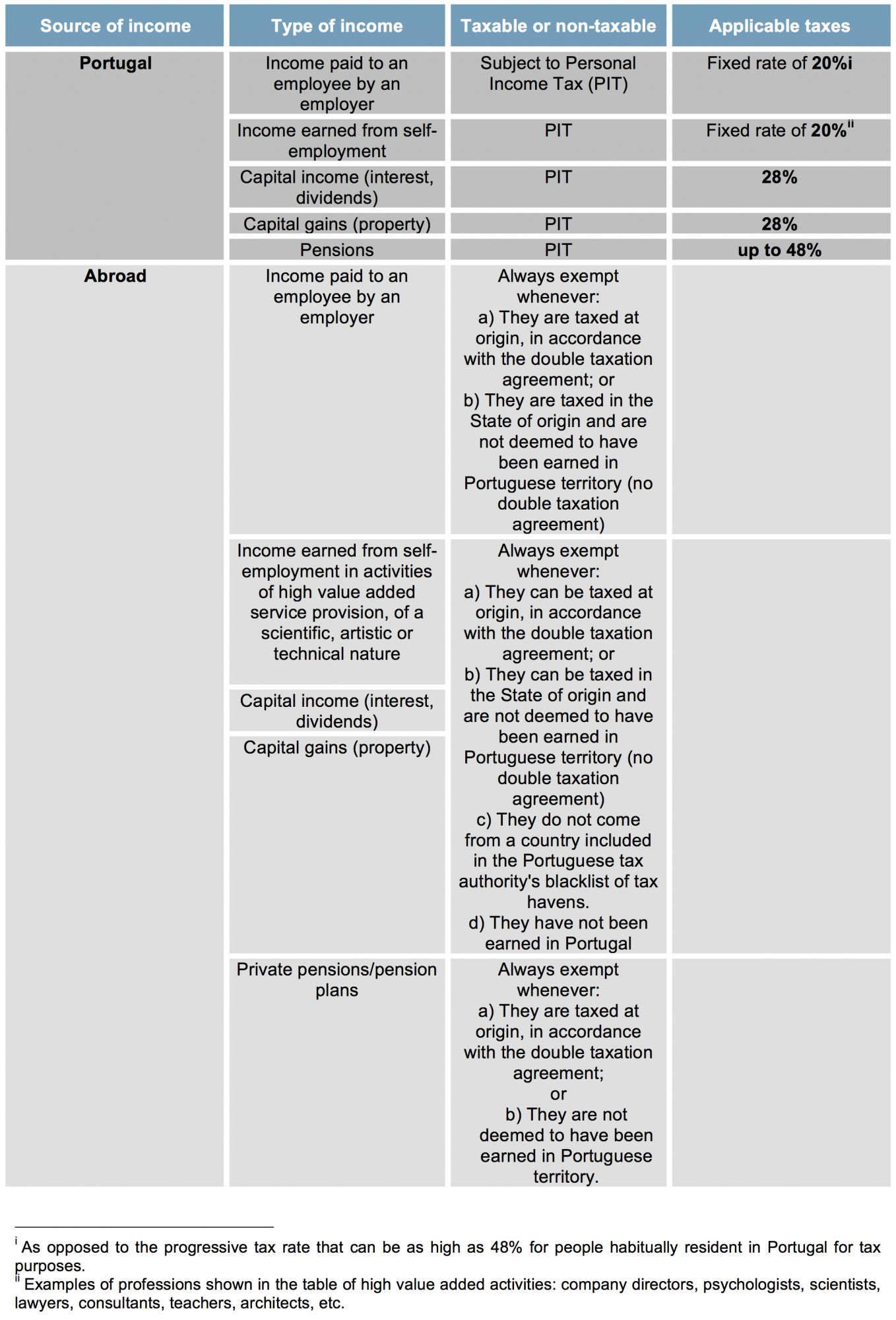

In short, by becoming a Portuguese tax resident under the Non-Habitual Residency scheme, your income will be tax-free both in Portugal and in the income’s source country (example income from UK).

According to Belvins Franks

British expatriates can potentially receive UK pensions, rental income, capital gains on real estate, interest, dividends and non-Portuguese employment income tax-free. Importantly, this can apply even if the income is not actually taxed in the home country. UK dividends, for example, escape Portuguese taxation under the NHR scheme because they are taxable in Britain (according to the UK/Portugal double tax treaty). In practice, however, ‘disregarded income’ rules can eliminate UK tax liability for non-residents. As a result, you could end up paying no tax – in either country – on the income (although gains on UK shares will not qualify for NHR exemption).

Most UK pensions – including private pensions, company pensions and the State Pension – will not be taxed under NHR (even though the UK/Portugal tax treaty gives Portugal exclusive taxing rights). So however you access your UK pensions – regular income, cash withdrawals or one lump sum – you can generally do so as a non-habitual resident without being taxed in either country. The exceptions here are UK government pensions (including local authority, army, police, teaching, fire service and some NHS pensions) which always remain taxable in the UK.

All nationalities including EU/EEA nationals can qualify for this NHR scheme. Anyone who has not been a tax resident in Portugal during the preceding five years and takes up residence in Portugal is eligible to participate in this scheme. Becoming a Portuguese tax resident requires residing in Portugal for at least 183 days in a 12 month period. A person who does not fulfil this requirement can still be considered a tax resident in Portugal if he has a home in Portugal which is intended to be his permanent residence. Ownership of home and residency status can be easily obtained by purchasing a property for 350K euros through the existing Golden visa scheme in Portugal.

The NHR status is issued for ten year period is not extendable. For ten years, the migrant can profit from advantageous tax rates. The migrants’ Portuguese sourced income will be taxed at a flat rate of 20% if the income is derived from ‘high value activities’, while many forms of foreign source income (including foreign source pensions) are exempted from taxation. Moreover, Portugal does not impose wealth taxes.

There are no wealth tax or capital duties in Portugal. Inheritance or a gifts received by a spouse, descendant or ascendant is tax exempt. capital gains from the sale of securities will be subject to tax in Portugal, currently at a flat rate of 28%.

Benefits of NHR

- Non habitual residents will be exempt from Personal income tax (PIT) on salaries of a non Portuguese source if such salaries were subject to tax in the country of source under an existing Double Tax Treaty or, if no Tax Treaty exists, were subject to tax in another jurisdiction and are not considered as Portuguese source income under domestic rules.

- Business and professional income of a non Portuguese source relating to high added value services of a scientific, artistic or technical nature, as well as from intellectual or industrial property or industrial, commercial or scientific information, earned by non habitual residents abroad are exempt from PIT provided such fees could have been taxed under an existing Double Tax Treaty or could have been taxed in another non black listed jurisdiction in accordance with the provisions of the OECD.

- Rental income, investment income and capital gains of a non Portuguese source obtained by non habitual residents are also PIT exempt, provided the above mentioned conditions are met.

- Pensions paid abroad to non habitual residents are also PIT exempt if such pensions were subject to tax under an existing Double Tax Treaty or if the pension should not be considered as obtained in Portugal and related contributions did not allow a PIT deduction in Portugal.

- Under the non habitual residents tax regime, MNC’s will have a major advantage in placing their centres of excellence in Portugal, for example their R&D departments, and Portuguese companies will have a significant stimulus to attract the best talent.

- UHNWI’s are able to accrue their wealth in a white listed friendly tax environment, to dispose of their assets benefiting from tax exemptions, to pass on their wealth or estate without inheritance or gift taxes and/or to enjoy their retirement without tax leakage on their pensions.

The deadline for registering for the regime is the 31st of March, inclusive, in the year following that in which the individual becomes resident in Portugal. Once approval has been granted by the Portuguese tax authorities, the regime will remain in force for 10 years.

Source: PWC