While tens of thousands of chinese are waiting over two years to obtain green cards under EB-5, a record number of americans are emigrating and renouncing US citizenship.

IRS publishes list of individuals who have chosen to expatriate every quarter.

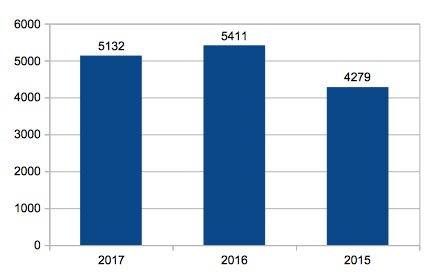

A total of 5,132 Americans renounced their US citizenship in 2017, 5411 in 2016, and 4,279 bin 2015.

- Q1 2018 – 1099

- Q4 2017 – 685

- Q3 2017 – 1376

- Q2 2017 – 1758

- Q1 2017 – 1313

The US State Department clearly mentions the following obligations when renouncing US citizenship.

- A person seeking to renounce U.S. citizenship must renounce all the rights and privileges associated with such citizenship.

- Persons intending to renounce U.S. citizenship should be aware that, unless they already possess a foreign nationality (dual nationals), they may be rendered stateless and, thus, lack the protection of any government. They may also have difficulty traveling as they may not be entitled to a passport from any country. Statelessness can present severe hardships: the ability to own or rent property, work, marry, receive medical or other benefits, and attend school can be affected. Former U.S. citizens would be required to obtain a visa to travel to the United States or show that they are eligible for admission pursuant to the terms of the Visa Waiver Program. If unable to qualify for a visa, the person could be permanently barred from entering the United States.

- Persons who wish to renounce U.S. citizenship should be aware of the fact that renunciation of U.S. citizenship may have no effect on their U.S. tax or military service obligations.

- The act of renouncing U.S. citizenship does not allow persons to avoid possible prosecution for crimes which they may have committed in the United States, or escape the repayment of financial obligations, including child support payments, previously incurred in the United States or incurred as United States citizens abroad.

- Citizenship is a status that is personal to the U.S. citizen. Therefore parents may not renounce the citizenship of their minor children. Similarly, parents/legal guardians may not renounce the citizenship of individuals who lack sufficient capacity to do so. Minors seeking to renounce their U.S. citizenship must demonstrate to a consular officer that they are acting voluntarily, without undue influence from parent(s), and that they fully understand the implications/consequences attendant to the renunciation of U.S. citizenship.

U.S. Department of State has raised the fee for renunciation from $450 those who renounce or relinquish US Citizenship $2350

But why so many American expats are not interested and renouncing their own US citizenship?

According to Forbes,

One organization suggests renouncing U.S. citizenship not because of Trump, but because of American taxes. America’s global income tax compliance and disclosure laws can be a burden, especially for U.S. persons living abroad. Their American status can make them untouchable by many banks. Many foreign banks do not want American account holders. Americans living and working in foreign countries must generally report and pay tax where they live. But they must also continue to file taxes in the U.S., where reporting is based on their worldwide income. Ironically, leaving America can be costly. America charges $2,350 to hand in your passport, a fee that is more than twenty times the average of other high-income countries.

According to Investopedia,

While the reasons for abandoning citizenship vary from one person to the next, the recent spike in numbers is largely due to newer tax laws, including the Foreign Account Tax Compliance Act (FATCA) of 2010. According to the IRS, FATCA is “an important development in U.S. efforts to combat tax evasion by U.S. persons holding accounts and other financial assets offshore.”

U.S. taxpayers about their foreign financial accounts and offshore assets foreign financial institutions regarding financial accounts held by U.S. taxpayers or

foreign entities in which U.S. taxpayers hold a substantial ownership interest Under FATCA, certain U.S. taxpayers with financial assets outside the U.S. that total more than the reporting threshold must report their assets to the IRS, using Form 8938, Statement of Specified Foreign Financial Assets (the threshold varies based on your filing status and whether you live in the U.S. or abroad).

Worldwide Income Taxation

Worldwide income taxation is also one of the factors driving US expats renouncing citizenship. Ultra and high-net worth foreigners investing in the US are careful not to apply to become permanent resident (green card holder) or US citizen, spend less time in the US, to escape from US taxation on worldwide income.

Almost all countries tax foreign income based on residency, but only two countries in the world systematically and comprehensively tax the worldwide income of nonresident citizens (US and Eritrea):

According to Wikipedia, The United States taxes its nonresident citizens on their worldwide income using the same marginal tax rates for both foreign and U.S.-source income. To mitigate double-taxation of the same income, U.S. citizens residing in another country may exclude some of their foreign income from U.S. taxation, and take credit for income tax paid to other countries, but they must file a U.S. tax return to claim the exclusion or credit even if they result in no tax liability.[115] “U.S. persons” abroad, like U.S. residents, are also subject to various reporting requirements regarding foreign finances, such as FBAR, FATCA, and IRS forms 3520, 5471, 8621 and 8938. The penalties for failure to file these forms on time are often much higher than the penalties for not paying the tax itself