Citizenship by investment schemes help create a new class of HNWI diaspora population in Europe and Caribbean. The word Diaspora often used to refer immigrant populations living away from homeland.

CBI programs link citizenship in a particular nation with an associated investment by a noncitizen. These programs have been gaining in popularity, the diaspora population that arises from these programs could be an interesting source for investment, particularly for larger infrastructure projects.

According to World Bank, in a diaspora report

A new class of potential Diaspora investors has emerged among a subset of Caribbean small states: those who gain Caribbean nationality, through Citizenship By Investment (CBI) programs. This group of HNW citizens are likely to have the investment capacity, professional networks, and experience to be strong Diaspora investors.

The Diaspora population that arises from CBI schemes could be an interesting source for investment. For example, if some of these individuals were to relocate part of their business operations into the islands in which they are citizens, it could result in increased jobs and capital coming into the country.

The CBI schemes operating in about 10 countries do not require investors to live permanently in the country after becoming citizens. Golden visa schemes such as Portugal, Spain and Greece require property investment and have very minimal residency requirements with many investors chose to live outside the country for various reasons. Both schemes essentially contribute to rise diaspora investor population.

CBI schemes contributes to new kind of citizenship known as ‘Diaspora citizenship‘. New diaspora citizens are free to invest, do business, invest in property or visit the country whenever they want.

A blog by Heather Cover-Kus, Technical Research Officer – Commonwealth Secretariat mentions

Diaspora investment and citizenship-by-investment programmes are two sides of the same coin. They both seek to increase investment by appealing to people’s affinity for a country through its citizenship or would-be citizenship.

According to UN report, Indians are the world’s largest diaspora population with 16 million living overseas, followed by Mexicans. A total of US$8.4 billion remittances sent by foreign workers to India.

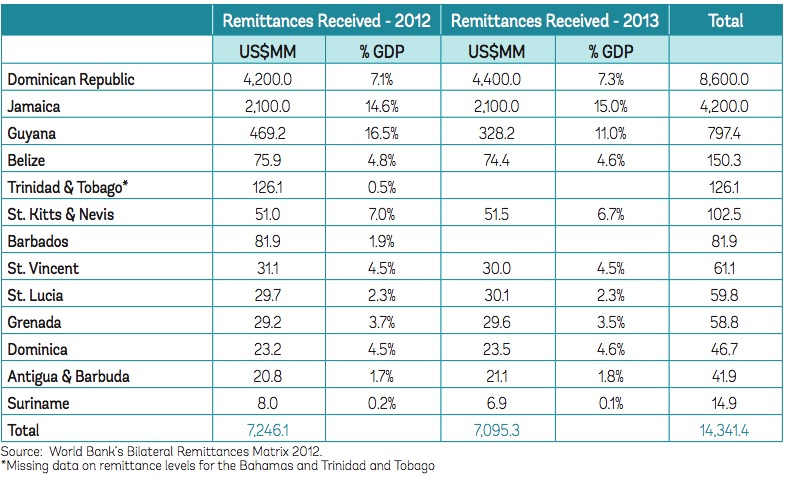

In the Caribbean, Dominican Republic and Jamaica received top remittances from abroad. These two countries does not have CBI Programs. In the Caribbean CBI schemes run in Dominica, St Kitts, Antigua, St Lucia and Grenada.

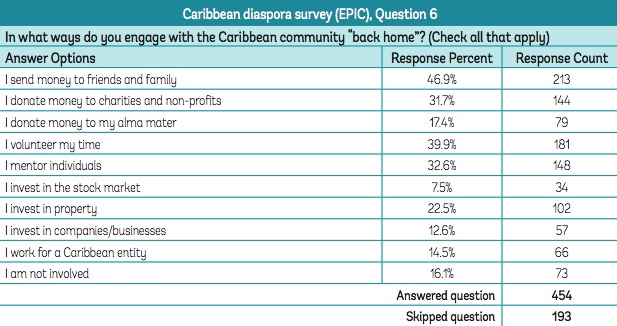

In a caribbean diaspora survey by world banks. 46% answered they send money to friends and family, 22.5% invested in property home.

On June 26, St Kitts and Nevis organized a historic Inaugural Diaspora Conference, held at the St. Kitts Marriott Resort.

Deputy Prime Minister Richards, who was delivering remarks on behalf of Prime Minister Dr. the Honourable Timothy Harris, further stated that the Government intends for the conference to also heighten awareness of investment opportunities “and also lead to the establishment of a database of Diaspora expertise and an approved Diaspora Policy that will provide a legislative and regulatory framework to facilitate Diaspora investments.”

He added, “The Government will also consider whether we should raise financing from our overseas nationals by issuing Diaspora bonds – which both India and Israel have had much success with and which development economists such as Dilip Ratha of the World Bank are proponents of – to fund infrastructure projects and social investments.”

He further stated “Government is also actively considering offering tax incentives and duty-free concessions for Kittitians and Nevisians coming back home to engage in agriculture, real estate development and other key activities.”

Source: worldbank.org