Citizenship coin, launched in April 2018, is the first ever crypto currency meant to be used within the Citizenship and residence by investment (CRBI) industry for real estate transactions and citizenship related services.

The Citizenship coin startup has plans to become the first ‘Crypto bank’ for the investment migration industry in the future when crypto-currencies get widespread adoption after 2020, offering financial freedom, cheaper transaction costs to small countries.

CBI/RBI industry is already a $15 billion dollar industry and RBI-Golden visa industry contributes excess of $10 billion every year, and both industries combined set to reach $25 billion by 2020.

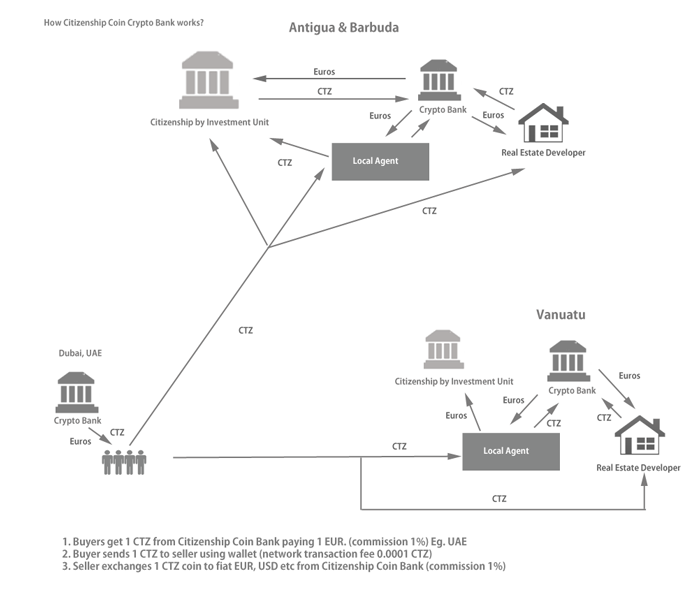

The Crypto bank, we named it “Citizenship bank” will be setup first in the crypto valley of the world in Zug, Switzerland and then will expand to other countries such as Antigua, Malta, UAE etc to facilitate real estate transactions in exchange for citizenship or residency.

As of 2019, We are still a startup in initial stages of development. The new bank will support all top cryptocurrencies traded in the market such as bitcoin, bitcoin SV, Bitcoin cash, Ethereum, Litecoin, Tron etc..

Citizenship coin is a stable, non-volatile digital currency, tied to fiat currency euro. Payments can be sent directly sent directly between two persons without any intermediaries. The value of one citizenship coin equals one euro, with no inflation. We decided to create this coin because of the high volatility of bitcoin. Many agents and real estate developers lose their money when bitcoin swings around $1K in a day.

Citizenship coin can be used to pay for any citizenship related services including real estate, investments and other fees. Citizenship coin can be exchanged to fiat currencies and also other cryptos such as Bitcoin, Bitcoin Cash, Ethereum and Ripple.

In 2018, Antigua became the first country to accept Bitcoin and other cryptocurrencies for the CIP after government as a payment option under the citizenship by investment program. Currently the option is still in the pipeline. Vanuatu government also introduced Volcano coin to be used for payments within the country instead of bitcoin

The working of citizenship coin is very simple, similar to that of bank. There are key differences between Bitcoin and Citizenshipcoin.

1. Buy 1 CTZ from Citizenship Coin Bank paying 1 EUR. (commission 1%)

2. Exchanges 1 CTZ coin to fiat EUR etc from Citizenship Coin Bank (commission 1%)

The bank will also function similar to currency exchanges.

Governments and CIUs may or may not chose to accept citizenship coin. Authorized agents will convert coins to fiat and pay to Governments making it easier.

Citizenship coin supply is limited to 100 million coins and 1 million coins will be in circulation during the initial period of its operation. Citizenship coin can be freely exchanged from/to Bitcoin, Bitcoin Cash, Ethereum and other cryptos at the price of Euro.

Read the whitepaper or visit our website at http://citizenshipcoin.org