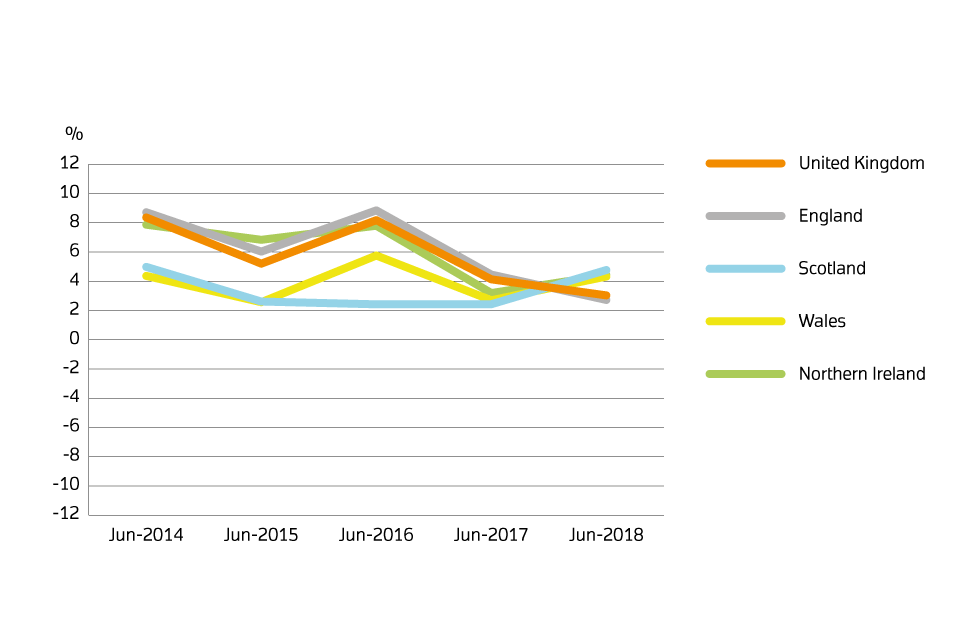

UK house prices rose by 3.0% in the year to June 2018, down from 3.5% in the year to May 2018.

- Average house prices in the UK increased by 3.0% in the year to June 2018 (down from 3.5% in May 2018).

- At the country level, the largest annual price growth was recorded in Scotland, where house prices increased by 4.8% over the year to June 2018.

- Wales saw house prices increase by 4.3% over the last 12 months.

- In England, the average price increased by 2.7% over the year.

- The average price in Northern Ireland increased by 4.4% over the year to quarter 2 (April to June) 2018.

According to UK property statistics for June 2018

- The average price of a property in the UK was £228,384

- The annual price change for a property in the UK was 3.0%

- The monthly price change for a property in the UK was 0.4%

- The monthly index figure (January 2015 = 100) for the UK was 119.8

- 65,619 mortgages were approved in June 2018

Average price by country and government office region

| Country and government office region | Price | Monthly change | Annual change |

|---|---|---|---|

| England | £245,076 | 0.3% | 2.7% |

| Northern Ireland (Quarter 2 – 2018) | £132,795 | -1.0% | 4.4% |

| Scotland | £150,472 | 0.8% | 4.8% |

| Wales | £156,886 | 1.7% | 4.3% |

| East Midlands | £187,553 | -0.5% | 4.1% |

| East of England | £292,632 | 1.0% | 3.3% |

| London | £476,752 | -0.6% | -0.7% |

| North East | £127,271 | -1.9% | -0.6% |

| North West | £159,801 | 0.5% | 3.1% |

| South East | £325,107 | 0.6% | 2.1% |

| South West | £252,558 | -0.5% | 3.1% |

| West Midlands Region | £196,015 | 1.9% | 5.8% |

| Yorkshire and The Humber | £160,727 | 0.9% | 3.2% |

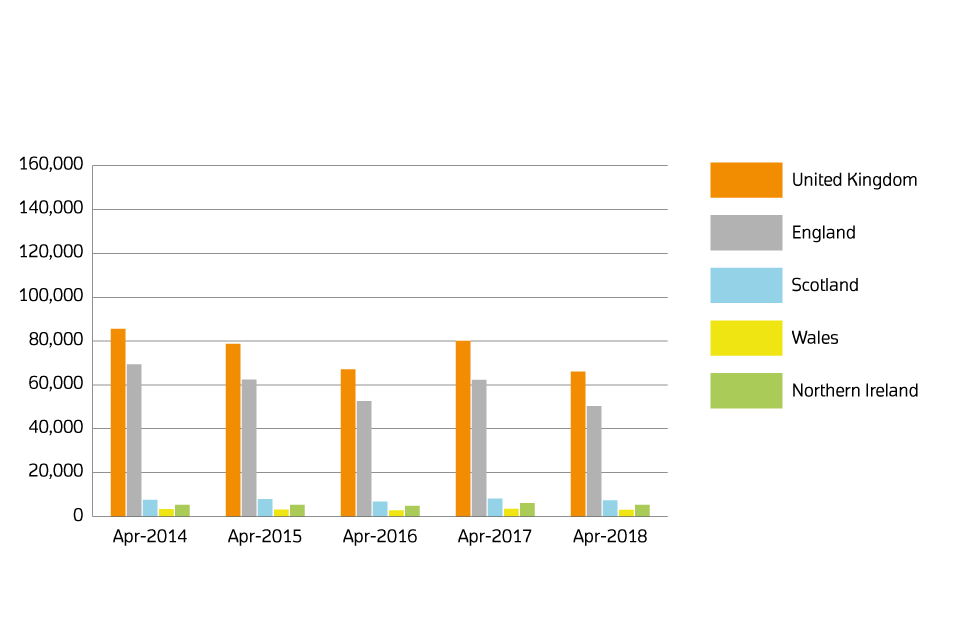

Number of sales volumes by country

| Country | April 2018 | April 2017 | Difference |

|---|---|---|---|

| England | 50,308 | 62,318 | -19.3% |

| Northern Ireland (Quarter 2 – 2018) | 5,308 | 6,099 | -13.0% |

| Scotland | 7,371 | 8,139 | -9.4% |

| Wales | 3,005 | 3,490 | -13.9% |

In April 2018, the number of property transactions completed in the UK decreased by 17.5% when compared to April 2017

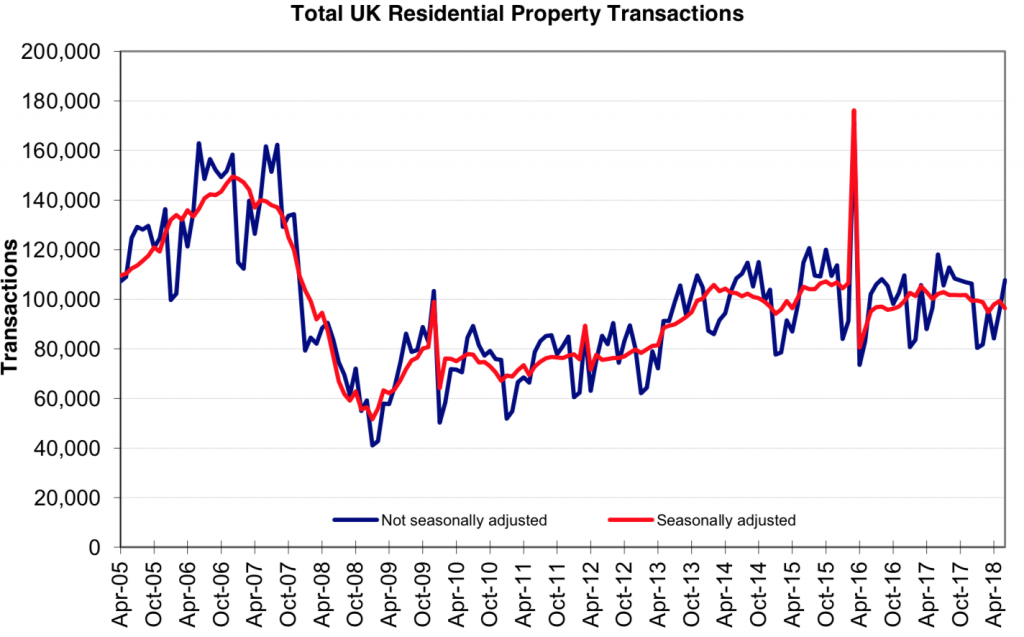

Residential transactions

The provisional seasonally adjusted UK property transaction count for June 2018 was 96,340 residential and 9,710 non-residential transactions above 40,000 GBP.

Property taxes

Stamp Duty Land Tax (SDLT) is payable on the purchase or transfer of most property or land in England,

and Northern Ireland. Land and Buildings Transaction Tax (LBTT) is the equivalent tax payable in Scotland.

Land Transaction Tax (LTT) is the equivalent tax payable in Wales.

The SDLT, LBTT or LTT due on a transaction is calculated from the amount paid for the property with higher rates applied to higher value transactions though with different rates and thresholds. Some transactions will qualify for a relief or exemption.

Different rates and thresholds will also apply depending on whether the property is being used for

residential or non-residential purposes, and whether the property is sold as a freehold or leasehold.

Most UK land and property transactions will be notified to HM Revenue & Customs (HMRC) directly on

a Stamp Duty Land Tax return – even if no tax is due. Transactions with value less than £40,000

do not need to be notified. Transactions in Scotland need to be notified to the Scottish Administration.

Transactions in Wales need to be notified to the Welsh Revenue Authority (WRA).

SDLT replaced Stamp Duty on Land and Property on 1 December 2003. LBTT replaced SDLT in Scotland

on 1 April 2015. LTT replaced SDLT in Wales on 1 April 2018.

Read more: