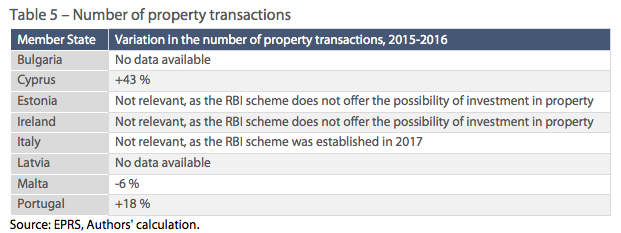

The European Parliamentary research services (EPRS) has published a study on citizenship/residency schemes and said that CBI/RBI scheme boosted property prices in Cyprus by 43% highest than any other country.

Cyprus offers citizenship by investment for €2 million euro property investment and also a RBI property scheme for €300,000 plus VAT.

The study also compares Cyprus with other countries such as Malta, Portugal however Greece is left out.

Cyprus

In Cyprus, the number of deeds of sale transactions increased by 43 % in 2016 compared to 2015. Of the total deeds of sale submitted to the land registry for 2016, it is noteworthy that 25.67 % relate to sales to foreign buyers. This is a 34.44 % increase compared to the previous year and can be attributed to the fact that Cyprus has attracted foreign investors via its CBI/RBI schemes

Latvia

According to existing research, the impact of the Latvian RBI scheme ‘on the real property market of Latvia until 2014 was significant. […] In some regions of Latvia, the share of real property transactions in which foreigners were involved reached more than 50%’

Malta

The number of deeds decreased by 6 % between 2015 and 2016 in Malta, the aggregate volume amount of transactions on the property market rose by 12 % during the same period, meaning that there are fewer but bigger transactions. According to the available data, in 2016, the Maltese CBI scheme represented 0.43 % of the total number of sales in Malta, but 5.43 % of the total sale prices. These data clearly suggest that the Maltese property market is impacted by the CBI scheme, with a potential effect of a rise in house prices.

Portugal

In Portugal, from 2012 to 2018, €3.5 billion was invested in property through its RBI scheme. Within the same period of time, the number of property transactions rose by more than 100 %. The rapid increase in RBI applications has reportedly boosted the performance of the property market, leading to a steep rise in prices, especially for luxury property.

Research shows that the commodification of Lisbon’s historic centre is partly due to the Portuguese RBI scheme.156 The gap between actual and potential property rent in Lisbon’s historic centre owes much to the gap between domestic and external market purchasing powers. Because of the Portuguese RBI – although not exclusively – ‘real estate prices are pushed above the financial capacity of most local households, and an enclave-type exploitation of the housing stock emerges in Lisbon’s historic centre that jeopardizes the former’s access to housing in that territory and in its immediate surroundings

The EPRS study said that investment in property can stimulate construction activity and thus create jobs. But evidence of these impacts in practice is scarce.

The report also warns that

- CBI/RBI schemes are artificially driving the property prices..

- Large and sudden influx of private investment can also impact the quality of new construction, as a result of demand pressures and if regulation of construction projects does not keep pace,.

- House prices could rise due to CBI/RBI schemes. As housing costs represent an important share of a household’s income, this could lead to vulnerable groups experiencing increasing difficulties to access housing, in addition to an greater burden on household incomes – potentially leading to indebtedness, increasing vulnerability to repossession, foreclosure and eviction and ultimately, homelessness.

The full report is available here