IMF has published 2018 Article IV consultation report on Portugal.

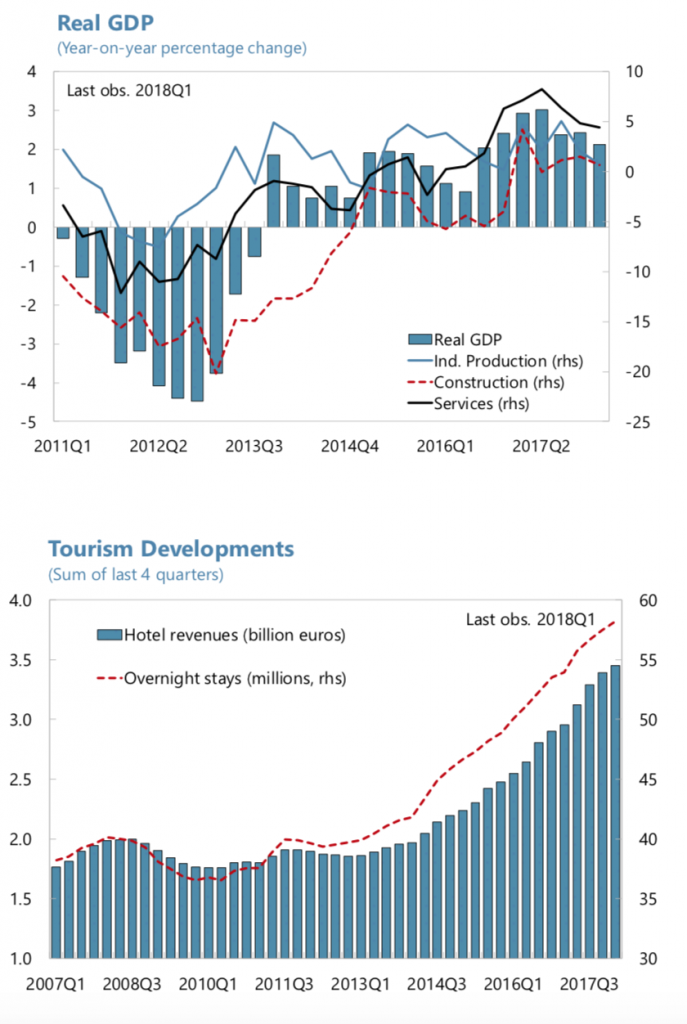

According to the report, The Portuguese economy performed strongly in 2017. Investment and exports were the key drivers of growth. Labor market conditions continued to improve, with falling unemployment and broad-based employment creation.

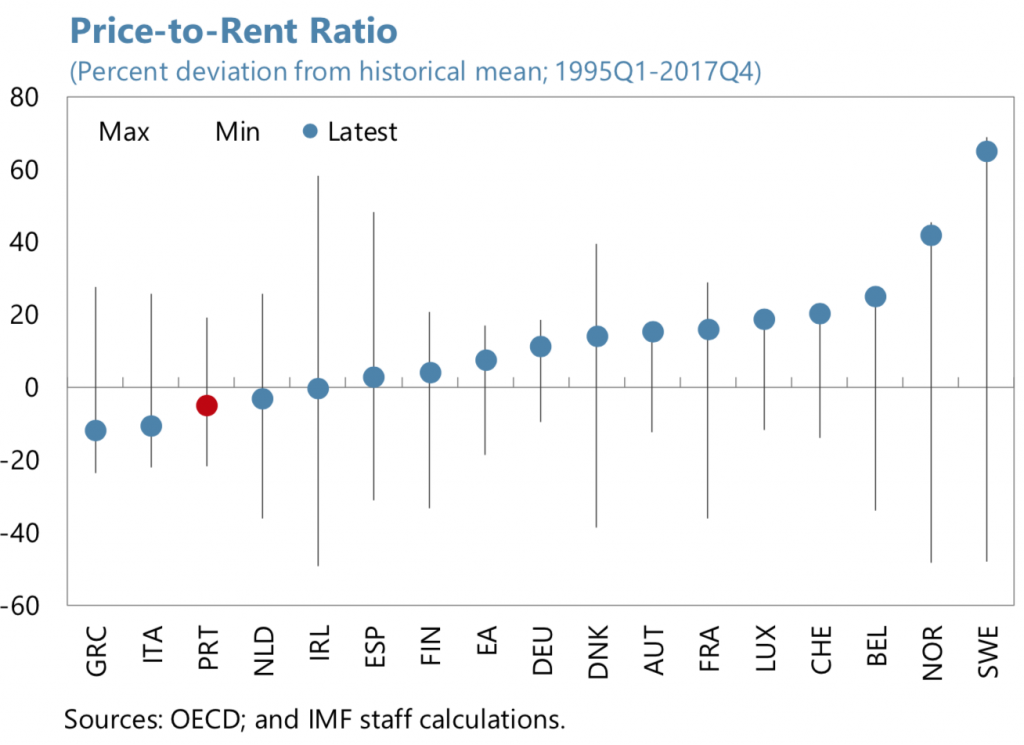

IMF said housing prices continue to increase, but there is no significant overvaluation yet.

The developments in real estate markets have been shaped by robust demand from non- residents and tourism, with upward pressures on prices, mostly, since the second half of 2017, and in particular in the residential segment of the real estate market.

Following a decline of 18 percent in real terms over 2010–13, housing prices have since increased by about 20 percent in real terms (7.9 percent in 2017), especially in Lisbon, Porto and the Algarve region.

While the increases have been driven largely by transactions on existing dwellings by non-residents, the share of housing transactions financed by Portuguese mortgages has been growing since 2015 (reaching 41 percent in the last quarter of 2017).

Estimates in the ECB’s May 2018 Financial Stability Review suggest that there are incipient signs of overvaluation in the residential real estate market. The authorities should continue to improve the quality of real estate data and related analytical tools, and to monitor mortgage markets and the evolution of risks to banks from developments in real estate markets.

Portugal’s real GDP is on a positive bound compared to 2012 with construction, services and industrial production playing a key role. The tourism in Portugal has also increased significantly contributing to over 50 billion euros

Read the full IMF report here