Latvia opened golden visa scheme in June 2010 and is one of the oldest golden visa schemes in Europe. Since 2010 various amendments have been made on the golden visa law offering residence permits to foreign investors.

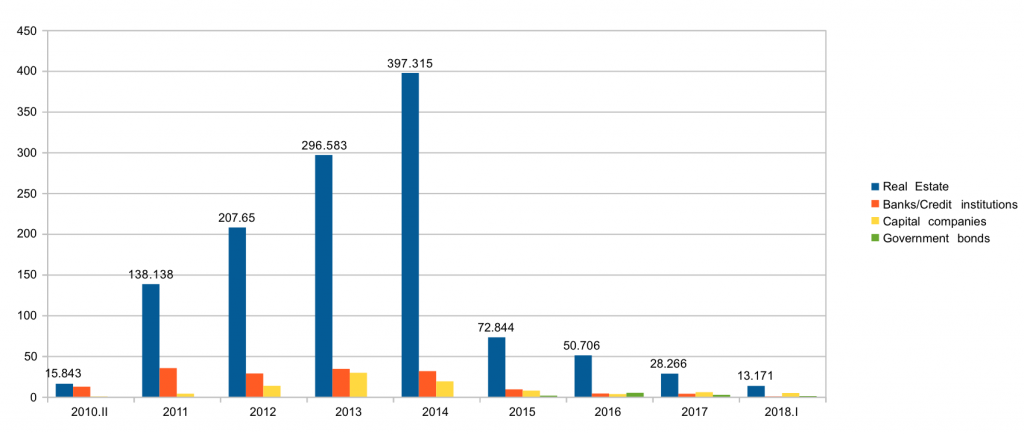

As of 2014, the scheme has significantly declined by 84% after Latvia tightened the scheme with new regulations. In 2015, the number of golden visa applications took a nose dive from 2,532 in 2014 to just 398 in 2015. Further it plunged to just 160 applications in 2017. The latvian scheme is on a massive decline by 93% from its 2014 peak levels.

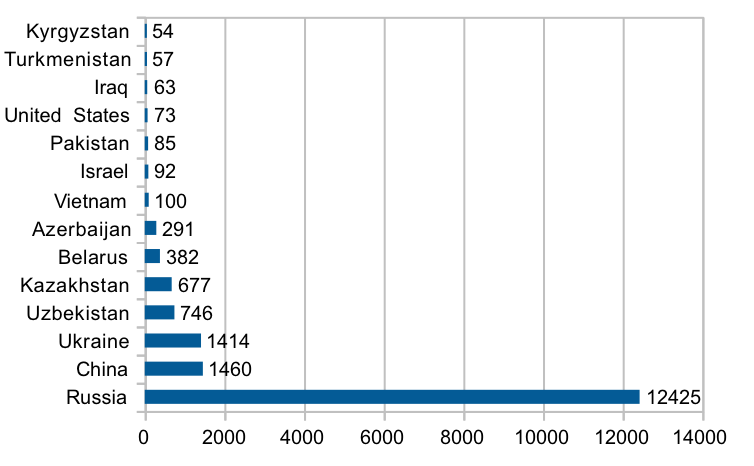

According to official figures from OCMA, Latvia has received some €1.5 billion euros foreign investment in the past eight years with 90% russians investing in the scheme

Due to changes in the conditions of the investment program, as they became more stringent from 1 September 2014, the number of applications received and the volume of investments significantly decreased. As a result of which the demand for golden visas in Latvia has declined and never recovered. The decrease in the number and size of investments related to FDI has also been influenced by the measures taken in recent years to strengthen supervision of non-resident savings in Latvian commercial banks.

Latvia also tightened integration and language levels to acquire permanent residency and citizenship. Participation in integration activities in Latvia is voluntary and a certain level of knowledge of the Latvian language is required only upon entering into employment and applying for a permanent residence permit and then for citizenship. Non-payment of taxes, social security contributions also makes golden visa applicants ineligible for permanent residency or citizenship.

The Golden investment program had a positive effect during the crisis and over time the economic situation in Latvia improved.

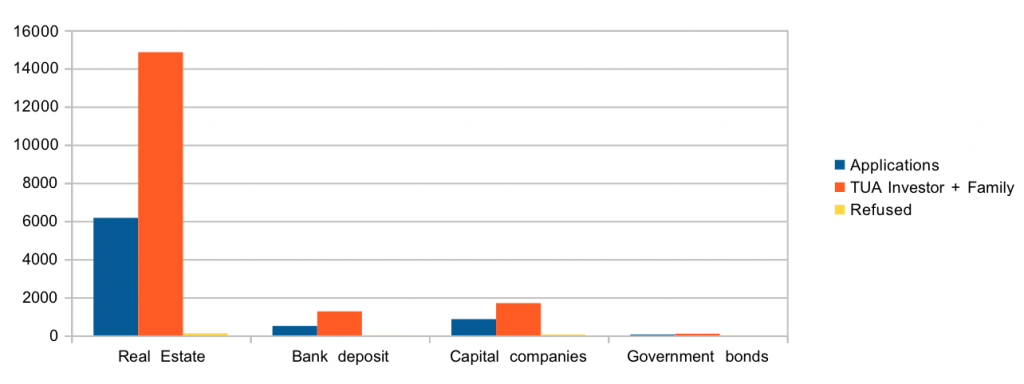

Latvia also refused some 165 golden visa applications and revoked/canceled 3,278 residence permits (TUA) of investors, the highest revoking of any golden visa country.

Latvia Golden visa

The current investment conditions for golden visa in Latvia are

- €250,000 in Government bonds + €38,000 state fee

- €250,000 in Real estate + 5% state fee

- €100,000 company investment + €10,000 state fee

- €280,000 Bank deposit or in a credit institution + €25,000 state fee

Here is the brief summary of the report…

- From July 1, 2010 to June 30, 2018, within the framework of the investment program, OCMA has issued 17 ,900 TUA (temporary residence permits) . In 165 cases, the issuance of TUA to investors was refused but canceled by 3 278 TUAs.

- Investments related to non-resident TUAs received from 1 July 2010 to 30 June 2018 amounted to EUR 1.5 billion. euro .

- In total, the investment program under real estate received 82.8% of the invested funds, or 1.2 billion. Investments in special non-interest-bearing government securities for special purposes amounted to EUR 9 million. EUR 0.7% of total investment.

- About 90% of all TUAs have been requested by investors from the territory of the former USSR.

- Until mid-2018 only 82 applications were received. In 2014, the number of TUAs issued under the Investment Program accounted for 53% of all first-time TUA issued to third-country nationals . In 2015, their share decreased to 21%, in 2016 – 10%, in 2017 and in the first half of 2018 – only 5%.

- With the investment program related investment properties will reduce the amount of NAS practically no effect on the real estate market as a whole.

- Although the number of transactions has dropped, Riga and Greater Riga, especially Jurmala, continue to dominate the acquisition of real estate in connection with the receipt of TUA – exclusive sites and new projects. Since 2016, only two properties have been acquired outside Riga and Pieriga.

- Riga and Jurmala property TRP holders 2017 together contributed 2.3 million euro or 1% of the total real estate tax collected in the country.

Real estate investment

From July 1, 2010 to June 30, 201 8, Latvian real estate market occurred in the TRP receipt of the purchase of real estate-related transactions with a total of 1, 221 mill EUR (detailed information on the TRP-related investments in real estate, see Annex No. 2).

As of the second half of 2014, the number and proportion of real estate foreigners has decreased. A significant drop was in 2015, and the trend continued in the coming years . This can mainly be explained by the amendments to the Immigration Law (LV, adopted by the Saeima on 8 May 2014). 98 (5158), 22.05.2014), which entered into force on 1 September 2014 and determined a higher minimum investment amount in case of real estate acquisition .

The change (increase) of the minimum investment required for the acquisition of TUA from 1 September 2014 has reduced the number of transactions outside Riga and Pieriga (Jurmala and Babīte, Marupe, Olaine, Kekava, Baldone, Salaspils, Ikšķile, Stopiņi, Ropaži, Garkalne, Adazi, Carnikava and Saulkrasti municipalities). Of the 272 applications submitted in 2015, only 72 occurred after September 1, 2014, ie according to the new requirements of the Immigration Law, none of which has been performed outside Riga and Pieriga. In 2016, 140 out of 177 applications complied with the new requirements of the law, but only four properties were acquired outside Riga and Pieriga – one property in the municipalities of Jaunjelgava, Bauska, Engure and Kuldiga. As of January 1, 2017, applications for the acquisition of real estate in accordance with the version of the Immigration Law in force until 31 August 2014 are no longer to be submitted, so all real estate purchase transactions ( 100) are in compliance with the current minimum amount of real estate, ie at least EUR 250 000. None of the properties have been purchased outside Riga or Pieriga . A similar situation was observed in the first half of 2018 – 44 applications, all in Riga or Pieriga, except for 2 transactions in Bauska county.

Investments in subordinated liabilities of credit institutions

Since September 1, 2014 came into force on amendment to Appendix I to the Immigration Law, the number of foreigners who want to get a TRP in accordance with Section 23, Clause 30 (TUA able to get a contribution Latvian credit downstream commitments at least 280 thousand. Euros) has decreased. From September 1, 2014 to June 30, 201 8 .gada TRP applications submitted only 64 investors.Compared to the period from 1 July 2010 to 31 August 2014, when 427 investors submitted applications (average number of applications per year – around 90 applications), there was a significant decrease in the number of applications – In 2016, 13 applications were received, in 2017 – 12 applications, and in the first half of 2018 – 1 application .

Section 23, Paragraph one, Clause 30 of the Immigration Law, which came into force on July 1, 2010, provides an opportunity to develop and actively offer previously low-demand service – a contract on subordinated liabilities, resulting in the possibility for credit institutions to expand the range of potential customers and increase number of deposits. Credits are returned by credit institutions in the form of loans, ie they develop the lending sphere and allow money to work in the interest of the national economy. With increased capital raised, the opportunity to refinance part of bad and delayed loans is emerging, which means that their share is declining and credit institutions’ capital adequacy ratios are improving.

Subordinated liabilities are used only in Tier 2 Capital and are taken into account in the credit institution’s capital adequacy calculation. Thus, it is used to mitigate the risks of the respective bank and the entire banking system (capital adequacy increases) and accordingly the possibility for banks to issue loans (for more detailed information on the financial investment in credit institutions related to TUA, see Appendix 3 ).

Investments in the equity capital of corporations

The TRP recommendation number to receive a reduction from 2015 a is also observed in relation to Section 23, the first paragraph of Paragraph 28 of the TRP to receive an investment capital company share capital. From 2015 the number of applications has decreased, as well as other investment ways – if 2014 were received 178 applications, then in 2015 – 82, 2016 – 55, 2017 A – 40, but in the first half of 2018 – 33 applications . As of July 1, 2010, within the framework of the relevant Immigration Law norm, 4 86 investment companies registered in Latvia have been invested in the equity capital of companies, reaching only 5, 8 % of the total allocated investments, therefore the issue of TUA to investments in equity capital of capital companies can still be assessed as one of the incentives, which contributes to attracting foreign investment in the real sector. It should be noted that these investments flow into the real economy by solving the companies’ own lack of finances, facilitating the development of enterprises, introduction of innovations, thus increasing their competitiveness (for more detailed information on investment in the capital companies of TUA, see Annex 3 ).

Acquisition of interest-free government securities as the basis for receiving TUA

From January 1, 2015, Section 23, Paragraph one, Clause 31 of the Immigration Law has come into force – the possibility to request TUA for a period of up to five years, if a foreigner acquires specific interest-free government securities for a nominal value of EUR 250,000 . Upon receipt of TRP, the alien must contribute to the national budget of 38,000 euros.

From January 1, 2015 to June 30, 2018 , 43 investors and 115 members of their families have applied for a special purpose interest-free state securities purchase . Investor Citizenship – Russian Federation – 21 , Ukraine – 8 , Azerbaijan – 5, Belarus – 4 , Uzbekistan – 2, Kazakhstan – 1, Iraq – 1, China – 1.

In the period from 2015 on 1 January January to 2018 on 30 June As of June 2006, the government debt has increased by 9.0 as a result of the issue of interest-free government securities for a specific purpose million EUR, to be formed in 2015, 2016 year and 2017 issued non-interest-bearing government securities in the year 1.25 mln. EUR 4.75 million EUR 2.25 million as well as in the period from 2018 onwards. on 1 January January to 30 As of June 2008, the issued interest-free government securities amounted to 0.75 mln. euro amount. Thus, it can be considered that this type of investment has not significantly increased the public debt in 2018. and the risk that this could jeopardize the maximum level of government debt at the end of the year under this year’s state budget law is currently considered low.

In the initial placement auctions, the weighted average yield rates of the Latvian State 5-year bonds have stabilized at around 0.5% ( Figure 4 ) and are still significantly behind the 1% yield, which was topical in 2015. on 1 January January 23, when the Immigration Law came into force. Article 1, first paragraph, point. Thus, it is now justified to maintain a one-off fee at the current level so that interest-free bond issues do not have a negative impact on the government balance and maintain the added economic benefits.

The Economic Development Program was launched on September 1, 2014, when the amendments to the Immigration Law came into force, which stipulated that a foreigner must make a payment to the State Budget General Budget Program 33.00.00 “Economic Development Program” before receiving a temporary residence permit (hereinafter – TUA). in the State basic budget expenditure account with the Treasury 5% of the value of the purchased real estate or in case of purchase of subordinated liabilities or bonds by the bank 25 000. Along with the amendments to the Immigration Law adopted by the Saeima on June 9, 2016 (LV, 123 (5695), 29.06.2016), which came into force on July 1, 2016) also changed the conditions for the one-off contributions of foreigners to the State Budget General Budget Program “Economic Development Program”, setting the following contribution for receiving TUA also for foreigners investing in the capital company share capital. On the other hand, upon entry into force of the amendments to the Immigration Law (LV, 36 (5863), 16.02.2017), from March 2, 2017, a one-time contribution to TUA for foreigners who have purchased government securities was increased.

In order to issue a first-time TUA, the amount of contributions to be made in the State Budget General Budget Program “Economic Development Program” is:

- EUR 10 000 in accordance with the provisions of Section 23, Paragraph one, Clause 28 of the Immigration Law, when investing in the equity capital of a capital company;

5% of the value of the immovable property, in accordance with the provisions of Section 23, Paragraph one, Clause 29 of the Immigration Law, when acquiring real estate; - EUR 25 000, in accordance with Section 23, the first paragraph of Paragraph 30 of the conditions to form a subordinated liabilities to the Latvian credit institution;

- EUR 38 000, in accordance with Section 23, the first paragraph of article 31 of the conditions of the acquisition of an interest-free government securities.

The decrease in the total number of applications and investments in all forms of TUA acquisition, including real estate transactions, which make up the largest part of the program revenue, is also reflected in the decrease in the number of contributions made and the amount of the amount paid in the National Basic Budget Program “Economic Development Program”. Q3 2016 (see Figure 5 ).

As of September 2014, the number of applications related to the investment program decreased significantly. If 2 were received in 2014 532 applications, then in 2015 – 398 , in 2016 – 262, in 2017 – 160, and in the first half of 2018 – 82 applications.

total investment program funds invested from July 1, 2010 to June 30, 201 8

Total investment

( thsd, euro )

| Real Estate | Credit institutions | Capital companies | State-worth-papers | In total | |

| 2010.II pusg. | 1 5 8 43 | 1 2 2 83 | 305 | – | 2 8 4 31 |

| 2011 | 138 1 38 | 3 5 0 64 | 3 6 41 | – | 17 6 8 43 |

| 2012 | 20 7 650 | 2 8 4 74 | 1 3 3 35 | – | 24 9 4 59 |

| 2013 | 296 5 83 | 3 4 1 06 | 2 9 3 00 | – | 35 9 9 89 |

| 2014 | 39 7 315 | 3 1 3 28 | 1 8 8 25 | – | 44 7 4 68 |

| 2015 | 7 2 844 | 8 9 62 | 7 4 33 | 1 2 50 | 9 0 4 89 |

| 2016 | 5 0 706 | 3 8 74 | 3 1 95 | 4 7 50 | 6 2 5 25 |

| 2017 | 28 266 | 3 565 | 5 5 28 | 2 250 | 3 9 609 |

| 2018 I pusg. | 1 3 171 | 3 25 | 4 5 15 | 75 0 | 1 8 436 |

| In total | 1 22 0 5 16

|

15 7 981

|

8 6 077

|

9 00 0

|

1 47 3 249

|

Source: OCMA

A summary of the TUA of investors and their family members

(01.07.2010 – 30.06.2018 8 )

| 2010

|

2011 | 2012 | 2013 | 2014

|

2015

|

2016

|

201 7

|

2018 | In total | ||

| Number of applications (investors) |

127 |

836 |

122 6 |

1922 |

2532 |

398 |

262 |

160 |

82 |

7545 |

|

|

Real Estate Bank Capital companies Government securities |

79 40 8 |

669 112 55 |

101 3 86 127 |

1556 94 272 |

2250 104 178 |

272 30 82 14 |

177 13 55 17 |

100 12 40 8 |

44 1 33 4

|

6160 492 850 43

|

|

| Applicants (investors and their family members) |

289 |

1977 |

29 18 |

4508 |

5944 |

1209 |

763 |

571 |

2 82 |

18461 |

|

|

Real Estate Bank Capital companies Government securities |

172 103 14 |

1560 298 119 |

24 39 210 269 |

3683 256 569 |

5311 246 387 |

934 71 166 38 |

560 46 115 42 |

421 31 99 20 |

161 7 99 15 |

15241 1268 1837 115

|

|

|

|

2010

|

2011 |

2012 |

2013 |

2014

|

2015

|

2016

|

2017 |

2018

|

In total |

|

|

Issued by TUA (investors and their family members) |

288 |

1950 |

2890 |

4438 |

5822 |

1084 |

705 |

513 |

188 |

17878 |

|

|

Real Estate Bank Capital companies Government securities |

172 102 14 |

1534 298 118 |

2415 210 265 |

3626 255 557 |

5219 246 357 |

865 66 137 16 |

515 45 97 48 |

279 29 79 18 |

110 7 66 5 |

14843 1258 1690 87 |

|

| Refusals of TUA (investor) |

1 |

11 |

18 |

29 |

54 |

30 |

13 |

9 |

0 |

165 |

|

|

Real Estate Bank Capital companies Government securities |

0 1 0 |

10 0 1 |

16 0 2 |

23 0 6 |

39 0 15 |

15 3 11 1 |

4 0 9 0 |

5 1 3 0

|

0 0 0 0

|

112 5 47 1 |

|

| TUA canceled (investors and their family members) |

0 |

20 |

94 |

258 |

568 |

1008 |

919 |

690 |

304 |

3278 |

|

|

Real Estate Bank Capital companies Government securities |

0 0 0 |

9 4 7 |

56 9 29 |

191 23 44 |

339 65 164 |

588 118 302 0 |

633 61 225 0 |

543 46 101 0 |

243 18 43 0 |

2142 307 829 0 |

|

Source: OCMA

Investors and their family members by country

01.07.2010.-30.06.2018 8 .

| Nationality of citizenship | 2010 | 2011 | 2012 | 2013 | 2014

|

2015 | 2016

|

2017 | 2018 | Total |

| Russia | 219 | 1465 | 2098 | 3107 | 3978 | 677 | 425 | 330 | 127 | 12425 |

| China | 2 | 16 | 118 | 445 | 669 | 117 | 53 | 21 | 19 | 1460 |

| Ukraine | 25 | 156 | 264 | 229 | 485 | 136 | 71 | 33 | 14 | 1414 |

| Uzbekistan | 8 | 53 | 111 | 251 | 223 | 45 | 20 | 25 | 10 | 746 |

| Kazakhstan | 18 | 128 | 147 | 164 | 113 | 58 | 27 | 18 | 4 | 677 |

| Belarus | 3 | 62 | 64 | 100 | 93 | 20 | 28 | 10 | 2 | 382 |

| Azerbaijan | 1 | 19 | 37 | 61 | 92 | 36 | 17 | 2 0 | 8 | 291 |

| Vietnam | 4 | 17 | 11 | 12 | 5 | 51 | 100 | |||

| Israel | 5 | 14 | 5 | 23 | 21 | 12 | 5 | 7 | 92 | |

| Pakistan | 2 | 6 | 8 | 10 | 40 | 19 | 85 | |||

| United States | 4 | 8 | 11 | 11 | 17 | 8 | 8 | 2 | 4 | 73 |

| Iraq | 1 | 17 | 27 | 16 | 2 | 63 | ||||

| Turkmenistan | 6 | 3 | 8 | 10 | 12 | 10 | 4 | 4 | 57 | |

| Kyrgyzstan | 2 | 14 | 7 | 16 | 7 | 3 | 5 | 54 | ||

| Egypt | 3 | 1 | 19 | 17 | 9 | 3 | 52 | |||

| Georgia | 4 | 12 | 12 | 19 | 4 | 1 | 52 | |||

| Syria | 1 | 3 | 20 | 12 | 4 | 1 | 8 | 49 | ||

| India | 8 | 20 | 2 | 9 | 4 | 5 | 48 | |||

| Turkey | 4 | 3 | 16 | 2 | 11 | 4 | 6 | 46 | ||

| Armenia | 2 | 3 | 3 | 13 | 18 | 2 | 1 | 1 | 43 | |

| Lebanon | 3 | 6 | 23 | 6 | 1 | 1 | 40 | |||

| Iran | 3 | 3 | 3 | 16 | 3 | 1 | 4 | 1 | 34 | |

| Afghanistan | 6 | 1 | 5 | 12 | ||||||

| Moldova | 3 | 4 | 1 | 4 | 12 | |||||

| Nigeria | 1 | 5 | 5 | 1 | 12 | |||||

| South Africa | 11 | 1 | 12 | |||||||

| Sri Lanka | 4 | 6 | 10 | |||||||

| Canada | 1 | 3 | 2 | 2 | 1 | 1 | 10 | |||

| Tajikistan | 1 | 4 | 2 | 1 | 1 | 9 | ||||

| Jordan | 9 | 9 | ||||||||

| Korea | 4 | 3 | 7 | |||||||

| Australia | 2 | 1 | 2 | 2 | 7 | |||||

| Philippines | 1 | 1 | 4 | 1 | 7 | |||||

| Bangladesh | 6 | 6 | ||||||||

| Saudi Arabia | 5 | 5 | ||||||||

| Japan | 1 | 3 | 1 | 5 | ||||||

| Thailand | 3 | 1 | 4 | |||||||

| Belize | 3 | 1 | 4 | |||||||

| Ukraine / Israel | 3 | 3 | ||||||||

| Mongolia | 3 | 3 | ||||||||

| Egypt / Georgia | 3 | 3 | ||||||||

| Dominican Republic | 1 | 2 | 3 | |||||||

| Russia / Israel | 2 | 1 | 3 | |||||||

| Serbia | 1 | 1 | 1 | 3 | ||||||

| Angola | 1 | 2 | 3 | |||||||

| Chad | 2 | 2 | ||||||||

| Palestinian refugee | 2 | 2 | ||||||||

| Kyrgyzstan / Russia | 2 | 2 | ||||||||

| Russia / Canada | 2 | 2 | ||||||||

| Russia / Asv | 1 | 1 | 2 | |||||||

| Algeria | 1 | 1 | 2 | |||||||

| Brazil | 1 | 1 | ||||||||

| British overseas territories | 1 | 1 | ||||||||

| Saint Kitts and Nevis | 1 | 1 | ||||||||

| Cuba | 1 | 1 | ||||||||

| Lithuanian stateless person | 1 | 1 | ||||||||

| Kenya | 1 | 1 | ||||||||

| Russia, Afghanistan | 1 | 1 | ||||||||

| Hong Kong | 1 | 1 | ||||||||

| Vanuatu | 1 | 1 | ||||||||

| Nepal | 1 | 1 | ||||||||

| Antigua and Barbuda | 1 | 1 | ||||||||

| Mauritius | 1 | 1 | ||||||||

| Congo | 1 | 1 | ||||||||

| Morocco | 1 | 1 | ||||||||

| In total | 289 | 1977 | 2918 | 4508 | 5944 | 1209 | 763 | 571 | 282 | 18461 |

Source: OCMA

Number of applications for residence permits issued to investors by the Office of Citizenship and Migration Affairs by month

07.2010.- 06.2018

| Month | 2010 | 2011 | 2012 | 2013 |

2014 |

2015 |

2016 |

2017 |

2018 |

In total | |||||

| 01 | X | 38 | 90 | 111 | 242 | 60 | 20 | 12 | 16 | 589 | |||||

| 02 | X | 38 | 81 | 105 | 157 | 38 | 24 | 13 | 18 | 474 | |||||

| 03 | X | 50 | 106 | 113 | 180 | 35 | 20 | 6 | 17 | 528 | |||||

| 04 | X | 42 | 72 | 120 | 235 | 35 | 30 | 14 | 10 | 558 | |||||

| 05 | X | 72 | 98 | 123 | 188 | 27 | 25 | 9 | 14 | 556 | |||||

| 06 | X | 90 | 103 | 136 | 156 | 33 | 22 | 10 | 7 | 557 | |||||

| 07 | 3 | 97 | 81 | 178 | 277 | 34 | 18 | 15 | X | 703 | |||||

| 08 | 8 | 84 | 107 | 159 | 374 | 23 | 14 | 25 | X | 794 | |||||

| 09 | 10 | 68 | 86 | 152 | 258 | 33 | 22 | 12 | X | 641 | |||||

| 10 | 33 | 77 | 132 | 176 | 225 | 28 | 18 | 18 | X | 707 | |||||

| 11 | 35 | 77 | 139 | 282 | 140 | 31 | 25 | 15 | X | 744 | |||||

| 12 | 38 | 103 | 131 | 267 | 100 | 21 | 24 | 11 | X | 695 | |||||

| In total | 127 | 836 | 1 226 | 1 922 | 2,532 | 398 | 262 | 160 | 82 | 7,546

|

|||||

In general, 90% of all TRP requested investors from the former Soviet republics. Outside the territory of the former USSR, the greatest investor interest is from China (1 460 or 8% of TUA demand), Vietnam (100 TUA requests) and Israel ( 92 TUA requests ). Proportion of Chinese citizens’ applications from 11% in 2014 decreased to 8% in the first half of 2018, while the share of Ukrainian citizens’ requests decreased by 6% from 2015. The increase in the proportion of Vietnamese nationals detected in the first half of 2018 – 18% of all requests for the first half of 2018 – should be noted. 14 Vietnamese investors , including 2 in relation to the acquisition of real estate, submitted applications to TUA 12 for investment in two capital companies (6 invested by one Vietnamese citizen in one capital company and 6 in another corporation)

Requests for repeated residence permits

07.2015.-30.06.2018.

| Number of repeated UA requests | A decision has been taken on the award of the TUA | A decision has been made on the allocation of PUA | Refusal | The application is pending | |

| Investors in a corporation | 87 | 61 | 13 | 12 | 1 |

| including, investor | 42 | 32 | 6 | 4 | 0 |

| family members | 45 | 29 | 7 | 8 | 1 |

| Real Estate Investors | 5055 | 3782 | 505 | 150 | 618 |

| including, investor | 2320 | 1675 | 261 | 83 | 301 |

| family members | 2735 | 2107 | 244 | 67 | 317 |

| Investors in a credit institution | 200 | 169 | 8 | 13 | 12 |

| including, investor | seventy eight | 65 | 4 | 5 | 4 |

| family members | 122 | 104 | 4 | 8 | 6 |