Australia attracts significant number of HNW millionaires from China for a number of reasons from education to healthcare.

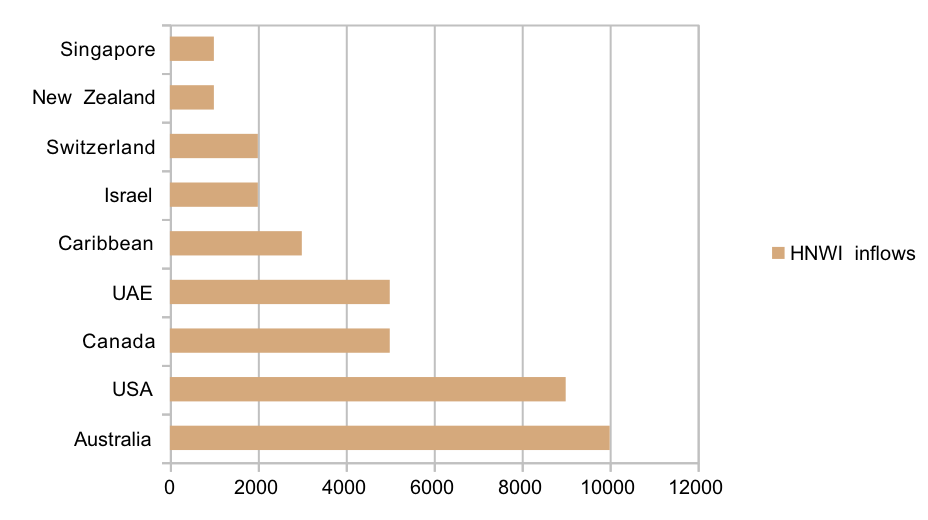

Australia was the top country worldwide for HNWI inflows in 2017, beating out its main rival the US for the third year running, according to New world wealth report. The report also said Australia is the 9th wealthiest country in the world in 2017 with total wealth of $6.1 trillion with only 22 million people living.

China’s is creating more millionaires or HNW than any other country in the world.

In 2017, about 10,000 High net worth individuals (HNWI) emigrated to Australia and took their wealth with them (wealth migration). Below you will see over 6000 HNW rich chinese invested and emigrated to Australia through investor visa scheme.

Australia’s superior growth over the past decade has also no doubt had an impact on confidence and business opportunities.

- Australia’s location makes it a better base for doing business in emerging Asian countries such as China, Japan, South Korea, Hong Kong, Singapore and Vietnam.

- Safety – Australia was recently rated as the safest country for woman worldwide during our annual woman safety ratings (see section 9.2). Australia is also a particularly safe country to raise children (although some describe it as a nanny state with too many rules).

- Australia has lower inheritance taxes than the US.

- Healthcare – Problems in the US healthcare industry. In the US, getting healthcare insurance can be difficult for incoming HNWIs. Notably, several international medical aids cover patients in all developed countries with the exception of the US (which is a big warning sign). In particular, the Affordable Care Act enacted in 2010 has not turned out well for wealthy and middle class patients in the US, with average premiums rising by over 120% since the act was passed in 2010.

- Education – Australia has some of the best universities in the world offering high quality education.

- Real estate – Soaring property prices in Australia is the highest in the world.

Australia Golden visas

Australia offers gold investor visas under Class 188 of Business innovation and provisional visa with these categories

- Business innovation (Net assets of $800,000)

- Investor ($1.5 million)

- Significant investor (A$ 5 million)

- Premium Investor (A$ 15 million)

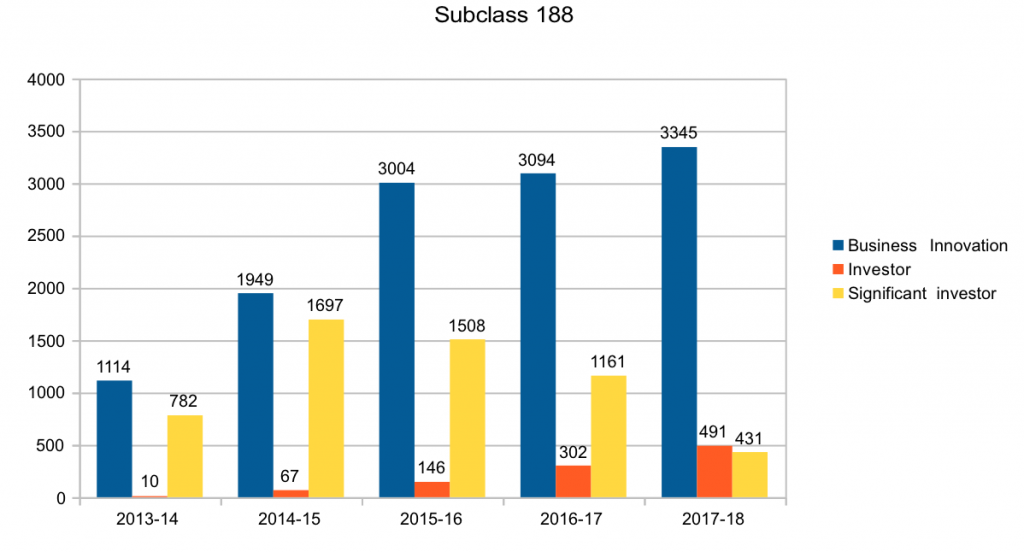

Please note the statistics is only for chinese who invested in Austria and the figures include family members.

| Subclass 188 – Granted visas for chinese | |||

| Granted | Business Innovation | Investor | Significant investor |

| 2013-14 | 1114 | 10 | 782 |

| 2014-15 | 1949 | 67 | 1697 |

| 2015-16 | 3004 | 146 | 1508 |

| 2016-17 | 3094 | 302 | 1161 |

| 2017-18 | 3345 | 491 | 431 |

| Total visas | 12506 | 1016 | 5579 |

The top territories for investment are New South Wales, Victoria and Queensland based on the number of applications launched

Chinese Investment

According to the Australian Government statistics published for chinese, Australia granted over 6595 IV/SIV visas for chinese millionaires. Since these figures include family members, assuming 3 members per family, the SIV/IV received close to AUD 10 billion from Chinese alone from 2013 to 2018. The Department of home affirst SIV statistics show about 88% of rich investors are from China.

The SIV stream which requires $5 million per visa more popular with chinese than the $1.5 million investor stream according to the figures. This genuinely confirms, Australia is the prime destination for rich chinese migrants.

- Investor – A$ 500 million

- Significant Investor Visa (SIV) – $9.2 billion

Investor visa

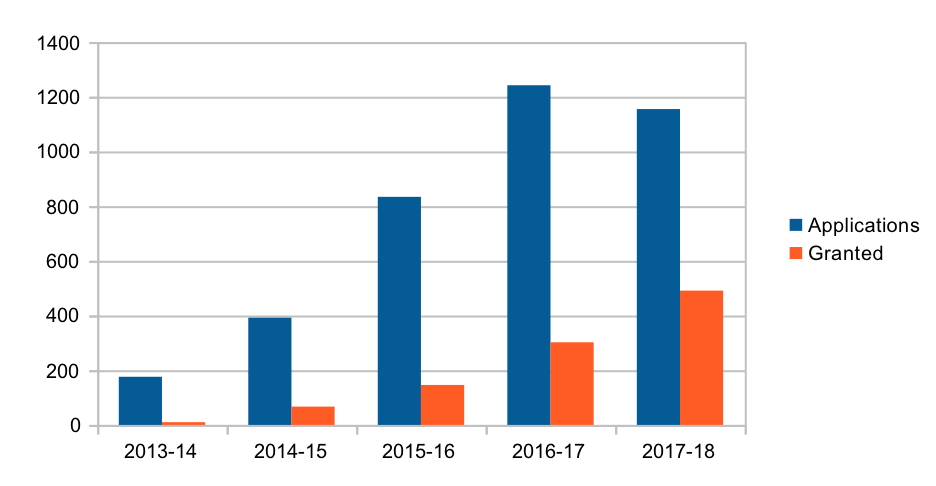

The numbers show the 398 applications were refused each with $1.5 million investment. A total of 3799 applications submitted and only 1016 granted for chinese.

| Chinese | Applications | Granted | Refusal | Refusal % |

| 2013-14 | 176 | 10 | 5 | 2.84% |

| 2014-15 | 392 | 67 | 46 | 11.73% |

| 2015-16 | 834 | 146 | 58 | 6.95% |

| 2016-17 | 1242 | 302 | 148 | 11.92% |

| 2017-18 | 1155 | 491 | 141 | 12.21% |

| Total | 3799 | 1016 | 398 | 10.48% |

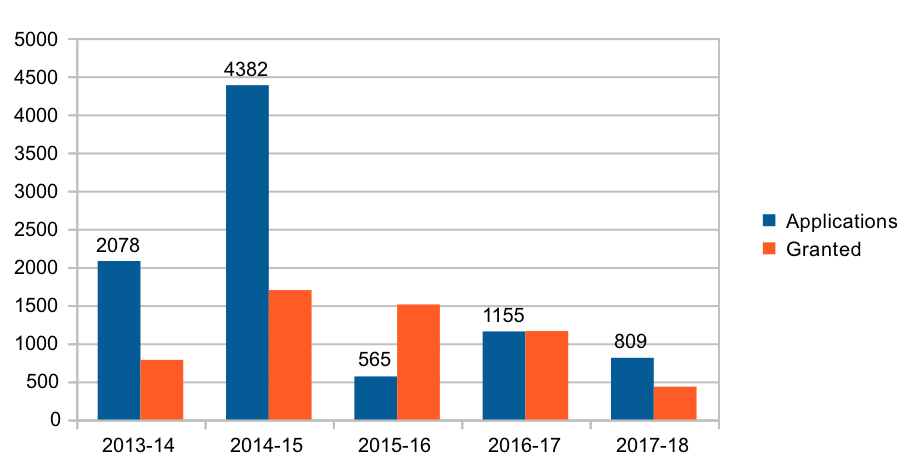

Significant investor visa (SIV)

The refusal rate for chinese investors with A$ 5 million is well above average. It is important to note that in 2015-16, Australia refused over 80% of the applications each with $5 million investment

| Applications | Granted | Refusal | Refusal % | |

| 2013-14 | 2078 | 782 | 123 | 5.92% |

| 2014-15 | 4382 | 1697 | 505 | 11.52% |

| 2015-16 | 565 | 1508 | 463 | 81.95% |

| 2016-17 | 1155 | 1161 | 103 | 8.92% |

| 2017-18 | 809 | 431 | 64 | 7.91% |

| Total | 8989 | 5579 | 1258 | 13.99% |