The Greek economy grew by 1.9% year-on-year in 2018, according to the latest data, confirming that the country’s recovery remains on track.

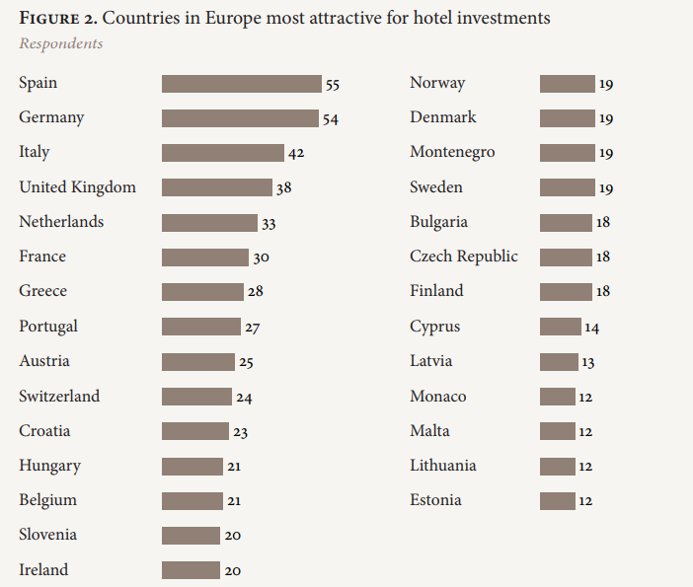

Greece has emerged as top 10 destination in Europe for hotel investors. Greece has taken 7th spot for hotel investment attractiveness.

A recent survey released at the International Hotel Investment Forum 2019 in Berlin showed Greece was among the two most popular destinations in the Mediterranean – and among the top 10 in Europe – for hotel investors.

According to a survey released Tranio for the 22nd edition of the International Hotel Investment Forum (IHIF), Greece ranks 7th for hotel attractiveness.

The results also revealed that the Mediterranean region specifically is most popular with American (44%), Russian (41.5%), and Chinese (29%) investors.

Over 30% indicated the holding period is 5-7 years.

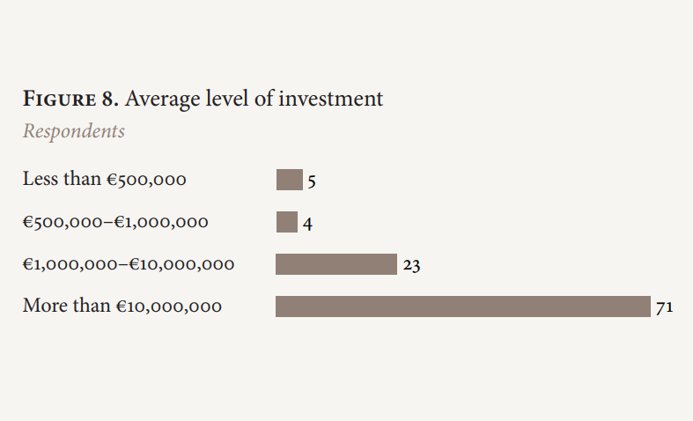

Hotel investors further said higher priced hospitality real estate, valued at €10 million or more.

Golden visa program

Greece also has the most popular golden visa program in Europe. The GV scheme played a vital role in economic recovery from debt and revival of the property sectors.

Over 4200 golden visas have been issued to property investors as of 2019.

Enterprise Greece, strong promotion of golden visa scheme resulted in

- 1200 Investor inquiries to Help desk

- Contact with 2,500 foreign investors and Greek companies, of which 31 companies proceeded with investment projects

- Promotion of 66 targeted investment projects to foreign investors

- Information provided to more than 1,000 inquiries 36 inquiries to the investor help desk

Property Prices

After falling more than 40% from their pre-crisis peaks, Greek property prices have seen a slight upturn, according to the latest data. Nominal apartment prices rose 2.5% year-on-year in the last quarter of 2018, according to the Bank of Greece, and were up 1.5% on average compared with 2017.

Government bonds

Greece successfully issued a new €2.5 billion, 10-year government bond, its first since the country entered its protracted financial crisis in 2010. The bond issue, which was more than four times subscribed, was priced at a yield of just 3.9%, reflecting strong investor confi- dence in Greece’s recovery and follows just weeks after the country returned to international bond markets with a seven-year issue.

Greece is also considering issuing government bonds for golden visas against €800,000

Greek FDI reaches €3.6 billion

For a third consecutive year, foreign direct investment in Greece has risen sharply reflecting growing interest by overseas investors in Greek assets ranging from renewable energy to food manufacturers. According to the latest figures from the Bank of Greece, FDI inflows in 2018 reached an historic high of €3.64 billion, a 13.8% increase from 2017. Overall, FDI has tripled between 2015 and 2018 and is on track for a new record in 2019. Particular interest has been in Greek property assets where prices remain well below their pre-crisis peak and where investors are being lured by the country’s booming tourism sector.

German investments in Greece rose by €3.5 billion last year,