The UK has operated a migration route for investors since 1994. It was called ‘Investor Immigrant’ visa was introduced in 1994.

Upto 2004, this scheme allowed for non-EEA (and non-Swiss) nationals to obtain a residence visa after a significant investment (the scheme required the investor to hold at least GBP 1 million in the UK as well as an investment of GBP 750,000 in UK government bonds, stocks or corporate bonds) and had made the UK their main home.

In 2008, the tier1 UK investor route was introduced with PBS points based system. The standard £1 million investment threshold has not been altered since 1994, not until 2014 for a period of two decades. Today the new changes to immigration rules require £2 million but the scheme started the scheme required only £1m investment.

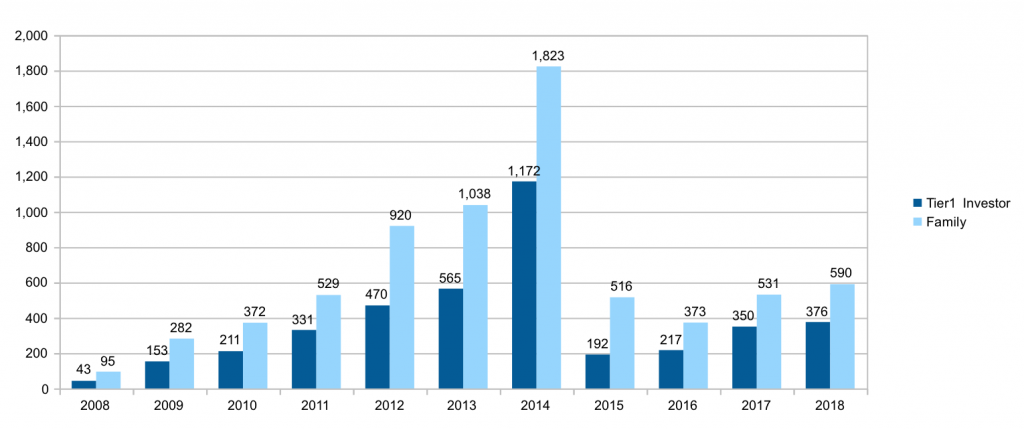

As of today by end of 2018, in the period of ten years UK has issued 4,080 golden visas targeted at High-net worth investors (HNWI), since the program gained first applications in 2008.

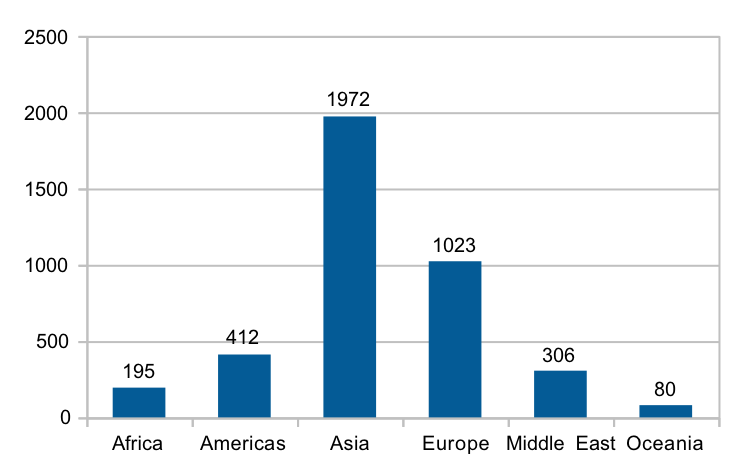

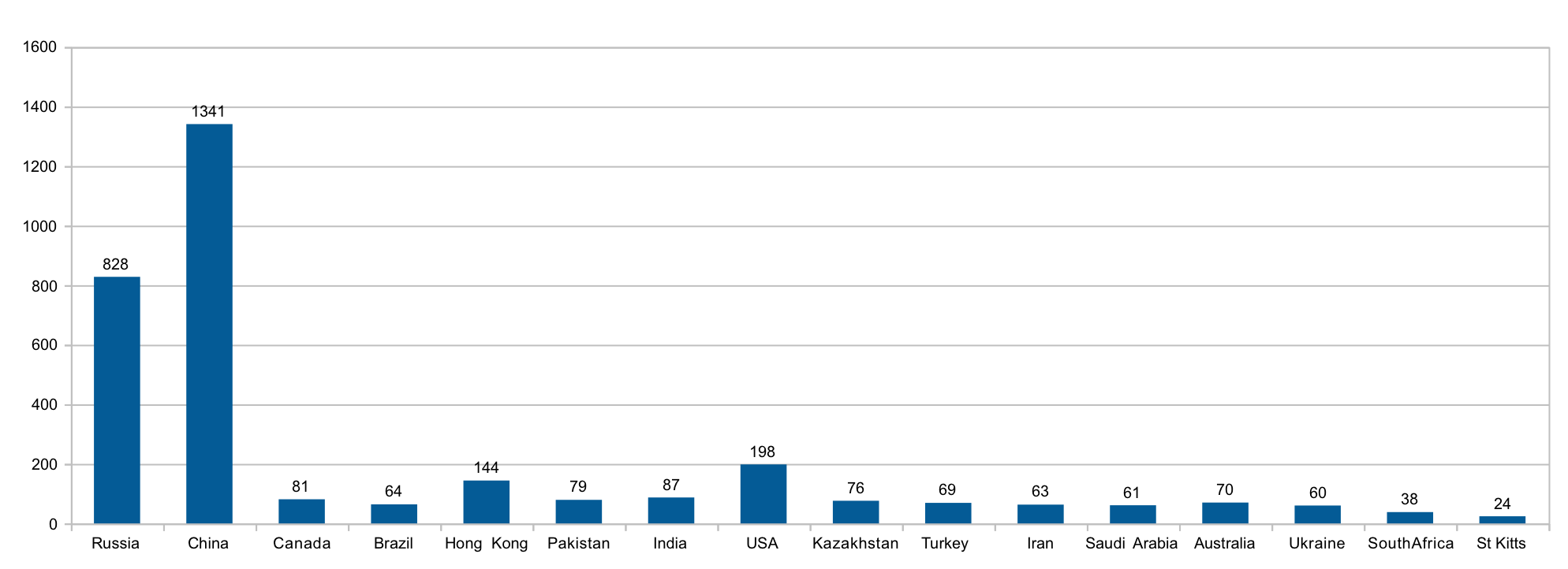

Most of those investing in UK tier1 investor visa scheme are from Asia, according to Home office statistics.

A total of over 11,000 entry clearances issued for investors and their family members, the data from Home office immigration statistics reveal.

The entry clearance visa is granted for an initial period of Leave to Enter (LTE) the UK and remain for three years and four months . After this period, a Leave to Remain (LTR) can be granted, which is an extension of two years.

| 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | Total | |

| Tier1 Investor | 43 | 153 | 211 | 331 | 470 | 565 | 1,172 | 192 | 217 | 350 | 376 | 4080 |

| Family | 95 | 282 | 372 | 529 | 920 | 1,038 | 1,823 | 516 | 373 | 531 | 590 | 7069 |

Changes introduced to Tier1 Investor visas

- In 2004, the Government made a change to the route to permit the investment funds to be sourced through a loan from a UK regulated financial institution provided that the applicant had personal assets (once any liabilities were taken into account) of at least twice the value of the investment.

- In 2008, the Government made significant changes to the UK immigration system, introducing the Points Based System.

- In April 2011, provisions were introduced to allow accelerated settlement for Tier 1 (investors) Migrants who choose to invest higher sums.

- In April 2011 the residence requirement for applications for Indefinite Leave to Remain was reduced to permit absences of 180 days per year (Paragraph 245AAA Immigration Rules). Prior to this only absences of no more than three consecutive months and no more than six months over a five-year period were permitted.

- In November 2014, the minimum investment threshold was raised from GBP 1 million to GBP 2 million (Paragraph 245EE(e) Immigration Rules). This followed findings from the Migration Advisory Committee (MAC) that the Tier 1 scheme was not generating benefits for UK residents.

- In 2015, in an effort to address money-laundering concerns and lack of transparency criteria the legislation introduced criteria to be considered by the entry clearance officer to determine whether there are risks of money-laundering. A requirement that investors open a FCA-regulated UK bank account prior to their application was also introduced in 2015

- In 2019, new immigration reforms introduced effective from May 29, 2019, removed the government bonds option and funds must be held for five years.

Changes in 2019

Home office has announced new changes to UK golden visa scheme known as tier1 investor visas effective from 29 March 2019.

Here are the most important changes under the new reform proposed by Home office for tier1 investor and entrepreneur category

- Government bonds has been excluded

- Applicants must open a UK bank account complying with AML/Due diligence/KYC

- Hold investments for 2 years (24 months) instead of previous 3 months.

- Tier1 entrepreneur scheme to be removed and replaced with Startup and Innovation visas

- Intermediaries to be regulated by the Financial Conduct Authority (FCA),

- Investment pools option introduced