The European parliament has published economic impact of CBI/RBI schemes in a latest study of Europe’s two trillion euro dividend: Mapping the Cost of Non-Europe, 2019-24

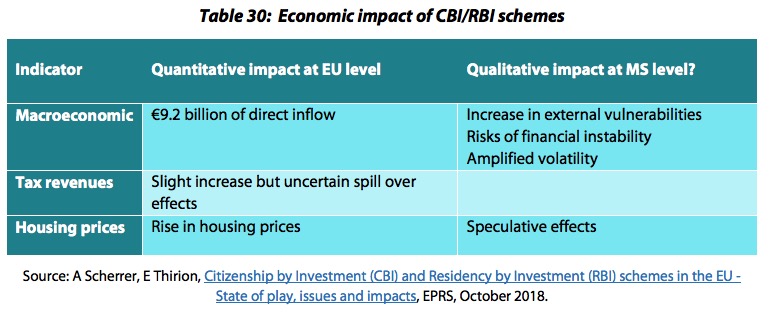

At the economic level, Member States enjoy the benefits of new investment, including tax revenue and job creation. From the available data, the direct flow of investment has been estimated at around €9.2 billion since 2008.

According to the report

- Large investment inflows can adversely affect the financial stability of small states and make them more vulnerable to external shocks.

- The real-estate sector of the Member States in question could face higher demand pressures, leading to an increase in property prices. Social impacts include the difficulty for low-level income sections of the population to have access to housing as property prices increase. As housing represents and important share of a household costs, this could also become a greater burden to a family’s budget.

- The criminality checks of the schemes are sometimes questionable and can lead to a threat to security and justice affecting all EU Member States. This in turn can lead to a negative impact on citizens’ freedom of movement, as the visa-free travel agreements between the EU countries mainly rely on the assumption that other members’ citizens are safe to admit.

- The schemes are also perceived as discriminatory towards those who are following a more traditional path towards residency and citizenship.

EU Parliament Position

The European Parliament strongly supports the idea of stronger EU action regarding CBI/RBI schemes. At the request of the European Parliament, the European Commission published in January 2019 a report on Investor Citizenship and Residence Schemes in the EU

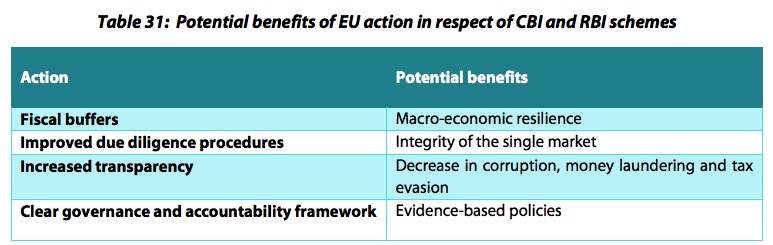

In the light of the important impacts affecting the EU and its Member States, there is potential for the EU to take action in this field. As underlined by the IMF, the introduction of fiscal buffers would help to mitigate the negative macro-economic impacts and decrease the external vulnerabilities of the schemes. The European Commission could integrate, as part of its European Semester, specific recommendations on prudential regulation related to the pace of inflows to the private sector.

- Fiscal buffers would include measures on budgetary support and saving accumulation, savings drawdown for stabilisation, exceptional spending or large public investments.

- Moreover, existing due-diligence standards enshrined in EU law could be more rigorously applied in the Member States that offer the CBI/RBI schemes. The Commission could also evaluate the efficiency and effectiveness of the Member States’ due diligence procedures.

- Concerning increased transparency, as highlighted by a 2017 Irish report on its own RBI scheme, it would be desirable for such schemes to be formally evaluated on an annual basis.

- Better data collection is not only critical to forecast vulnerabilities induced by the system, but it would also strengthen their reputation and sustainability over time. In this case, the Commission could provide some guidance on the transparency standards and give a clear sign on how private firms should operate in the sector of CBI/RBI schemes. A structured exchange of information between Member States would be also helpful.

In its EU citizenship report of 2017, the Commission highlighted the principle of sincere cooperation between Member States. It also emphasised how each has a specific responsibility when granting or removing national citizenship, as this implies granting or removing EU citizenship and all the rights that go with it. The Council also invited all Member States to act in accordance to the principle of sincere cooperation

Read the full report here