Malta registered a surplus €250.8 million euros in 2018, second highest in the EU for the third consecutive year. The Individual Investor program (IIP) contributed about €190 million euros which is about 75% of the surplus

Speaking at Castille on Tuesday, Finance Minister Scicluna said that while income from the IIP helps amplify the surplus, the surplus is not solely reliant on it. He later said that the IIP had contributed €190 million, and that without it, the government would still register a surplus of €60 million.

PM Muscat said substantial part of the income from the IIP – some 70% of it – goes to the NDSF for social projects which are independent from the government.

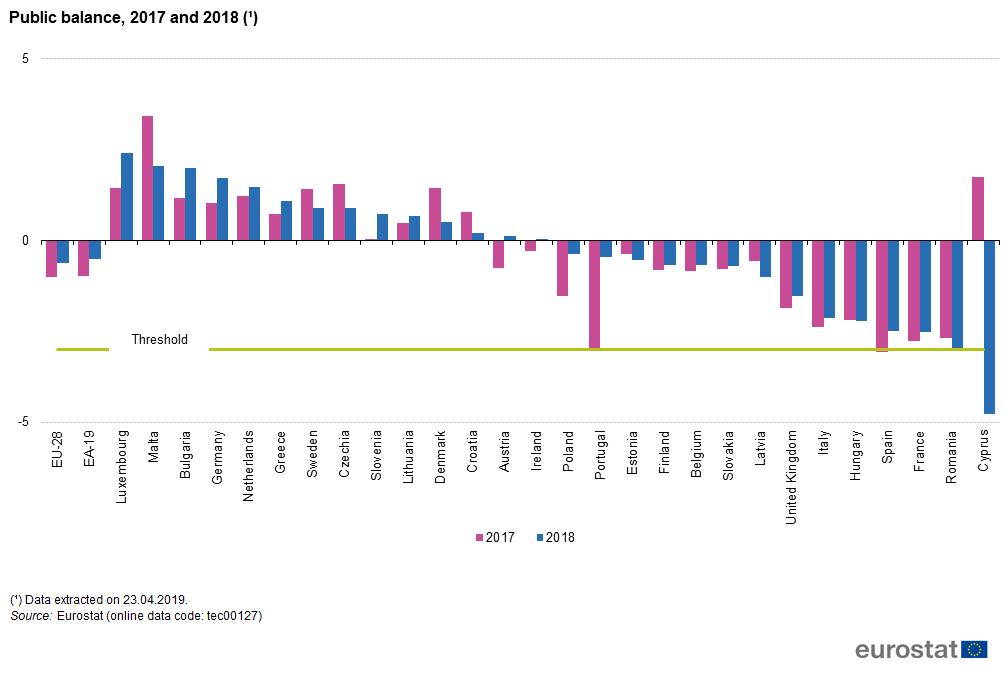

Figures from National Statistics Office (NSO) show in 2018, the General Government registered a surplus of €250.8 million, equivalent to 2.0 per cent of GDP. The gross consolidated debt amounted to €5,664.7 million or 46.0 per cent of GDP.

NSO said the Extra Budgetary Units (EBU) registering the highest surplus was the National Development and Social Fund (NDSF) with €133.7 million, which includes 70 per cent of the contributions under the Individual Investor Programme (IIP).

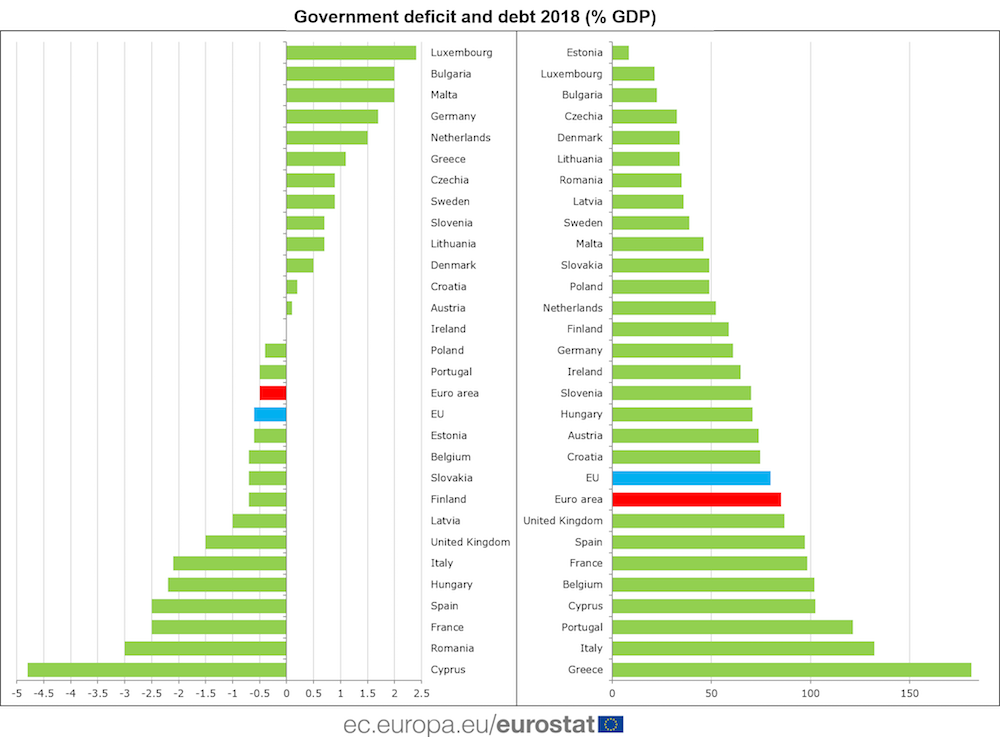

According to Eurostat, 13 EU Member States — Luxembourg (+2.4 %), Bulgaria and Malta (both +2.0 %), Germany (+1.7 %), the Netherlands (+1.5 %), Greece (+1.1 %), Czechia and Sweden (both +0.9 %), Lithuania and Slovenia (both +0.7 %), Denmark (+0.5 %), Croatia (+0.2 %) and Austria (+0.1 %) — registered government surpluses in 2018. Ireland reported a government balance.

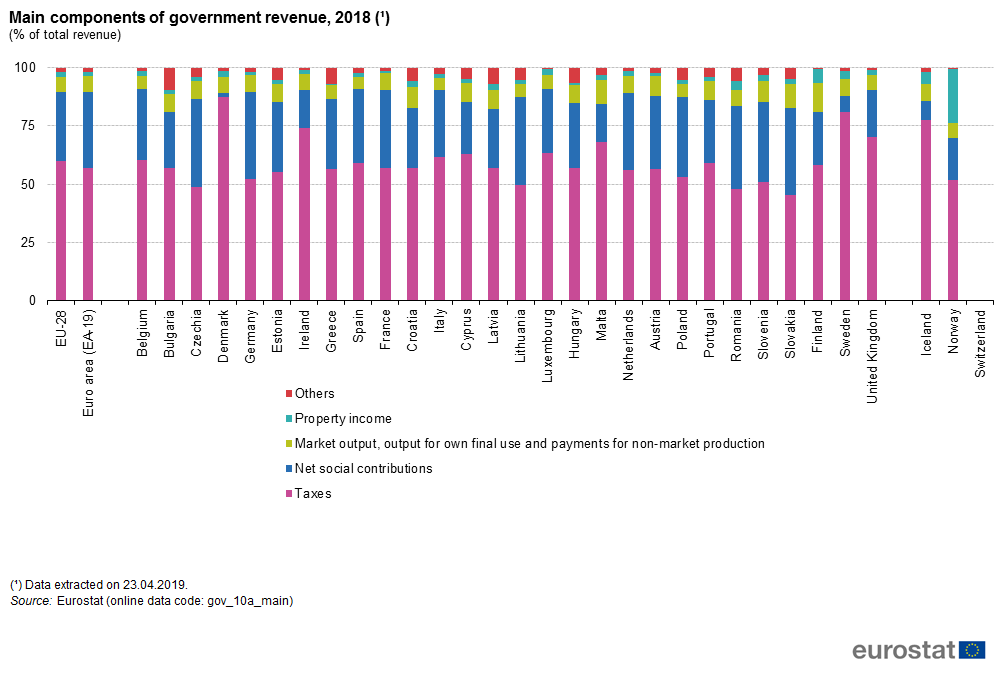

Taxes and social contributions form a major source of revenue for 2018. Property income contributed significantly in Norway and Iceland.

The highest increase in housing prices for Q4 2018, was registered in Malta up +3.8%

Greece, Italy, Portugal and Cyprus still have over 100% government debt