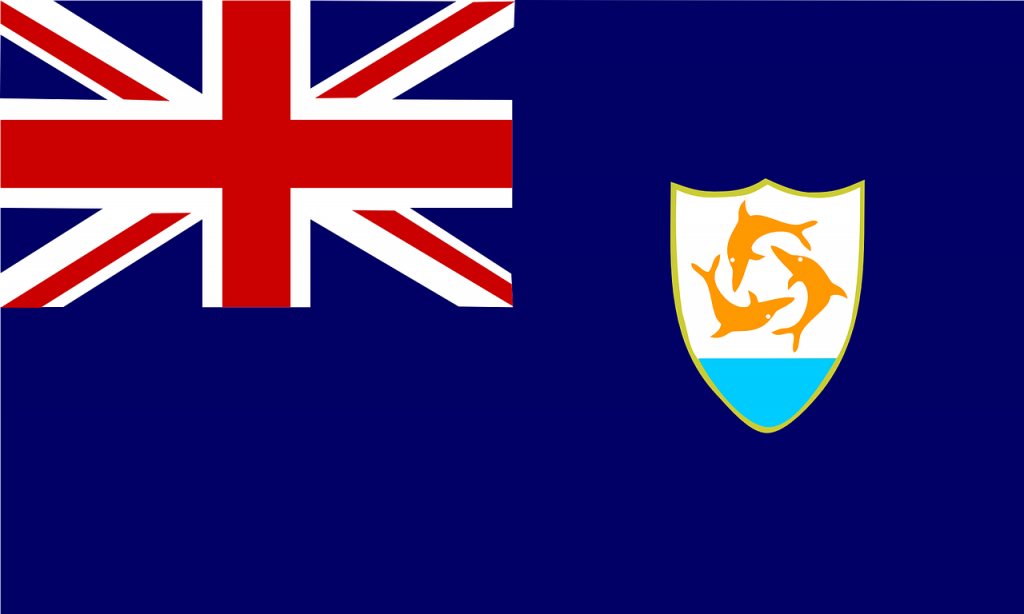

Anguilla launched Residence by investment (ARBI) scheme last year in Nov 2018.

In a recent interview with The Anguillian newspaper, Shantelle Richardson, Director of Economic Planning announced that the first phase has been going reasonably well, but it as been extended to Jun 30. The second phase of the scheme is planned to launch in IMC forum in Geneva by the Consortium Ltd (Latitude and Arton Capital).

She revealed, so far 13 applications have been received mostly from Canadians and Americans, who were property buyers for $750,000 US dollars and were given permanent resident status. Six applications have been approved

In Phase 1, the applicants were required to have owned property in Anguilla for $750,000 by September 30, 2018, to be eligible under this programme. All of these applicants owned property in Anguilla prior to that date.

Phase 2 of the residency programme, persons are required to own property in Anguilla for $400,000 and are required to spend a certain number of days in Anguilla. In addition there is Government an annual tax lump sum of 75,000 US dollars and will be issued a Tax Certificate making the person is a tax resident of Anguilla and paying taxes on the island. Anguilla’s RBI programme will allow foreign nationals the opportunity to become a tax resident by proving to be of good character, making an annual lump-sum tax payment to the Treasury and by creating genuine links with Anguilla.

Anguilla permanent resident status can be an attractive route to becoming a British Overseas Territories Citizen (BOTC) and eventually a British Citizen. The status offers full right to live, but no rights to work or vote.

Anguilla RBI scheme is not a passport by investment scheme instead offers PR status bypassing 10 years of living. The scheme currently has three investment options

- Capital Investment Fund ($150,000)

- Real Estate Investment (Phase 1 – $750,000 / Phase2: $400,000)

- Tax Residency

The phase 1 of the scheme will not be extended after Jun 30, after that when the phase 2 of the scheme fully rolls out the fees will be doubled. Investors are required to take advantage of the pricing which currently prevails.

The Capital Development Fund is a special fund that will established by the Government of Anguilla for the purpose of financing public sector projects in an effort to grow, develop and diversify Anguilla’s economy and fund meaningful social projects.

Due Diligence

Anguilla employs a robust due diligence process screening applicants in great detail including the present and past activities of applicants in effort to ascertain a risk profile of prospective permanent residents. Anguilla appointed well-reputed international due diligence companies to verify the authenticity, correctness of information contained in application package.

Consortium

The Anguilla Agency Consortium Ltd is an Anguillan entity equally owned by Latitude Consultancy Ltd and Arton Group which contracted with the Government to establish the Agency and its two Programmes ( Thomson Reuters, Exiger, Wealth X, Others)

Naturalization

Th naturalization process to become a BOTC (British overseas territory citizen) requires that the applicant has been lawfully residing in Anguilla for at least 9 months per year for a consecutive five year period prior to the date of application and a similar time requirement applies to registration as a British Citizen.

Tax residency

The Applicant will be deemed a Tax Resident in Anguilla if they:

- Pay $75,000 per year in annual worldwide income tax to Anguilla’s Treasury; and

- Own and maintain property in Anguilla valued in excess of $400,000 (inclusive of land purchase in excess of $100,000); and

- Establish other genuine links in Anguilla, such as bank accounts, memberships, etc.; and

- Spend a minimum number of days in Anguilla each year; and e) Declare annually in writing that they are spending less than 183 days per year in any other country; and

- Demonstrates their ability to readily transfer the total amount of funds which covers the Applicant’s Annual Lump Sum Tax obligations under the RTP for the first five years.

- Pay the Programme application and due diligence fees and remain in good standing throughout their residency status.

The full interview is available here