Cryptocurrency is a new technology works much pretty much like an anonymous numbered accounts, which swiss banks used to offer decades ago.

Cryptocurrencies such as Bitcoin and other altcoins which present a number of challenges for due diligence and verifying sources of funds to financial institutions. Bankers still struggle to understand these complex new technologies such as blockchain and cryptocurrencies, while criminals understand it better and have gone to new level to launder money. Financial institutions in many countries are freezing bank accounts involved in risky cryptocurrency transactions.

Cryptocurrency research group CipherTrace conducted an analysis of 45 million transactions from the top 20 cryptocurrency exchanges globally and found that $2.5bn laundered due to lax AML regulations. 97% of direct bitcoin payments from identifiable criminal sources were received by unregulated cryptocurrency exchanges. Hackers have stolen $1bn worth of cryptocurrencies last year , the report said.

Bitcoin is the first cryptocurrency launched in 2009 and since then during a period of 10 years, thousands of types of altcoins have emerged with various functions. The volatility of cryptocurrencies makes it difficult to use as effective payment transactions. The problems faced by digital cryptocurrencies still trust, manipulation by whales, regulations, governance and hacking.

A KPMG report said, The inherent reduction of correspondent banking services to some countries or regions, such as e.g. Caribbean islands, Venezuela or Africa, has caused an increase in crypto activity in these geographies, jeopardizing financial intermediaries’ global de-risking efforts.

Cryptocurrencies are an effective way for evading international sanctions (North Korea, Iran, Venezuela etc). Funds from these countries are used to buy Bitcoin/Ethereum etc. and can be transferred to other wallets in a another country and then converted to fiat either through an exchange or over the counter.

What is Crypto Cleansing?

Crypto cleansing is used to evade international sanctions. The money launderers layer multiple privacy coins, exchanges and digital addresses to sever the audit trail, effectively preparing illicit funds by cleansing them for integration back into the traditional financial system.

This involves buying cryptocurrency by cash or debit card at an exchange for the purchase primary coins (e.g. Bitcoin, Etherum or Litecoin). Later these coins are exchanged to privacy coins (e.g. Zcash, Verge, Monero, Dash, Desire etc.) to fool blockchain and audit trail. These are channeled further across multiple digital exchanges, finally exchanged to primary crypto, then withdrawn to a connected bank account or transferred to real estate, by citing the legal desire to avoid capital gain taxes. The KYC is defeated by using personal misrepresentation (or forged documents) and then the coins can be exchanged for another privacy coins. Cryptocurrencies are safely held in cold storage (hardware wallets)

KYC, AML and CFT

To mitigate risk, worldwide KYC/AML/CFT has to become more rigorous to companies issuing e-wallets.

FATF in May 2019, published recommendations for Virtual Asset Service Providers (VASP).

Countries should ensure that VASPs are subject to adequate regulation and supervision or monitoring for AML/CFT and are effectively implementing the relevant FATF Recommendations, to mitigate money laundering and terrorist financing risks emerging from virtual assets. VASPs should be subject to effective systems for monitoring and ensuring compliance with national AML/CFT requirements. VASPs should be supervised or monitored by a competent authority (not a SRB), which should conduct risk-based supervision or monitoring.

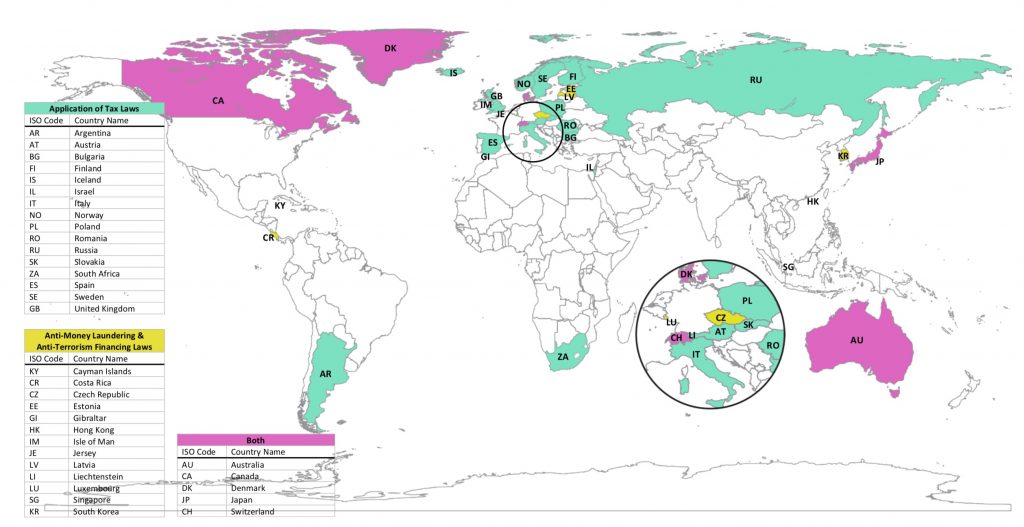

The European Union has also recently taken steps to ensure that exchanges fall under KYC and AML requirements, with the European Commission adopting proposals that ensure that cryptocurrency exchanges and wallet providers would fall within the EU’s anti-money laundering framework, effective from July 2017. The European Central Bank classifies bitcoin as a convertible decentralized virtual currency.

The European parliament has published a TAX3 report on Crypto currencies said regulators are worrying about criminals who are increasingly using cryptocurrencies for illegitimate activities like money laundering, terrorist financing and tax evasion. The problem is significant: even though the full scale of misuse of virtual currencies is unknown, its market value has been reported to exceed EUR 7 billion worldwide

AMLD5 new rules includes a definition of virtual currencies and subjects virtual currency exchange services and custodian wallet providers to customer due diligence requirements and the duty to report suspicious transactions to financial intelligence units.

Legality of Cryptocurrencies

The legal status of bitcoin (and related crypto instruments) varies substantially from state to state and is still undefined or changing in many of them

Algeria, Bolivia, Morocco, Nepal, Pakistan, and Vietnam) ban any and all activities involving cryptocurrencies. There are also countries that, while not banning their citizens from investing in cryptocurrencies, impose indirect restrictions by barring financial institutions within their borders from facilitating transactions involving cryptocurrencies (Bangladesh, Iran, Thailand, Lithuania, Lesotho, China, and Colombia).

Initial coin offerings (ICOs) use cryptocurrencies as a mechanism to raise funds. Of the jurisdictions that address ICOs, some (mainly China, Macau, and Pakistan) ban them altogether, while most tend to focus on regulating them.

These countries that have or are in the process of issuing their own national or regional cryptocurrency, according to Library of Congress

- Anguilla (ECCB)

- Antigua and Barbuda (ECCB)

- China

- Dominica (ECCB)

- Grenada (ECCB)

Ireland - Lithuania

- Marshall Islands

- Montserrat (ECCB)

- Saint Kitts and Nevis (ECCB)

- Saint Lucia (ECCB)

- Saint Vincent and the Grenadines (ECCB)

- Venezuela

Crypto Exchanges

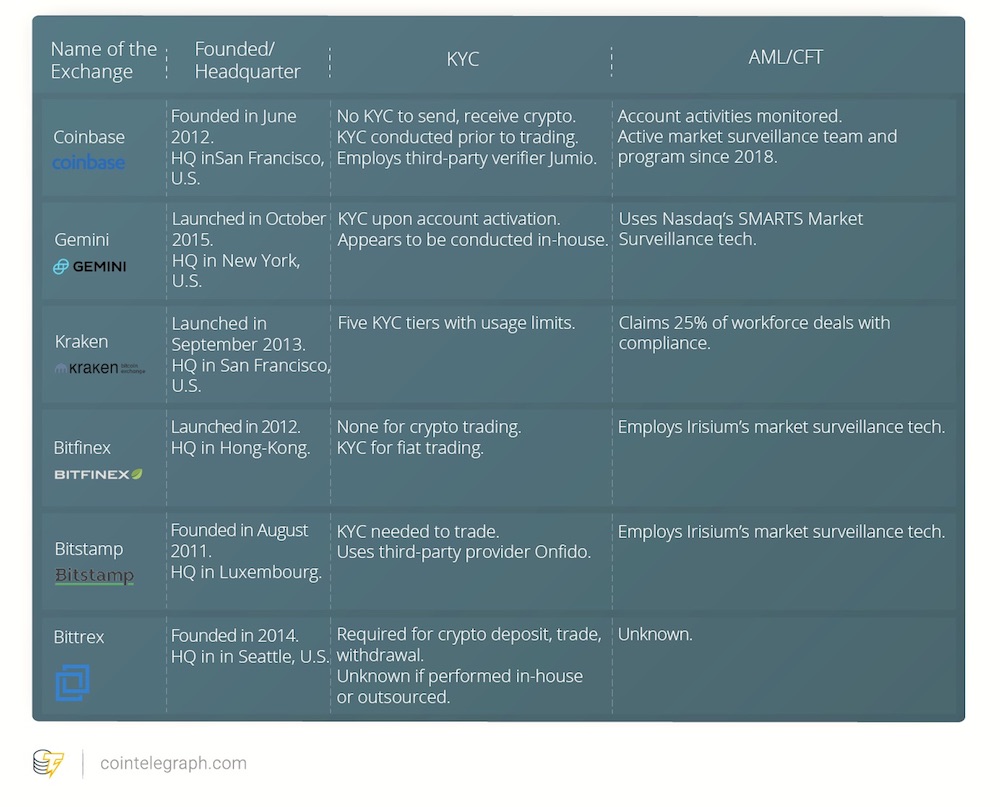

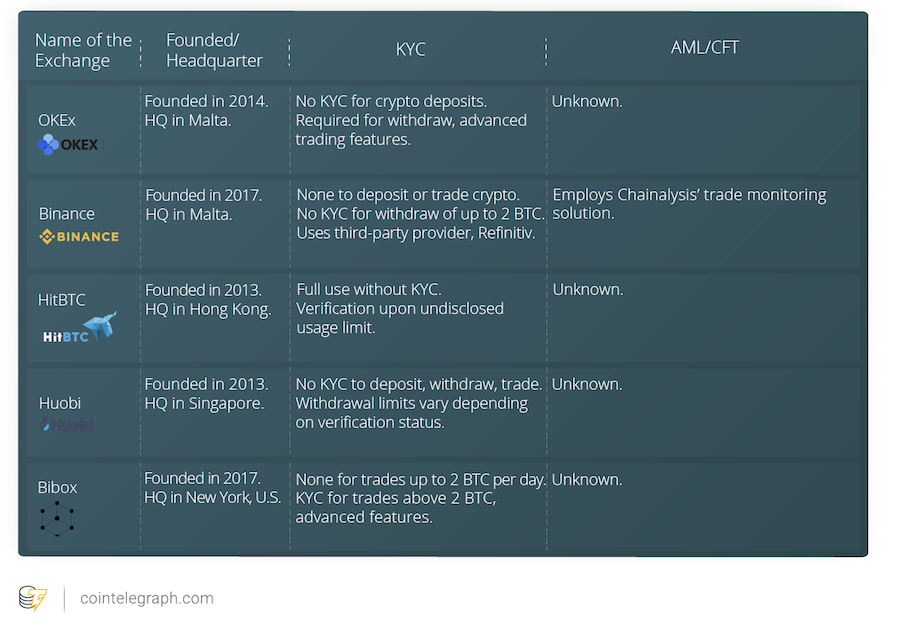

Cryptocurrency exchanges exist of two types: Coin-2-Fiat (C2F) and Coin-2-Coin (C2C). It is impossible to trace coin transactions involving C2C and such exchanges are very difficult to regulate. Most exchanges do allow withdrawal of 2 BTC per day without any KYC or verification.

Crypto Exchanges are now required to comply with new KYC, AML and CFT Regulations. Binance and Okex are based in Malta due to friendly crypto and blockchain regulations in the island.

Binance recently announced tightening of KYC after the hack that occured this month.

Due diligence

Cryptocurrency investors have invested in CBI/RBI schemes through real estate or donation. No governments currently accept Bitcoin or cryptocurrencies for citizenship investment schemes, agents do accept crypto funds. Some agents also contract due diligence firms to perform background checks.

The following checks must be applied on cryptocurrency investors seeking citizenship or residency.

- Apply Know your Customer (KYC) policy for cryptocurrency investors.

- Verify source of funds. The income could be earned as a miner, trader etc. Obtain wallet addresses and trace it back to blockchain. Miners can prove coins earned tracing it back to blockchain.

- Crypto traders can show their trading activity in exchanges as proof.

- Fiat deposits invested in crypto assets can be shown as proof of investment.

- Crypto startups raise money from Initial coin offerings (ICO) issuing tokens. Bills, invoices and contracts can be showed for proof . A study recently found that only 9% of startups who raised funds delivered. Most ICO’s are scams and have disappeared with funds. ICOs have been prone to scams and securities law violations.

- Check bank statements for increased activity of transfers to crypto exchanges.

- Large purchases of real estate, automobiles and boats

- Scrutiny of Crypto funds from exchanges that do not require KYC.

- Entities and Non-profits using crypto could be a sign of shell company

- Large purchases and cash activity of real estate, automobiles and boats;

- Check for connections, transactions or travel to digital money laundering hubs (e.g. Russia, Venezuela, Lebanon, Iran, North Korea, Ukraine, Turkey, Paraguay) which are close proximity to substantial conflicts, corruption, organized crime and terrorist activity.

- Launderers could obfuscate trail by creating multiple wallet addresses and may not disclose for checks.

- Check for taxes paid by crypto miners, traders or investors.

- Illicit Crypto could also be hacked or stolen funds .

Blockchain

Blockchain technology itself can be use reduce anti-money laundering risks. It is possible to alter blockchain protocol to comply with KYC of clients so that all transactions are connected to concerned persons and not anonymous with more supervision.

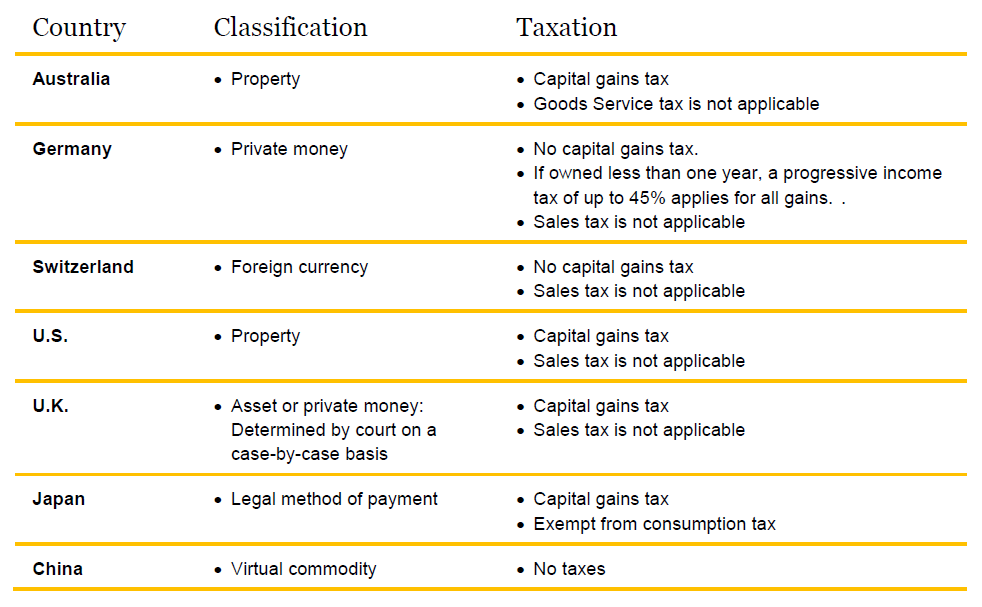

Taxation

In the US, IRS for federal tax purposes, virtual currency is treated as property. General tax principles applicable to property transactions apply to transactions using virtual currency. It is not treated as currency that could generate foreign currency gain or loss for U.S. federal tax purposes

The UK treats Crypto or Bitcoin like a foreign Currency. In Germany, bitcoin sales do not incur a capital gains tax;