The once touted Australia is the dream destination for HNW investors is not what it seems.

Australia’s gold visas, known as SIV visa has been losing its shine since 2015 and have failed to attract investors from countries other than China, new data reveals.

The Significant Investor visa (SIV) scheme requires AUD 5 million (US$3.5m) invested in the economy in exchange for permanent residence status after two years, removing english requirements and have to spend only 40 days a year. The Golden ticket scheme was launched in 24 November 2012

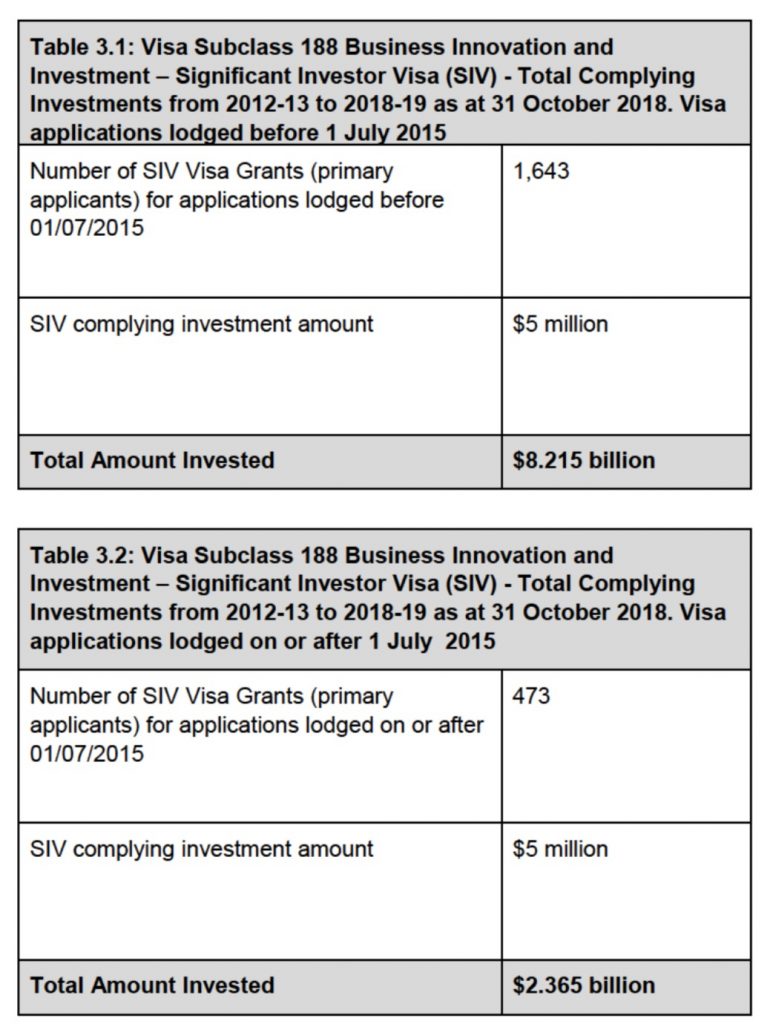

Before 2015, a total of AUD 8.5 billion invested under the scheme, but from 2015 onwards until 2018, only $2.3 billion invested under the scheme, according to the new Home affairs report released in 2019 under freedom of information.

Before July 1, 2015, a significant number of 1,653 SIV applications were approved, after that date until end of 2018 there has been only 473 visa grants. This is a 71% decline of interest. Over

The total SIV investment exceeded AUD$10 billion, but the report reveals, the number of SIV applications approved only 95 for the year 2018, compared to 183 applications received in the previous year. This is almost a 50% drop.

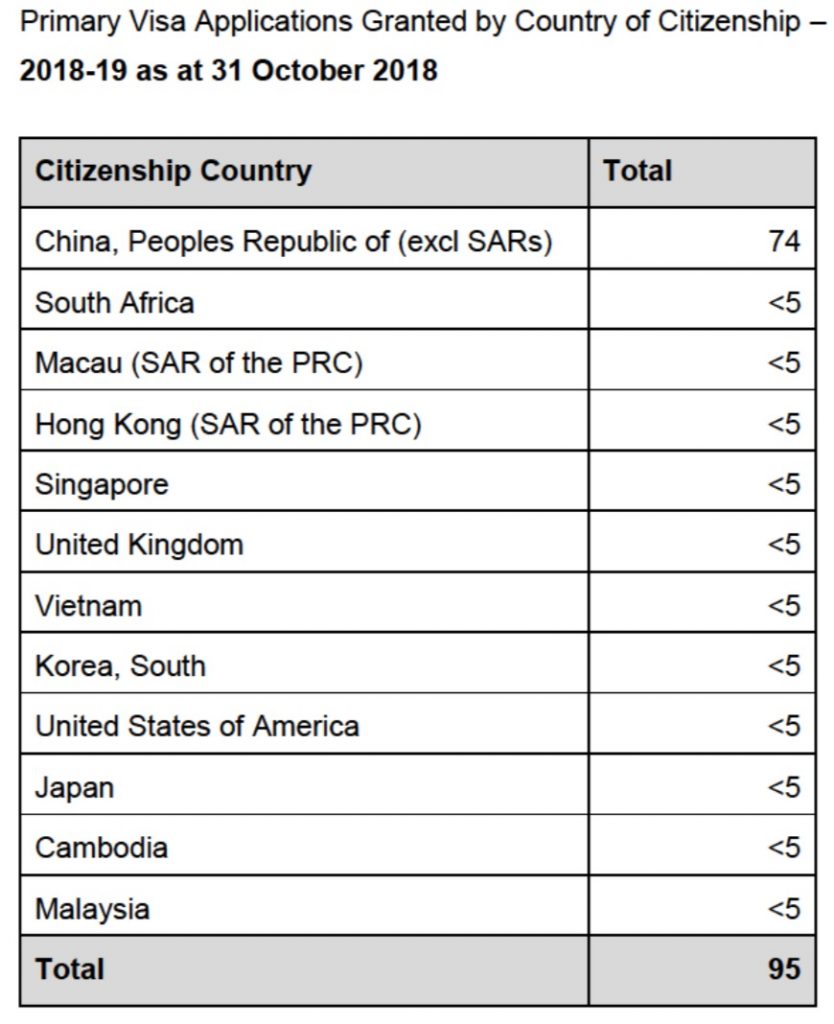

Breakdown by country for SIV visas

About 77% of applicants receiving SIV visas are Chinese, all other countries are less than five annually.

The Deloitte Access Economics report released recently that argued the “golden ticket” program has created positive impact and will add to economic growth in the long run.

The reason for such drastic drop in applications is practically not known. High taxes, fast rising expensive property prices could deter foreigners making such huge investment. Australia made no changes to the SIV visa since 2015 but the conditions for the scheme are strict including the background checks for source of funds. The investment criteria must include $500K investment in emerging startups or venture capital private equities, $1.5m invested in managed funds of emerging companies in Australian stock exchanges, and the final $3m can be invested in corporate bonds or property (10% ceiling)

Financial planners are required to consider the risks posed by a customer’s source of funds and wealth, and report anomalous client wealth to AUSTRAC.

Austrac published a vulnerability report , saying Suspicious Matter Report (SMRs) came usually from 70% from individuals, only 15% from companies. 23 per cent submitted during the sample period identified the involvement of a foreign jurisdiction, where either the transaction involved a foreign bank account, or where one of the parties involved in the suspicious matter was in a foreign jurisdiction. These SMRs related to a wide spectrum of countries; around half of the SMRs referred to either China, the United States, United Kingdom or Malaysia from Cyber-fraud, money laundering and tax-evasion.

The quality of life, stable conditions, education, healthcare, english speaking country, strong currency and close to mainland china has made Australia a great investment destination to many before.

Australia currently competes with Europe, Canada and United States in attracting the golden visa investment from HNW investors.