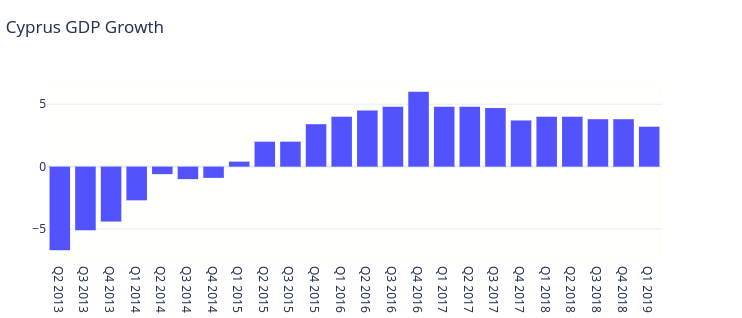

Cyprus registered a strong GDP growth rate of 3.2% in real terms during the second quarter of 2019 over the corresponding quarter of 2018. The increase of the GDP growth rate is mainly attributed to construction activity, IT, professional activities and service and recreation sectors, according to Cystat.

The Cyprus Investment Program (CIP) is a major revenue source adding €1.5bn euros (4.8% of GDP) to the Cyprus GDP every year. This revenue comes from 700 applications with each investing €2.15mn to citizenship investments, of which 80% invested in real estate. The Government besides this, receive additional revenues from VAT collection (19%), property taxes, application and passport fee. The Government has also decided to spend €1.4m on enhanced due diligence checks on applicants, which equates to roughly 2000€ for each of the 700 applications.

Since the inception of the investment scheme, Cyprus raised €8bn euros, according to our rough estimates. From 2013 to 2018, €6.6bn invested, and further €1.4bn from 700 applications as of 2019.

No other country achieved this feat and enormously benefiting from CIP scheme.

Cyprus launched the investment citizenship scheme in 2013, as a result of financial crisis which led to the failure of Cyprus popular bank and the economy contracted by -6.7% in Q2 2013 and the economy recovered in 2015. Cyprus received a €10bn bailout package from EU.

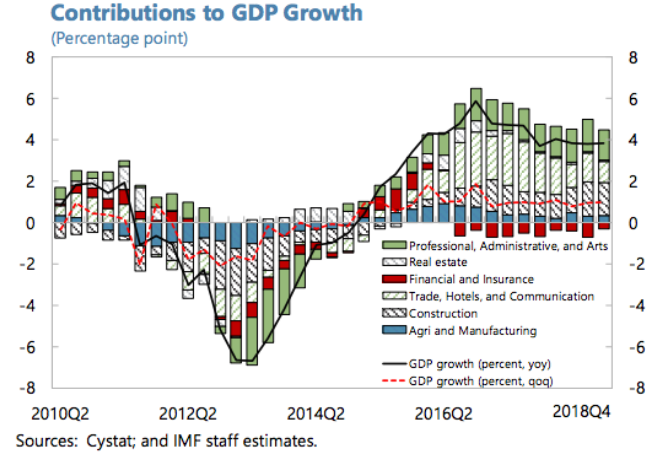

In 2019, IMF has warned Cyprus, given the reliance of the booming construction sector on inflows related to the citizenship investment schemes, further tightening of the CIP scheme could also lead to a gradual slowdown of investment over the medium term.

Further IMF said, property prices are picking up, albeit mostly concentrated in the CIP-linked luxury segment. But growth may be affected, as business cycle becomes increasingly dependent on construction activity leading to excess supply of luxury properties and recommend to decouple CIP scheme in a phased manner.

The banking system remains highly liquid and the NPL provisioning ratio has increased to 51 percent, above the EU average. The banking sector reported the first net profit in eight years in 2018.

The IMF authorities estimate the macroeconomic impact of CIP to economic growth has been relatively limited.

According to Cyprus CIP registry of agents, as of today there are 577 registered service providers competing for 700 citizenship clients every year and the competition for market is also growing.

In the Picture: Limassol Marina