The UK golden visa scheme known as tier1 investor visas offers fast track residency to rich foreign investors who make £2m investment.

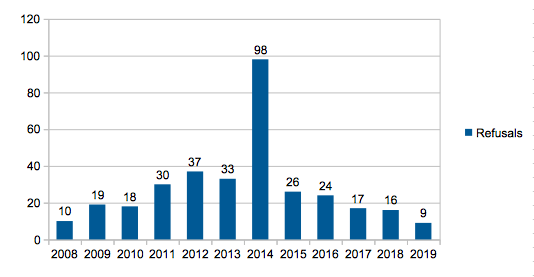

We decided to look into how many number of visas refused for these rich investors and it emerges there has been a total of 337 such visas have been refused between 2008 and Q2 2019, according to Home office figures.

The number of refusals reached record high 98 in 2014, and during the fourth quarter 2014 alone, almost 43 applications have been refused.

Please note in Oct 2014, of the fourth quarter, the Home office raised the investment threshold from £1m to £2m. So from Q1 2015 onwards the investment threshold of £2m applied.

Roughly calculating, because of refusing applications, UK has lost £429m in investments from these visa rejections. The Home office does not publish reasons for refusing such visas and the reasons behind such refusals are not known. Criminality, failing background checks for source of money are also common reasons for such refusals.

Tier 1 investor visa holders become eligible to settle permanently in the UK after two years if they invest £10 million, after three years if they invest £5 million, or after five years if they invest £2 million

Key changes took effect on 6 April 2015, required applicants to open a UK bank account regulated by the Financial Conduct Authority for the purpose of making their investment before making a Tier 1 (Investor) The bank must carry out all required KYC, AML and due diligence checks on the source of funds.

The Home office made further reforms to investor golden visas in 2019, increasing the investment period and tightening other investment rules

For the year ending June 2019, a total of 3.4m applications received for all categories, of which 390,000 visas were refused, keeping the visa refusal rate at 11%