Italy opened an investor visa scheme to foreigners in December 2017, according Article 1(148) of Law n. 232 of 11 December 2016 (commonly known as ‘Budget Law for 2017’) amended Legislative Decree n. 286. Article 26-bis TUI introduced a novelty in the Italian legislative system targeting foreign investors.

The legal framework is completed by two implementing regulations: the Inter-ministerial Decree n. 778 adopted in August 2017 by the Ministry of Economic Development, Ministry of Interior, Ministry of Foreign Affairs and International Cooperation, and the Operative Guidelines adopted in November 2017 to develop and provide details on the functioning of the investors’ residence scheme.

The Italian golden visa scheme had the following investment conditions to receive residence permit in Italy.

- Invest at least EUR 2,000,000 in bonds issued by the Italian Government and that are maintained for at least two years, but only under the condition that they prove to be holders and beneficiaries of such amount10 and that it is available and transferable to Italy; or

- Invest at least EUR 1,000,000 in instruments representative of the capital of a company (e.g. company shares) that is operating in Italy that are maintained for at least two years or an investment of at least EUR 500,000, if this company is an innovative start-up registered in the special section of the business register.11 Also, in this case, investors need to prove to be holders or beneficiaries of at least EUR 1,000,000 and that such amount is available and transferable to Italy; or

- Make a philanthropic donation of at least EUR 1,000,000 in support of a project of public interest, in the areas of culture, education, management of immigration, scientific research, recovery of cultural heritage and landscape.

Investors in this scheme given a 2-year long term visa for non-EU citizens who choose to invest in strategic assets for Italy’s economy and society. The residence permit will bear the name “For Investors”.

Investor Visa is renewable for further 3 years (provided that the original investment is maintained). After 5 years of stay, it is possible to apply for permanent residency if the foreign citizen meets the general requirements for doing so (more info here).

“The Investor Visa for Italy is still in its infancy. We have only received a limited number of applications”, said Ministry of Economic Development, in an interview to CIP Journal.

The EU commission has also published a report on italian golden visa scheme, last year, provided by the Ministry. The report said all applicants had to go through security checks for criminal record and lawful origins of investment.

There is no cap to the applications that can be filed for residence by investors under the Italian legal framework.

Equal rights for investors

Foreign investors who reside in Italy enjoy the right to equal treatment and have the right to: recognition for professional qualification, professional development, education and access to universities, social integration, and social assistance. It is assumed that the rules relating to other fields e.g. access to labour market, social welfare, rights arising from pension, health insurance that are applicable to third country nationals who are employees or self-employed may also be applied to investors.

Special tax regime

Third-country nationals who fall under the investors’ residence scheme and that are resident in Italy may benefit from the special tax regime for new residents (non-necessarily investors) holding substantial sources of income abroad.41 This regime allows new residents to substitute regular taxation on their entire income generated outside Italian territory by paying, once a year, a EUR 100,000 lump sum. The new regime is applicable, upon request, to anybody who is willing to move their tax residence to Italy, but only if they have not been resident in Italy for at least 9 out of the last 10 years.

Citizenship to investors

The Italian legal framework provides that holders of a residence permit can obtain the Italian citizenship. According Law n. 91 of 5 February 1992 setting up new rules on citizenship, Italian citizenship can be granted to a third country national who has legally resided in Italy for at least 10 years plus meeting other conditions such as clean criminal record; sufficient subsistence means; and oath of allegiance

Italy also offers startup visas, as an alternative golden visas.

Startup visa

The Italia Startup Visa (ISV) programme was launched by the Italian Ministry of Economic Development on 24 June 2014.

Italy implemented a groundbreaking Startup Law to encourage the creation and development of innovative startups. The Startup visa was one of the important Italian Government policies to attract and retain innovative entrepreneurs from all over the world. This visa can be applied through incubators and is free of charge. It is the most popular route to young entrepreneurs to acquire residence in Italy.

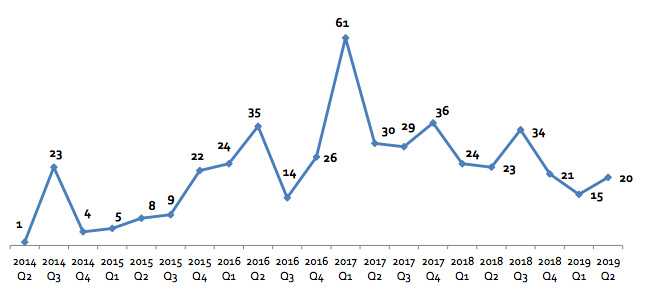

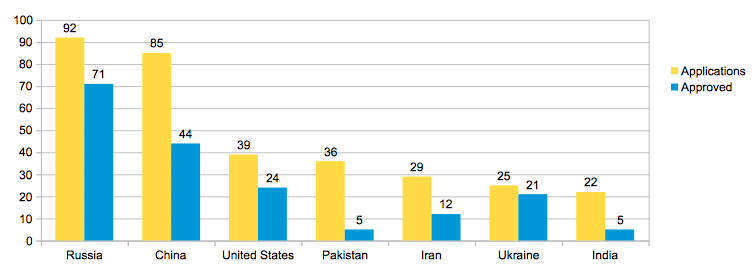

As of 30 June 2019, ISV has recorded 454 applications from 49 countries. Of these, 232 (51.1%) have received a positive evaluation from the Italia Startup Visa Technical Committee, resulting in a Certificate of No Impediment (in Italian, “Nulla Osta”) to the visa. Among the others, 171 applications (37.7%) were unsuccessful and 35 were withdrawn.

Russia, China and US nationals are the top countries applying for ISV visas.

Milan is the popular italian destination for startup formations.

- Milan – 64 applications

- Rome – 27

- Treviso – 16

- Varese – 10

- Verona – 8

Decree-law 179/2012, the “Italian Startup Act”, specifically refers to innovative startups to underline that its target is not any kind of new firm, but only those whose business model is strongly and undoubtedly linked to technological innovation. Innovative startups are limited liability companies, including cooperatives, not listed on the stock market, which meet the following requirements:

- they have been incorporated for less than 5 years;

- have their head office in Italy, or in another EU/EEA member provided that they have at least a branch in Italy;

- their annual turnover does not exceed €5 million;

- do not distribute profits;

- their company purpose (“oggetto sociale”) refers exclusively or predominantly to the production, development and commercialisation of innovative goods or services of high technological value;

- are not the result of a merger, split-up or selling-off of a company or branch;

meet one of the following three criteria (innovativeness indicators):

- at least 15% of the company’s expenses can be attributed to R&D activities;

- at least 1/3 of the total workforce are PhD students, the holders of a PhD or researchers;

- alternatively, 2/3 of the total workforce must hold a Master’s degree;

- the enterprise is the holder, depositary or licensee of a registered patent (industrial property) or the owner of a program for original registered computers.