IMF has published article IV consultation report for Malta for 2020.

According to IMF, The Maltese economy has continued to over perform European peers. The CA balance reflects the revenues from the government’s Individual Investor Program (IIP).

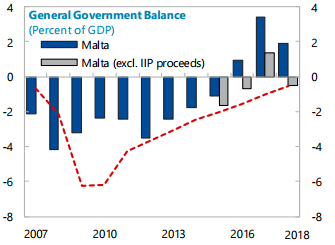

The authorities estimate that annual IIP export receipts amounted to roughly 1 percent of GDP over 2015–2017. Malta’s public debt continues to decline partly supported by IIP revenues. Public debt is projected to decline to 28 percent of GDP in 2024.

IMF said in the Article IV consultation report not to depend heavily on the IIP revenues, proposed to maintain gradual consolidation to ensure a balanced structural budget excluding proceeds from the Individual Investor Program (IIP).

IMF said in its report has provided recommendations for Malta to strengthen the due diligence and AML/CFT procedures for Individual Investor program

Below are the key recommendations from IMF

- IIP risk mitigation. In general, residence and citizenship schemes are subject to reputational and ML risks if due-diligence procedures are not sufficiently rigorous. In the context of the revision of the parameters of Malta’s IIP scheme, deficiencies identified by Moneyval and the FSAP should be addressed.

- Incoming and outgoing flows should be closely monitored, particularly those associated with non-residents clients, and higher-risk sectors such as remote gaming, VFAs and source of funds for the IIP.

- Strengthen AML/CFT supervision for banks. Ensure that banks are applying appropriate customer due diligence measures

The IMF Authorities highlighted progress in structural reforms such as IIP program is also being reviewed with the aim to enhance due diligence and improve the communication strategy.

IMF has warned that Public finances have greatly benefited from large proceeds from the IIP and corporate income tax, making Malta vulnerable to potential changes in taxation regimes. Changes to personal and corporate taxation will make Malta’s attractiveness as a financial and business location may weaken, and demand for its Individual Investor Program (IIP) could decrease, with adverse effect on tax revenues, foreign investment, and the external position.

To address this risk, IMF has asked Malta to continue diversifying the economy and accelerate structural reform implementation to remove impediments to growth, boost productivity and enhance competitiveness. Strengthen quality of public finances, improve spending efficiency, and enhance revenue collection to reduce the heavy reliance on CIT and IIP revenues.

The full IMF report is available here