The IMF has warned Dominica on the upside and downside risks associated with the buoyant revenues with the CBI program, in its Article IV consultation report published in 2024. The FY 2023/24 projection by IMF conservatively assumes a decline in CBI revenue to 18 percent of GDP.

Dominica is susceptible to major downside risk such as slower global growth and associated spillovers to tourism, further natural disaster (ND) shocks, and weaker than projected revenues from the CBI program.

CBI inflow projections are subject to downside risk further, if travel restrictions are imposed by other nations, reducing the value of holding a Dominican passport, which is the main incentive to acquire Dominica citizenship, said IMF in the report.

CBI also has upside risk. This upside risk has materialized during 2020-22 with the receipt of unprecedented inflows of CBI revenues.

IMF has called on Dominica to make reforms in ensuring “proper earmarking” of Citizenship-by-investment (CBI) inflows.

Declining CBI Revenues

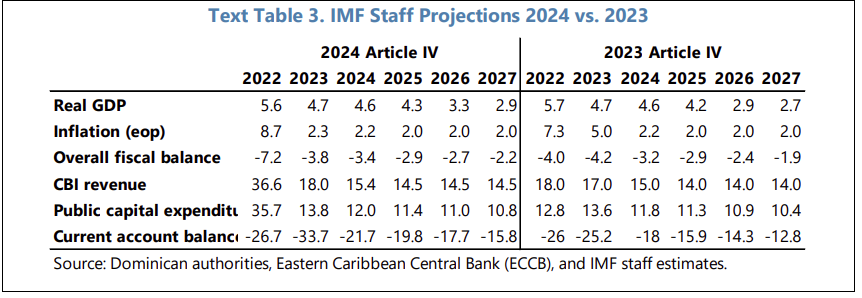

CBI revenue is projected to remain buoyant in the medium term, although declining substantially from an average of 32 percent of GDP during 2020-2022 to 14.6 percent of GDP by 2025. This assumption is supported by several years of sizeable inflows starting in 2014, which have remained resilient in the face of successive NDs and the pandemic shock, said the report.

While CBI reached 36.6 percent of GDP in FY2022/23—more than 7 percent of GDP higher than in the previous year—the FY2023/24 projection conservatively assumes a decline in CBI revenue to 18 percent of GDP.